APS 2011 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

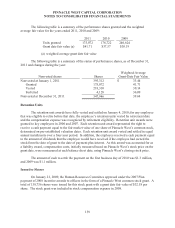

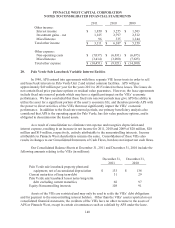

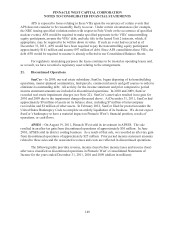

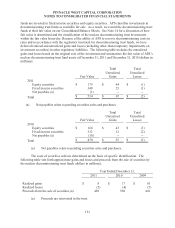

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

149

APS is exposed to losses relating to these VIEs upon the occurrence of certain events that

APS does not consider to be reasonably likely to occur. Under certain circumstances (for example,

the NRC issuing specified violation orders with respect to Palo Verde or the occurrence of specified

nuclear events), APS would be required to make specified payments to the VIEs’ noncontrolling

equity participants, assume the VIEs’ debt, and take title to the leased Unit 2 interests, which, if

appropriate, may be required to be written down in value. If such an event had occurred as of

December 31, 2011, APS would have been required to pay the noncontrolling equity participants

approximately $141 million and assume $97 million of debt. Since APS consolidates these VIEs, the

debt APS would be required to assume is already reflected in our Consolidated Balance Sheets.

For regulatory ratemaking purposes the leases continue to be treated as operating leases and,

as a result, we have recorded a regulatory asset relating to the arrangements.

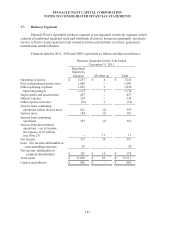

21. Discontinued Operations

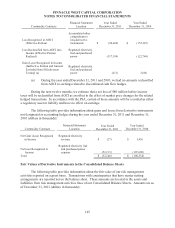

SunCor – In 2009, our real estate subsidiary, SunCor, began disposing of its homebuilding

operations, master-planned communities, land parcels, commercial assets and golf courses in order to

eliminate its outstanding debt. All activity for the income statement and prior comparative period

income statement amounts are included in discontinued operations. In 2010 and 2009, SunCor

recorded real estate impairment charges (see Note 22). SunCor’s asset sales resulted in no gain for

2010 and 2009 due to the impairment charges discussed above. At December 31, 2011, SunCor had

approximately $9 million of assets on its balance sheet, including $7 million of intercompany

receivables and $2 million of other assets. In February 2012, SunCor filed for protection under the

United States Bankruptcy Code to complete an orderly liquidation of its business. We do not expect

SunCor’s bankruptcy to have a material impact on Pinnacle West’s financial position, results of

operations, or cash flows.

APSES – On August 19, 2011, Pinnacle West sold its investment in APSES. The sale

resulted in an after-tax gain from discontinued operations of approximately $10 million. In June

2010, APSES sold its district cooling business. As a result of that sale, we recorded an after-tax gain

from discontinued operations of approximately $25 million. Prior period income statement amounts

related to these sales and the associated revenues and costs are reflected in discontinued operations.

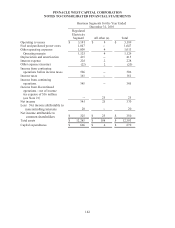

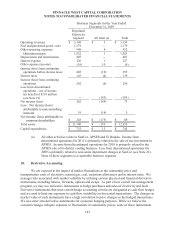

The following table provides revenue, income (loss) before income taxes and income (loss)

after taxes classified as discontinued operations in Pinnacle West’s Consolidated Statements of

Income for the years ended December 31, 2011, 2010 and 2009 (dollars in millions):