APS 2011 Annual Report Download - page 116

Download and view the complete annual report

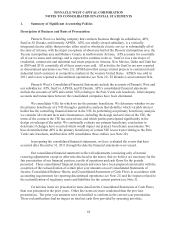

Please find page 116 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

91

recurring basis. Due to the short-term nature of net accounts receivable, accounts payable, and short-

term borrowings, the carrying values of these instruments approximate fair value. Fair value

measurements may also be applied on a nonrecurring basis to other assets and liabilities in certain

circumstances such as impairments. We also disclose fair value information for our long-term debt,

which is carried at amortized cost (see Note 6).

Fair value is the price that would be received for an asset or paid to transfer a liability (exit

price) in the principal or most advantageous market for the asset or liability in an orderly transaction

between willing market participants on the measurement date. Inputs to fair value may include

observable and unobservable data. We maximize the use of observable inputs and minimize the use of

unobservable inputs when measuring fair value.

We determine fair market value using observable inputs such as actively-quoted prices for

identical instruments when available. When actively quoted prices are not available for the identical

instruments we use other observable inputs, such as prices for similar instruments, other corroborative

market information, or prices provided by other external sources. For options, long-term contracts and

other contracts for which observable price data are not available, we use unobservable inputs, such as

models and other valuation methods, to determine fair market value.

The use of models and other valuation methods to determine fair market value often requires

subjective and complex judgment. Actual results could differ from the results estimated through

application of these methods.

See Note 14 for additional information about fair value measurements.

Derivative Accounting

We are exposed to the impact of market fluctuations in the commodity price and transportation

costs of electricity, natural gas, coal, emission allowances and in interest rates. We manage risks

associated with market volatility by utilizing various physical and financial instruments that may

qualify as derivatives, including futures, forwards, options and swaps. As part of our overall risk

management program, we use such instruments to hedge purchases and sales of electricity and fuels.

The changes in market value of such contracts have a high correlation to price changes in the hedged

transactions.

We account for our derivative contracts in accordance with derivatives and hedging guidance,

which requires all derivatives not qualifying for a scope exception to be measured at fair value on the

balance sheet as either assets or liabilities. Transactions with counterparties that have master netting

arrangements are reported net on the balance sheet. See Note 18 for additional information about our

derivative instruments.

Loss Contingencies and Environmental Liabilities

Pinnacle West and APS are involved in certain legal and environmental matters that arise in the

normal course of business. Contingent losses and environmental liabilities are recorded when it is

determined that it is probable that a loss has occurred and the amount of the loss can be reasonably

estimated. When a range of the probable loss exists and no amount within the range is a better estimate

than any other amount, Pinnacle West and APS record a loss contingency at the minimum amount in

the range. Unless otherwise required by GAAP, legal fees are expensed as incurred.