The Hartford 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.95

Operational Risk Management

The Hartford has an Operational Risk Management (“ORM”) function whose responsibility is to provide a comprehensive and

enterprise-wide view of the Company's operational risk on an aggregate basis. The Company defines operational risk as the

risk of loss resulting from inadequate or failed internal processes, people and systems, or from external events. Operational risk

is inherent in our business and functional areas. It includes legal risk and considers reputational risk as an impact. The

Company has developed a library of operational risks which have been classified into the following seven risk categories:

• Internal Fraud

• External Fraud

• Employment Practices & Workplace Safety

• Business Disruption & Systems Failures

• Clients, Products & Business Practices

• Damage to Physical Assets

• Execution, Delivery & Process Management

ORM is responsible for establishing, maintaining and communicating the framework, principles and guidelines of The

Hartford's operational risk management program. In addition, ORM also manages business continuity, model risk management,

the ORM system, and risk assessments. Responsibility for day-to-day management of operational risk lies within each business

unit and functional area.

ORM works closely with the Operational Risk Committee (“ORC”), an enterprise wide governance comprised of senior leaders

from functional areas such as ORM, Enterprise Business Services, Claims, Legal, Compliance, Finance and Internal Audit. The

ORC meets regularly and provides a forum for ensuring the effective management of operational risks across the enterprise. The

ORC's responsibilities include reviewing and approving: policies governing operational risk, key risk indicators and limits, and

risk mitigation strategies. This group also identifies emerging operational risks, prioritizes them, and ensures appropriate action

plans are in place. Individual committees, such as the Enterprise Privacy and Security Committee, and the Enterprise Health,

Environment and Safety Committee focus on specific operational risk issues and report to the ORC. Model Oversight

Committees have been established to oversee and govern model risk.

ORM has various tools and processes for identifying, monitoring, measuring, prioritizing, and reporting operational risks. ORM

facilitates loss event collection and analysis, risk assessments, scenario analysis, and reporting of key risk indicators and

aggregated risks. ORM uses a centralized Governance, Risk, and Compliance (GRC) system to help manage operational risk

across the Company's finance, legal, compliance, data security, and information technology functions.

The Company's business risk assessment process is used to identify the top risks in the business and functional areas, evaluate

controls to mitigate those risks, and monitor control improvements.

Financial Risk Management

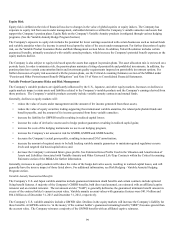

The Company identifies the following categories of financial risk:

• Liquidity Risk

• Interest Rate Risk

• Equity Risk

• Foreign Currency Exchange Risk

• Credit Risk

Financial risks include direct and indirect risks to the Company's financial objectives coming from events that impact market conditions

or prices. Financial risk also includes exposure to events that may cause correlated movement in multiple risk factors. The primary

source of financial risks are the Company's general account assets and the liabilities which those assets back, together with the

guarantees which the company has written over various liability products, particularly its portfolio of variable annuities. The Company

assesses its financial risk on a U.S. GAAP, statutory and economic basis. The Hartford has developed a disciplined approach to financial

risk management that is well integrated into the Company's underwriting, pricing, hedging, claims, asset and liability management, new

product, and capital management processes. Consistent with its risk appetite, the Company establishes financial risk limits to control

potential loss. Exposures are actively monitored, and mitigated where appropriate. The Company uses various risk management

strategies, including reinsurance and over-the-counter and exchange traded derivatives to transfer risk to well-established and financially

secure counterparties.