The Hartford 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

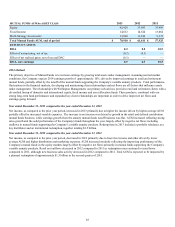

Reinsurance Recoverables

Reinsurance Security

To manage reinsurer credit risk, a reinsurance security review committee evaluates the credit standing, financial performance,

management and operational quality of each potential reinsurer. Through this process, the Company maintains a centralized list of

reinsurers approved for participation in reinsurance transactions. Only reinsurers approved through this process are eligible to participate

in new reinsurance transactions. The Company's approval designations reflect the differing credit exposure associated with various

classes of business. Participation eligibility is categorized based upon the nature of the risk reinsured, including the expected liability

payout duration. In addition to defining participation eligibility, the Company regularly monitors credit risk exposure to each reinsurance

counterparty and has established limits tiered by counterparty credit rating. For further discussions on how the Company manages and

mitigates third party credit risk, refer to the Credit Risk section.

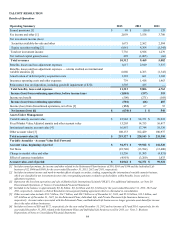

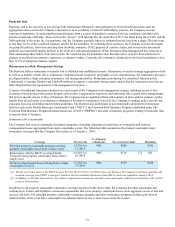

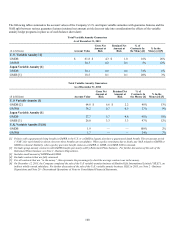

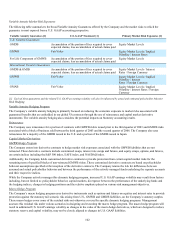

Property and Casualty Insurance Product Reinsurance Recoverable

Property and casualty insurance product reinsurance recoverables represent loss and loss adjustment expense recoverables from a

number of entities, including reinsurers and pools. The following table shows the components of the gross and net reinsurance

recoverable as of December 31, 2013 and December 31, 2012:

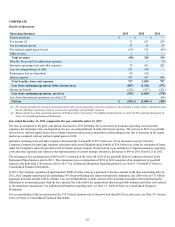

Reinsurance Recoverable 2013 2012

Paid loss and loss adjustment expenses $ 138 $ 170

Unpaid loss and loss adjustment expenses 2,841 2,852

Gross reinsurance recoverable 2,979 3,022

Less: allowance for uncollectible reinsurance (244) (268)

Net reinsurance recoverable $ 2,735 $ 2,754

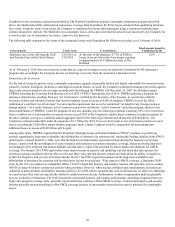

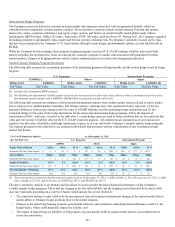

As shown in the following table, a portion of the total gross reinsurance recoverable relates to the Company’s mandatory participation in

various involuntary assigned risk pools and the value of annuity contracts held under structured settlement agreements. Reinsurance

recoverables due from mandatory pools are backed by the financial strength of the property and casualty insurance industry. Annuities

purchased from third-party life insurers under structured settlements are recognized as reinsurance recoverables in cases where the

Company has not obtained a release from the claimant. Of the remaining gross reinsurance recoverable as of December 31, 2013 and

December 31, 2012, the following table shows the portion of recoverables due from companies rated by A.M. Best:

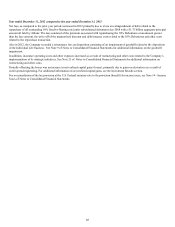

Distribution of gross reinsurance recoverable 2013 2012

Gross reinsurance recoverable $ 2,979 $ 3,022

Less: mandatory (assigned risk) pools and structured

settlements (569) (588)

Gross reinsurance recoverable excluding mandatory

pools and structured settlements $ 2,410 $ 2,434

% of Total % of Total

Rated A- (Excellent) or better by A.M. Best [1] $ 1,558 64.6 % $ 1,691 69.5%

Other rated by A.M. Best 4 0.2% 6 0.2 %

Total rated companies 1,562 64.8 % 1,697 69.7%

Voluntary pools 96 4.0% 95 3.9%

Captives 499 20.7 % 368 15.1 %

Other not rated companies 253 10.5 % 274 11.3 %

Total $ 2,410 100.0% $ 2,434 100.0%

[1] Based on A.M. Best ratings as of December 31, 2013 and 2012, respectively.

Where its contracts permit, the Company secures future claim obligations with various forms of collateral, including irrevocable letters

of credit, secured trusts, funds held accounts and group wide offsets. As part of its reinsurance recoverable review, the Company

analyzes recent developments in commutation activity between reinsurers and cedants, recent trends in arbitration and litigation

outcomes in disputes between cedants and reinsurers and the overall credit quality of the Company’s reinsurers. As indicated in the

above table, 64.6% of the gross reinsurance recoverables due from reinsurers rated by A.M. Best were rated A- (excellent) or better as of

December 31, 2013. Due to the inherent uncertainties as to collection and the length of time before such amounts will be due, it is

possible that future adjustments to the Company’s reinsurance recoverables, net of the allowance, could be required, which could have a

material adverse effect on the Company’s consolidated results of operations or cash flows in a particular quarterly or annual period.