The Hartford 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

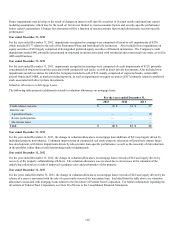

126

[3] Relates to annuities that are recorded in the general account (under U.S. GAAP), although these annuities are held in a statutory separate

account, as the contractholders are subject to the Company's credit risk. In the statutory separate account, Life Operations is required to

maintain invested assets with a fair value equal to the MVA surrender value of the Fixed MVA contract. In the event assets decline in value at

a greater rate than the MVA surrender value of the Fixed MVA contract, Life Operations is required to contribute additional capital to the

statutory separate account. Life Operations will fund these required contributions with operating cash flows or short-term investments. In the

event that operating cash flows or short-term investments are not sufficient to fund required contributions, the Company may have to sell

other invested assets at a loss, potentially resulting in a decrease in statutory surplus. As the fair value of invested assets in the statutory

separate account are generally equal to the MVA surrender value of the Fixed MVA contract, surrender of Fixed MVA annuities will have an

insignificant impact on the liquidity requirements of Life Operations.

[4] GICs are subject to discontinuance provisions which allow the policyholders to terminate their contracts prior to scheduled maturity at the

lesser of the book value or market value. Generally, the market value adjustment reflects changes in interest rates and credit spreads. As a

result, the market value adjustment feature in the GIC serves to protect the Company from interest rate risks and limit Life Operations’

liquidity requirements in the event of a surrender.

[5] Surrenders of, or policy loans taken from, as applicable, these general account liabilities, which include the general account option for

Talcott Resolution’s individual variable annuities and the variable life contracts of the former Individual Life business, the general account

option for annuities of the former Retirement Plans business and universal life contracts sold by the former Individual Life business, may be

funded through operating cash flows of Life Operations, available short-term investments, or Life Operations may be required to sell fixed

maturity investments to fund the surrender payment. Sales of fixed maturity investments could result in the recognition of realized losses and

insufficient proceeds to fully fund the surrender amount. In this circumstance, Life Operations may need to take other actions, including

enforcing certain contract provisions which could restrict surrenders and/or slow or defer payouts. See Note 2 - Business Dispositions of

Notes to the Consolidated Financial Statements as to the sale of the Retirement Plans and Individual Life businesses and related transfer of

invested assets in January 2013.

Off-Balance Sheet Arrangements and Aggregate Contractual Obligations

The Company does not have any off-balance sheet arrangements that are reasonably likely to have a material effect on the financial

condition, results of operations, liquidity, or capital resources of the Company, except for the contingent capital facility described above

and the following:

• The Company has unfunded commitments to purchase investments in limited partnerships, private placements and mortgage loans

of approximately $703 as disclosed in Note 15 of Notes to Consolidated Financial Statements.

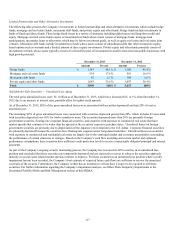

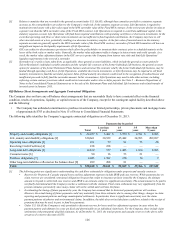

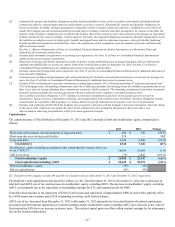

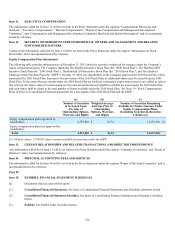

The following table identifies the Company’s aggregate contractual obligations as of December 31, 2013:

Payments due by period

Total Less than

1 year 1-3

years 3-5

years More than

5 years

Property and casualty obligations [1] $ 22,257 $ 5,402 $ 5,359 $ 2,591 $ 8,905

Life, annuity and disability obligations [2] 320,661 30,529 45,442 34,993 209,697

Operating lease obligations [3] 231 59 91 53 28

Revolving Credit Facilities [4] 238 238 — — —

Long-term debt obligations [5] 12,639 577 1,445 1,634 8,983

Consumer notes [6] 90 16 53 21 —

Purchase obligations [7] 2,043 1,582 378 74 9

Other long-term liabilities reflected on the balance sheet [8] 289 208 81 — —

Total $ 358,448 $ 38,611 $ 52,849 $ 39,366 $ 227,622

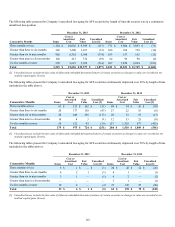

[1] The following points are significant to understanding the cash flows estimated for obligations under property and casualty contracts:

• Reserves for Property & Casualty unpaid losses and loss adjustment expenses include IBNR and case reserves. While payments due on

claim reserves are considered contractual obligations because they relate to insurance policies issued by the Company, the ultimate

amount to be paid to settle both case reserves and IBNR is an estimate, subject to significant uncertainty. The actual amount to be paid is

not finally determined until the Company reaches a settlement with the claimant. Final claim settlements may vary significantly from the

present estimates, particularly since many claims will not be settled until well into the future.

• In estimating the timing of future payments by year, the Company has assumed that its historical payment patterns will continue.

However, the actual timing of future payments could vary materially from these estimates due to, among other things, changes in claim

reporting and payment patterns and large unanticipated settlements. In particular, there is significant uncertainty over the claim

payment patterns of asbestos and environmental claims. In addition, the table does not include future cash flows related to the receipt of

premiums that may be used, in part, to fund loss payments.

• Under U.S. GAAP, the Company is only permitted to discount reserves for losses and loss adjustment expenses in cases where the

payment pattern and ultimate loss costs are fixed and determinable on an individual claim basis. For the Company, these include claim

settlements with permanently disabled claimants. As of December 31, 2013, the total property and casualty reserves in the above table

are gross of a reserve discount of $553.