The Hartford 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

PART II

Item 5. MARKET FOR THE HARTFORD’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

The Hartford’s common stock is traded on the New York Stock Exchange (“NYSE”) under the trading symbol “HIG”.

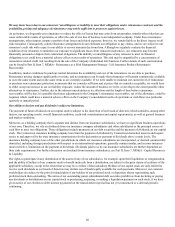

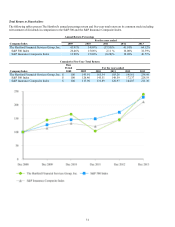

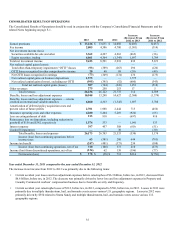

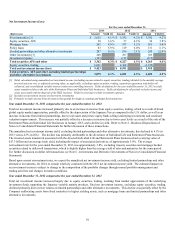

The following table presents the high and low closing prices for the common stock of The Hartford on the NYSE for the periods indicated,

and the quarterly dividends declared per share.

1st Qtr. 2nd Qtr. 3rd Qtr. 4th Qtr.

2013

Common Stock Price

High $ 26.46 $ 31.43 $ 32.30 $ 36.62

Low $ 23.05 $ 24.82 $ 29.60 $ 30.68

Dividends Declared $ 0.10 $ 0.10 $ 0.15 $ 0.15

2012

Common Stock Price

High $ 22.02 $ 21.95 $ 20.34 $ 22.88

Low $ 16.37 $ 16.10 $ 15.93 $ 19.41

Dividends Declared $ 0.10 $ 0.10 $ 0.10 $ 0.10

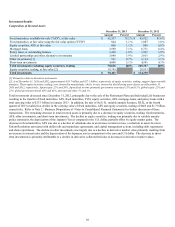

On February 27, 2014, The Hartford’s Board of Directors declared a quarterly dividend of $0.15 per common share payable

on April 1, 2014 to common shareholders of record as of March 10, 2014.

As of February 24, 2014, the Company had approximately 239,200 shareholders. The closing price of The Hartford’s common stock on

the NYSE on February 24, 2014 was $34.64.

The Company’s Chief Executive Officer has certified to the NYSE that he is not aware of any violation by the Company of NYSE

corporate governance listing standards, as required by Section 303A.12(a) of the NYSE’s Listed Company Manual.

There are also various legal and regulatory limitations governing the extent to which The Hartford’s insurance subsidiaries may extend

credit, pay dividends or otherwise provide funds to The Hartford Financial Services Group, Inc. as discussed in Part II, Item 7, MD&A

— Capital Resources and Liquidity — Liquidity Requirements and Sources of Capital.

See Part III, Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters, for

information related to securities authorized for issuance under equity compensation plans.

Purchases of Equity Securities by the Issuer

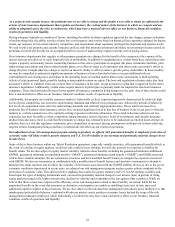

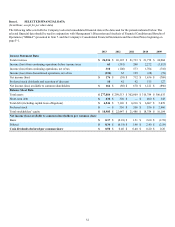

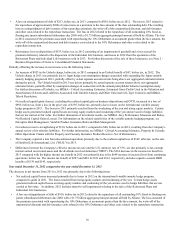

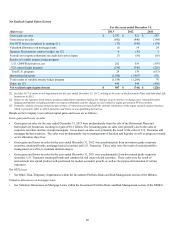

The following table summarizes the Company’s repurchases of its common stock for the three months ended December 31, 2013:

Period Total Number of

Shares Purchased

Average

Price Paid

per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans or

Programs

Approximate Dollar

Value of Shares that

May Yet Be

Purchased Under

the Plans or Programs [1]

(in millions)

October 1, 2013 – October 31, 2013 2,331,663 $ 32.77 2,331,663 $ 766

November 1, 2013 – November 30, 2013 1,787,466 $ 34.69 1,787,466 $ 704

December 1, 2013 – December 31, 2013 2,597,635 $ 34.44 2,435,940 $ 617

Total 6,716,764 $ 33.93 6,555,069

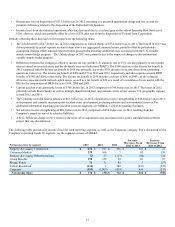

[1] On January 31, 2013 the Company’s Board of Directors authorized a $500 equity repurchase program. On June 26, 2013, the Board of Directors

approved a $750 increase in the Company's authorized equity repurchase program. In January 2014, the Board of Directors approved an

increase in the Company's authorized equity repurchase program by an amount that, when combined with the amount remaining under the

existing authorization, provides the Company with the ability to repurchase $2 billion in equity during the period commencing on January 1,

2014 and ending on December 31, 2015. The Company’s repurchase authorization, permits purchases of common stock, as well as warrants or

other derivative securities. Repurchases may be made in the open market, through derivative, accelerated share repurchase and other privately

negotiated transactions, and through plans designed to comply with Rule 10b5-1(c) under the Securities Exchange Act of 1934, as amended. The

timing of any future repurchases will be dependent upon several factors, including the market price of the Company’s securities, the Company’s

capital position, consideration of the effect of any repurchases on the Company’s financial strength or credit ratings, and other corporate

considerations. The repurchase program may be modified, extended or terminated by the Board of Directors at any time.