The Hartford 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

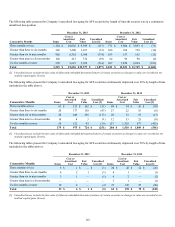

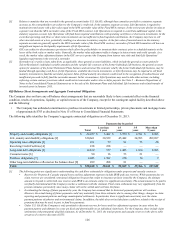

[2] Estimated life, annuity and disability obligations include death and disability claims, policy surrenders, policyholder dividends and trail

commissions offset by expected future deposits and premiums on in-force contracts. Estimated life, annuity and disability obligations are

based on mortality, morbidity and lapse assumptions comparable with the Company’s historical experience, modified for recent observed

trends. The Company has also assumed market growth and interest crediting consistent with other assumptions. In contrast to this table, the

majority of the Company’s obligations are recorded on the balance sheet at the current account values and do not incorporate an expectation

of future market growth, interest crediting, or future deposits. Therefore, the estimated obligations presented in this table significantly exceed

the liabilities recorded in reserve for future policy benefits and unpaid losses and loss adjustment expenses, other policyholder funds and

benefits payable and separate account liabilities. Due to the significance of the assumptions used, the amounts presented could materially

differ from actual results.

See Note 2 - Business Dispositions of Notes to Consolidated Financial Statements for further information as to Retirement Plans and

Individual Life reinsurance transactions.

[3] Includes future minimum lease payments on operating lease agreements. See Note 15 of Notes to Consolidated Financial Statements for

additional discussion on lease commitments.

[4] Represents revolving credit facility agreements in order to finance certain withholding taxes on mutual fund gains, that are subsequently

refunded when HLIKK files its’ income tax returns. Both of the credit facilities expire on September 30, 2014. See Note 13 of Notes to

Consolidated Financial Statements for additional discussion of revolving credit facilities.

[5] Includes contractual principal and interest payments. See Note 13 of Notes to Consolidated Financial Statements for additional discussion of

long-term debt obligations.

[6] Consumer notes include principal payments and contractual interest for fixed rate notes and interest based on current rates for floating rate

notes. See Note 15 of Notes to Consolidated Financial Statements for additional discussion of consumer notes.

[7] Includes $703 in commitments to purchase investments including approximately $531 of limited partnership, $7 of private placements and

$165 of mortgage loans. Outstanding commitments under these limited partnerships and mortgage loans are included in payments due in less

than 1 year since the timing of funding these commitments cannot be reliably estimated. The remaining commitments to purchase investments

primarily represent payables for securities purchased which are reflected on the Company’s consolidated balance sheet.

Also included in purchase obligations is $757 relating to contractual commitments to purchase various goods and services such as

maintenance, human resources, information technology, and transportation in the normal course of business. Purchase obligations exclude

contracts that are cancelable without penalty or contracts that do not specify minimum levels of goods or services to be purchased.

[8] Includes cash collateral of $180 which the Company has accepted in connection with the Company’s derivative instruments. Since the timing

of the return of the collateral is uncertain, the return of the collateral has been included in the payments due in less than 1 year.

Also included in other long term liabilities is $48 of net unrecognized tax benefits.

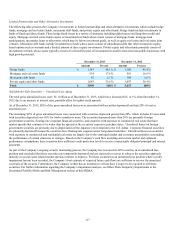

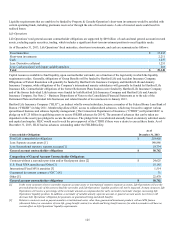

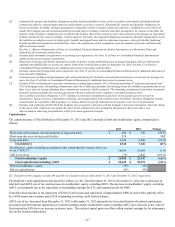

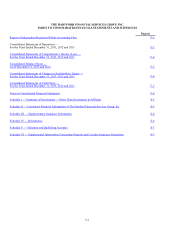

Capitalization

The capital structure of The Hartford as of December 31, 2013 and 2012 consisted of debt and stockholders’ equity, summarized as

follows:

2013 2012 Change

Short-term debt (includes current maturities of long-term debt) $ 200 $ 320 (38)%

Short-term due on revolving credit facility 238 — NM

Long-term debt 6,106 6,806 (10 )%

Total debt [1] 6,544 7,126 (8)%

Stockholders’ equity excluding accumulated other comprehensive income (loss), net

of tax (“AOCI”) 18,984 19,604 (3 )%

AOCI, net of tax (79) 2,843 (103 )%

Total stockholders’ equity $ 18,905 $ 22,447 (16)%

Total capitalization including AOCI $ 25,449 $ 29,573 (14)%

Debt to stockholders’ equity 35% 32%

Debt to capitalization 26% 24%

[1] Total debt of the Company excludes $84 and $161 of consumer notes as of December 31, 2013 and December 31, 2012, respectively.

The Hartford’s total capitalization decreased $4.1 billion, or 14%, from December 31, 2013 to December 31, 2012 due to decreases in

total debt and AOCI, net of tax, and decreases in stockholders' equity, excluding AOCI. The decrease in stockholders’ equity, excluding

AOCI, was primarily due to the repurchase of outstanding warrants for $33, and common stocks for $600.

Total debt decreased due to the repayment of $320 of senior notes and repurchase of approximately $800 of senior debt, partially offset

by a $300 senior note issuance and a $238 outstanding revolving credit facility balance.

AOCI, net of tax, decreased from December 31, 2012 to December 31, 2013 primarily due to reclassification of realized capital gains

associated with the business dispositions to retained earnings within stockholders' equity excluding AOCI, and a decease in the value of

fixed maturities AFS due to an increase in interest rates. The realized capital gains are offset within retained earnings by the reinsurance

loss on the business dispositions.