The Hartford 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

For additional information on debt and the repurchase of warrants, see MD&A – Liquidity Requirements and Sources of Capital, and

Note 13 - Debt of Notes to Consolidated Financial Statements. For additional information on the business dispositions and AOCI, net of

tax, see Note 2 - Business Dispositions and Note 17 -Changes In and Reclassifications From Accumulated Other Comprehensive Income

of Notes to Consolidated Financial Statements, respectively.

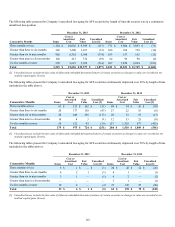

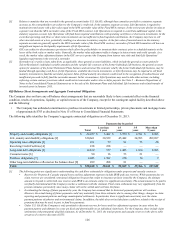

Cash Flow

2013 2012 2011

Net cash provided by operating activities $ 1,237 $ 2,681 $ 2,274

Net provided by (cash used) for investing activities $ 3,745 $ (2,557) $ (1,182)

Net cash used for financing activities $ (5,820) $ (228) $ (609)

Cash — end of year $ 1,428 $ 2,421 $ 2,581

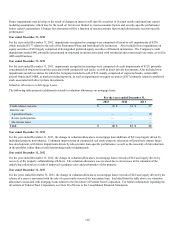

Year ended December 31, 2013 compared to the year ended December 31, 2012

Cash provided by operating activities decreased primarily due to realized capital losses of $1.5 billion in 2013, compared to an increase

in income taxes received of $486 in 2012.

Cash used for investing activities in 2013 primarily relates to net proceeds of available-for-sale securities of $4.9 billion and proceeds from

business sold of $815 offset by net payments on derivatives of $2.2 billion. Cash used for investing activities in 2012 primarily relates to

net payments on derivatives of $2.7 billion, purchases of mortgage loans of $968 and net payments for the purchases of partnerships of

$695, partially offset by net proceeds of available-for-sale securities of $1.7 billion and net receipts of fixed maturities, fair value option

of $101.

Cash used for financing activities in 2013 primarily consists of net outflows on investment and universal life-type contracts of $2.1 billion,

decrease in securities loaned or sold under agreements to repurchase of $1.9 billion, repayment of long term debt of $ 1.3 billion and treasury

stock acquired of $600. Cash used for financing activities in 2012 primarily consists of net outflows on investment and universal life-type

contracts of $1.4 billion, repurchase of warrants of $300, as well as share repurchases and dividends paid on common and preferred stock.

These were partially offset by net increases in securities loaned or sold of $1.9 billion.

Year ended December 31, 2012 compared to the year ended December 31, 2011

Cash provided by operating activities increased primarily due to income taxes received of $486 in 2012, compared to income taxes paid

of $179 in 2011.

Cash used for investing activities in 2012 primarily relates to net payments on derivatives of $2.7 billion, purchases of mortgage loans of

$968 and net payments for the purchases of partnerships of $695, partially offset by net proceeds of available-for-sale securities of $1.7

billion and net receipts of fixed maturities, fair value option of $101. Cash used for investing activities in 2011 primarily relates to net

purchases of mortgage loans of $1.3 billion and net purchases of fixed maturities, fair value option of $627, partially offset by net

receipts on derivatives of $720 and net proceeds of available-for-sale securities of $256.

Cash used for financing activities in 2012 primarily consists of net outflows on investment and universal life-type contracts of $1.4

billion, repurchase of warrants of $300, as well as share repurchases and dividends paid on common and preferred stock. These were

partially offset by net increases in securities loaned or sold of $1.9 billion. Cash used for financing activities in 2011 primarily consists

of repayment of long-term debt and dividends paid on common and preferred stock, partially offset by net inflows on investment and

universal life-type contracts.

Equity Markets

For a discussion of the potential impact of the equity markets on capital and liquidity, see the Financial Risk on Statutory Capital and

Liquidity Risk section in this MD&A.