The Hartford 2013 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-78

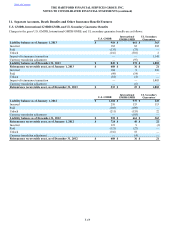

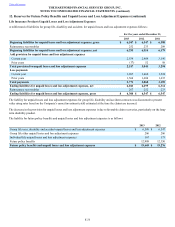

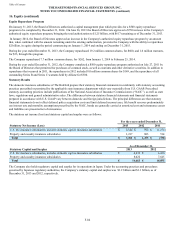

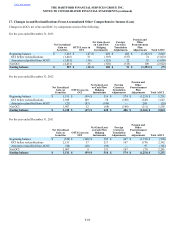

Deferred tax assets (liabilities) include the following:

As of December 31,

Deferred Tax Assets 2013 2012

Tax discount on loss reserves $ 632 $ 621

Tax basis deferred policy acquisition costs 207 481

Unearned premium reserve and other underwriting related reserves 434 414

Investment-related items 1,641 1,525

Insurance product derivatives 13 454

Employee benefits 523 599

Minimum tax credit 823 860

Net operating loss carryover 1,093 1,007

Foreign tax credit carryover 163 149

Capital loss carryover — 5

Other 63 118

Total Deferred Tax Assets 5,592 6,233

Valuation Allowance (4) (58)

Deferred Tax Assets, Net of Valuation Allowance 5,588 6,175

Deferred Tax Liabilities

Financial statement deferred policy acquisition costs and reserves (894) (1,694)

Net unrealized gains on investments (669) (2,396)

Other depreciable and amortizable assets (185) (143)

Total Deferred Tax Liabilities (1,748) (4,233)

Net Deferred Tax Asset $ 3,840 $ 1,942

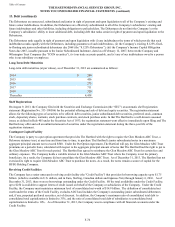

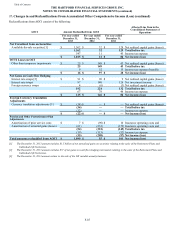

As of December 31, 2013 and 2012, the net deferred tax asset included the expected tax benefit attributable to net operating losses of

$3,123 and $2,946, respectively, consisting of U.S. losses of $3,123 and $2,725, respectively, and foreign losses of $0 and $221. The

U.S. losses expire as follows: $12 from 2014-2020, $3,111 from 2026-2032.

The Company has recorded a deferred tax asset valuation allowance that is adequate to reduce the total deferred tax asset to an amount

that will be more likely than not realized.

The deferred tax asset valuation allowance was $4 as of December 31, 2013 relating mostly to U.S. net operating losses and $58 as of

December 31, 2012 relating mostly to foreign net operating losses. The change in the valuation allowance is primarily related to the sale

of the U.K. variable annuity business.

In assessing the need for a valuation allowance, management considered future taxable temporary difference reversals, future taxable

income exclusive of reversing temporary differences and carryforwards, taxable income in open carry back years, as well as other tax

planning strategies. These tax planning strategies include holding a portion of debt securities with market value losses until recovery,

altering the level of tax exempt securities, selling appreciated securities to offset capital losses, business considerations such as asset-

liability matching, and the sales of certain corporate assets. Management views such tax planning strategies as prudent and feasible, and

would implement them, if necessary, to realize the deferred tax asset. In 2011, the Company released $86, or 100% of the valuation

allowance associated with realized capital losses based on the availability of additional tax planning strategies. Future economic

conditions and debt market volatility, including increases in interest rates, can adversely impact the Company’s tax planning strategies

and in particular the Company’s ability to utilize tax benefits on previously recognized realized capital losses.

Included in Other liabilities in the Consolidated Balance Sheets as of December 31, 2013 and 2012 are net deferred tax liabilities related

to Japan of $61 and $376, respectively. The net deferred tax liability of $61 as of December 31, 2013 was comprised of taxes on future

taxable income related to owed reinsurance recoverables, loss reserves and foreign currency translation adjustments.

The December 31, 2012 net deferred tax liability is comprised of a gross deferred tax asset of $274 related to tax discount on loss

reserves and a gross deferred tax liability of $650, comprised primarily of $331 for deferred policy acquisition costs and $197 for foreign

currency translation adjustments.

As of December 31, 2013 the Company had a current income tax receivable of $72, of which $70 was a payable related to Japan and due

to a foreign jurisdiction. As of December 31, 2012 the Company had a current income tax receivable of $19, of which $1 was related to

Japan and due from a foreign jurisdiction.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

14. Income Taxes (continued)