The Hartford 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

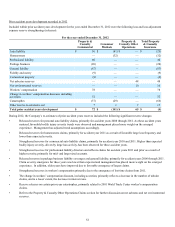

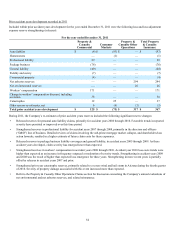

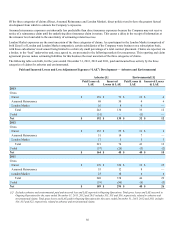

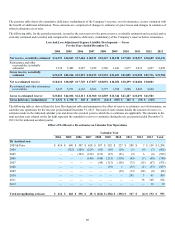

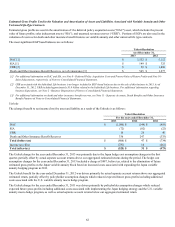

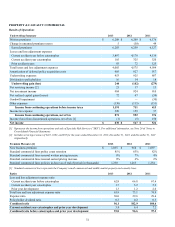

Estimated Gross Profits Used in the Valuation and Amortization of Assets and Liabilities Associated with Variable Annuity and Other

Universal Life-Type Contracts

Estimated gross profits are used in the amortization of: the deferred policy acquisition costs ("DAC") asset, which includes the present

value of future profits; sales inducement assets (“SIA”); and unearned revenue reserves (“URR”). Portions of EGPs are also used in the

valuation of reserves for death and other insurance benefit features on variable annuity and other universal life type contracts.

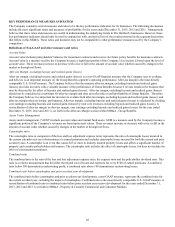

The most significant EGP based balances are as follows:

Talcott Resolution

As of December 31,

2013 2012

DAC [1] $ 1,552 $ 5,112

SIA [1] $ 149 $ 325

URR [2] $ 50 $ 1,880

Death and Other Insurance Benefit Reserves, net of reinsurance [3] $ 565 $ 1,277

[1] For additional information on DAC and SIA, see Note 8 - Deferred Policy Acquisition Costs and Present Value of Future Profits and Note 10 -

Sales Inducements, respectively, of Notes to Consolidated Financial Statements.

[2] URR associated with the Individual Life business is no longer included in EGP based balances due to the sale of this business in 2013. As of

December 31, 2012, URR included approximately $1.8 billion related to the Individual Life business. For additional information regarding

business dispositions, see Note 2 - Business Dispositions of Notes to Consolidated Financial Statements.

[3] For additional information on death and other insurance benefit reserves, see Note 11 - Separate Accounts, Death Benefits and Other Insurance

Benefit Features of Notes to Consolidated Financial Statements.

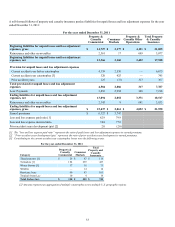

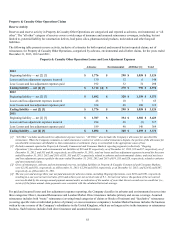

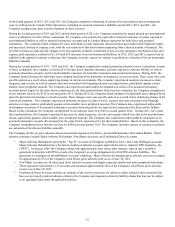

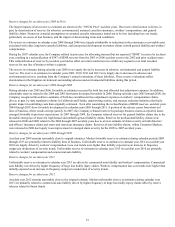

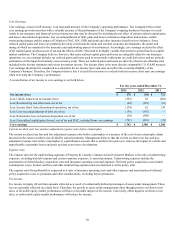

Unlocks

The (charge) benefit to net income (loss) by asset and liability as a result of the Unlocks is as follows:

Talcott Resolution

For the years ended December 31,

2013 2012 2011

DAC $ (1,086) $ (144) $ (419)

SIA (72)(82) (22)

URR 16 26 40

Death and Other Insurance Benefit Reserves 336 247 (333)

Total (before tax) $(806) $ 47 $ (734)

Income tax effect (281) 16 (261)

Total (after-tax) $ (525) $ 31 $ (473)

The Unlock charge for the year ended December 31, 2013 was primarily due to the Japan hedge cost assumption changes in the first

quarter, partially offset by actual separate account returns above our aggregated estimated returns during the period. The hedge cost

assumption changes for the year ended December 31, 2013 included a charge of $887, before tax, related to the elimination of future

estimated gross profits on the Japan variable annuity block based on increased costs associated with expanding the Japan variable

annuity hedging program in 2013.

The Unlock benefit for the year ended December 31, 2012 was driven primarily by actual separate account returns above our aggregated

estimated return, partially offset by policyholder assumption changes which reduced expected future gross profits including additional

costs associated with the U.S. variable annuity macro hedge program.

The Unlock charge for the year ended December 31, 2011 was driven primarily by policyholder assumption changes which reduced

expected future gross profits including additional costs associated with implementing the Japan hedging strategy and the U.S. variable

annuity macro hedge program, as well as actual separate account returns below our aggregated estimated return.