The Hartford 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

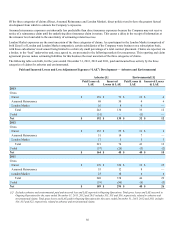

Derivative Instruments, including embedded derivatives within investments

The fair value of derivative instruments is determined using pricing valuation models for over-the-counter ("OTC") derivatives that

utilize market data inputs, quoted market prices for exchanged-traded derivatives and transactions cleared through central clearing

houses ("OTC-cleared"), or independent broker quotations. Excluding embedded and reinsurance related derivatives, as of December 31,

2013 and 2012, 97% of derivatives, based upon notional values, were priced by valuation models or quoted market prices. The

remaining derivatives were priced by broker quotations. The derivatives are valued using mid-market level inputs that are

predominantly observable in the market with the exception of the customized swap contracts that hedge GMWB liabilities. Inputs used

to value derivatives include, but are not limited to, swap interest rates, foreign currency forward and spot rates, credit spreads and

correlations, interest and equity volatility and equity index levels. For further discussion on derivative instrument valuation

methodologies, see the Derivative Instruments, including embedded derivatives within the investments section in Note 5 of Notes to

Consolidated Financial Statements. For further discussion on GMWB and other guaranteed living benefits, valuation methodologies,

see the Living Benefits Required to be Fair Valued section in Note 5 of Notes to Consolidated Financial Statements.

Limited partnerships and other alternative investments

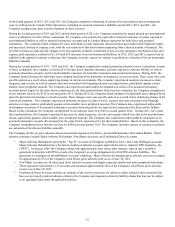

Limited partnerships and other alternative investments include hedge funds where investment company accounting has been applied to a

wholly-owned fund of funds measured at fair value. These funds are fair valued using the net asset value per share or equivalent

(“NAV”), as a practical expedient, calculated on a monthly basis and is the amount at which a unit or shareholder may redeem their

investment, if redemption is allowed. Certain impediments to redemption include, but are not limited to the following: 1) redemption

notice periods vary and may be as long as 90 days, 2) redemption may be restricted (e.g. only be allowed on a quarter-end), 3) a holding

period referred to as a lock-up may be imposed whereby an investor must hold their investment for a specified period of time before they

can make a notice for redemption, 4) gating provisions may limit all redemptions in a given period to a percentage of the entities' equity

interests, or may only allow an investor to redeem a portion of their investment at one time and 5) early redemption penalties may be

imposed that are expressed as a percentage of the amount redeemed. The Company assesses impediments to redemption and current

market conditions that will restrict the redemption at the end of the notice period. For further discussion of fair value measurement, see

Note 5 of Notes to Consolidated Financial Statements. In addition, certain limited partnerships and other alternative investments are

accounted for under the equity method of accounting. For further discussion, see the Investments - Overview section of Note 1 of Notes

to the Consolidated Financial Statements.

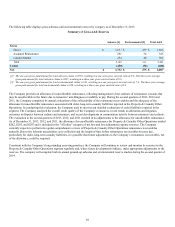

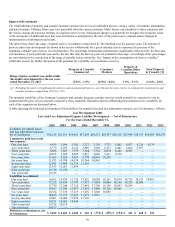

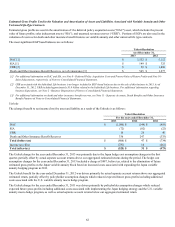

Valuation Allowance on Deferred Tax Assets

Deferred tax assets represent the tax benefit of future deductible temporary differences and operating loss and tax credit carryforwards.

Deferred tax assets are measured using the enacted tax rates expected to be in effect when such benefits are realized if there is no change

in tax law. Under U.S. GAAP, we test the value of deferred tax assets for impairment on a quarterly basis at the entity level within each

tax jurisdiction, consistent with our filed tax returns. Deferred tax assets are reduced by a valuation allowance if, based on the weight of

available evidence, it is more likely than not that some portion, or all, of the deferred tax assets will not be realized. The determination of

the valuation allowance for our deferred tax assets requires management to make certain judgments and assumptions. In evaluating the

ability to recover deferred tax assets, we have considered all available evidence as of December 31, 2013, including past operating

results, the existence of cumulative losses in the most recent years, forecasted earnings, future taxable income, and prudent and feasible

tax planning strategies. In the event we determine it is not more likely than not that we will be able to realize all or part of our deferred

tax assets in the future, an increase to the valuation allowance would be charged to earnings in the period such determination is made.

Likewise, if it is later determined that it is more likely than not that those deferred tax assets would be realized, the previously provided

valuation allowance would be reversed. Our judgments and assumptions are subject to change given the inherent uncertainty in

predicting future performance and specific industry and investment market conditions.

The Company has recorded a deferred tax asset valuation allowance that is adequate to reduce the total deferred tax asset to an amount

that will be more likely than not realized. The deferred tax asset valuation allowance was $4, relating mostly to U.S. net operating losses,

at December 31, 2013 and $58, relating mostly to foreign net operating losses, at December 31, 2012. In assessing the need for a

valuation allowance, management considered future taxable temporary difference reversals, future taxable income exclusive of reversing

temporary differences and carryforwards, taxable income in open carry back years, as well as other tax planning strategies. These tax

planning strategies include holding a portion of debt securities with market value losses until recovery, altering the level of tax exempt

securities held, selling appreciated securities to offset capital losses, business considerations such as asset-liability matching, and the

sales of certain corporate assets. Management views such tax planning strategies as prudent and feasible, and would implement them, if

necessary, to realize the deferred tax asset.