The Hartford 2013 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-76

The Debentures are unsecured, subordinated and junior in right of payment and upon liquidation to all of the Company’s existing and

future senior indebtedness. In addition, the Debentures are effectively subordinated to all of the Company’s subsidiaries’ existing and

future indebtedness and other liabilities, including obligations to policyholders. The Debentures do not limit the Company’s or the

Company’s subsidiaries’ ability to incur additional debt, including debt that ranks senior in right of payment and upon liquidation to the

Debentures.

The Debentures rank equally in right of payment and upon liquidation with (i) any indebtedness the terms of which provide that such

indebtedness ranks equally with the Debentures, including guarantees of such indebtedness, (ii) the Company’s existing 8.125% fixed-

to-floating rate junior subordinated debentures due 2068 (the “8.125% Debentures”), (iii) the Company’s Income Capital Obligation

Notes due 2067, issuable pursuant to the Junior Subordinated Indenture, dated as of February 12, 2007, between the Company and

Wilmington Trust Company (the “ICON securities”), (iv) our trade accounts payable, and (v) any of our indebtedness owed to a person

who is our subsidiary or employee.

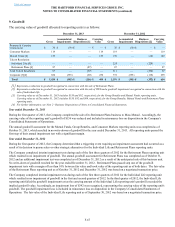

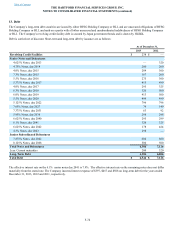

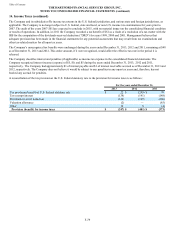

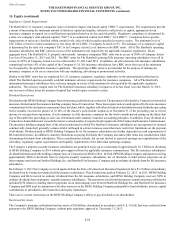

Long-Term Debt Maturities

Long-term debt maturities (at par values), as of December 31, 2013 are summarized as follows:

2014 $ 200

2015 456

2016 275

2017 711

2018 320

Thereafter 4,438

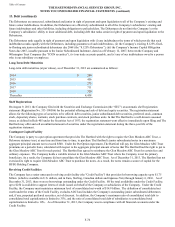

Shelf Registrations

On August 9, 2013, the Company filed with the Securities and Exchange Commission (the “SEC”) an automatic shelf registration

statement (Registration No. 333-190506) for the potential offering and sale of debt and equity securities. The registration statement

allows for the following types of securities to be offered: debt securities, junior subordinated debt securities, preferred stock, common

stock, depositary shares, warrants, stock purchase contracts, and stock purchase units. In that The Hartford is a well-known seasoned

issuer, as defined in Rule 405 under the Securities Act of 1933, the registration statement went effective immediately upon filing and The

Hartford may offer and sell an unlimited amount of securities under the registration statement during the three-year life of the

registration statement.

Contingent Capital Facility

The Company is party to a put option agreement that provides The Hartford with the right to require the Glen Meadow ABC Trust, a

Delaware statutory trust, at any time and from time to time, to purchase The Hartford’s junior subordinated notes in a maximum

aggregate principal amount not to exceed $500. Under the Put Option Agreement, The Hartford will pay the Glen Meadow ABC Trust

premiums on a periodic basis, calculated with respect to the aggregate principal amount of notes that The Hartford had the right to put to

the Glen Meadow ABC Trust for such period. The Hartford has agreed to reimburse the Glen Meadow ABC Trust for certain fees and

ordinary expenses. The Company holds a variable interest in the Glen Meadow ABC Trust where the Company is not the primary

beneficiary. As a result, the Company did not consolidate the Glen Meadow ABC Trust. As of December 31, 2013, The Hartford has not

exercised its right to require Glen Meadow ABC Trust to purchase the notes. As a result, the notes remain a source of capital for the

HFSG Holding Company.

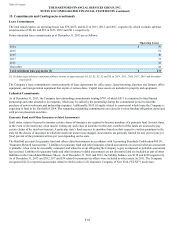

Revolving Credit Facilities

The Company has a senior unsecured revolving credit facility (the "Credit Facility") that provides for borrowing capacity up to $1.75

billion (which is available in U.S. dollars, and in Euro, Sterling, Canadian dollars and Japanese Yen) through January 6, 2016. As of

December 31, 2013, there were no borrowings outstanding under the Credit Facility. Of the total availability under the Credit Facility,

up to $250 is available to support letters of credit issued on behalf of the Company or subsidiaries of the Company. Under the Credit

Facility, the Company must maintain a minimum level of consolidated net worth of $14.9 billion. The definition of consolidated net

worth under the terms of the Credit Facility, excludes AOCI and includes the Company's outstanding junior subordinated debentures

and, if any, perpetual preferred securities, net of discount. In addition, the Company’s maximum ratio of consolidated total debt to

consolidated total capitalization is limited to 35%, and the ratio of consolidated total debt of subsidiaries to consolidated total

capitalization is limited to 10%. As of December 31, 2013, the Company was in compliance with all financial covenants under the

Credit Facility.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

13. Debt (continued)