The Hartford 2013 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-77

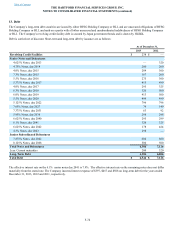

HLIKK has four revolving credit facilities in support of operations. Two of the credit facilities have no amounts drawn as of

December 31, 2013 with borrowing limits of approximately ¥5 billion, or $48 each, and individually have expiration dates of January 5,

2015 and September 30, 2014. In December 2013, HLIKK entered into two new revolving credit facility agreements with two Japanese

banks in order to finance certain withholding taxes on mutual fund gains, that are subsequently credited to HLIKK's tax liability when

HLIKK files its’ income tax returns. At December 31, 2013, HLIKK had drawn the total borrowing limits of ¥5 billion, or $48, and ¥20

billion, or $190 on these credit facilities. The ¥5 billion credit facility accrues interest at a variable rate based on the one month Tokyo

Interbank Offering Rate (TIBOR) plus 3 bps, which as of December 31, 2013 the interest rate was 18 bps, and the ¥20 billion credit

facility accrues interest at a variable rate based on TIBOR plus 3 bps, or the actual cost of funding, which as of December 31, 2013 the

interest rate was 20 bps. Both of the credit facilities expire on September 30, 2014.

Commercial Paper

While The Hartford's maximum borrowings available under its commercial paper program are $2.0 billion, the Company is dependent

upon market conditions to access short-term financing through the issuance of commercial paper to investors. There is no commercial

paper outstanding as of December 31, 2013.

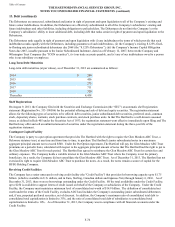

Consumer Notes

The Company issued consumer notes through its Retail Investor Notes Program prior to 2009. A consumer note is an investment

product distributed through broker-dealers directly to retail investors as medium-term, publicly traded fixed or floating rate, or a

combination of fixed and floating rate notes. Consumer notes are part of the Company’s spread-based business and proceeds are used to

purchase investment products, primarily fixed rate bonds. Proceeds are not used for general operating purposes. Consumer notes

maturities may extend up to 30 years and have contractual coupons based upon varying interest rates or indexes (e.g. consumer price

index) and may include a call provision that allows the Company to extinguish the notes prior to its scheduled maturity date. Certain

Consumer notes may be redeemed by the holder in the event of death. Redemptions are subject to certain limitations, including calendar

year aggregate and individual limits. The aggregate limit is equal to the greater of $1 or 1% of the aggregate principal amount of the

notes as of the end of the prior year. The individual limit is $250 thousand per individual. Derivative instruments are utilized to hedge

the Company’s exposure to market risks in accordance with Company policy. As of December 31, 2013, these consumer notes have

interest rates ranging from 4% to 6% for fixed notes and, for variable notes, based on December 31, 2013 rates, either consumer price

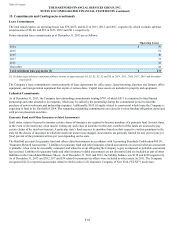

index plus 102 to 247 basis points, or indexed to the S&P 500, Dow Jones Industrials, or the Nikkei 225. The aggregate maturities of

Consumer Notes are as follows: $14 in 2014, $32 in 2015, $18 in 2016, $12 in 2017, $8 thereafter. For 2013, 2012 and 2011, interest

credited to holders of consumer notes was $6, $10, and $15, respectively.

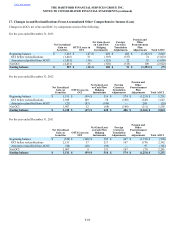

14. Income Taxes

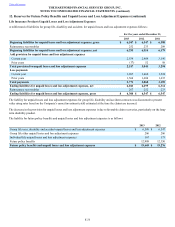

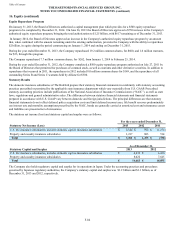

Income (loss) from continuing operations before income taxes included income (loss) from domestic operations of $276, $(1,267) and

$344 for the years ended December 31, 2013, 2012 and 2011, and income (loss) from foreign operations of $(213), $686 and $(144) for

the years ended December 31, 2013, 2012 and 2011. Substantially all of the income (loss) from foreign operations is earned by a

Japanese subsidiary.

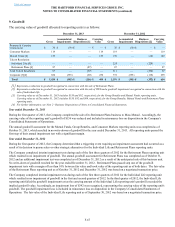

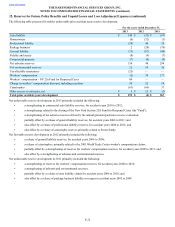

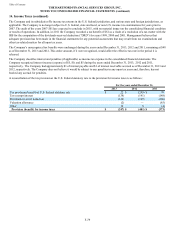

The provision (benefit) for income taxes consists of the following:

For the years ended December 31,

2013 2012 2011

Income Tax Expense (Benefit)

Current - U.S. Federal $ 219 $ 33 $ (543)

International 89 6 22

Total current 308 39 (521)

Deferred - U.S. Federal Excluding NOL Carryforward (233)(377) 921

U.S. Net Operating Loss Carryforward (86)(301) (652)

International (236) 158 (121)

Total deferred (555)(520) 148

Total income tax benefit $ (247) $ (481) $ (373)

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

13. Debt (continued)