The Hartford 2013 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-83

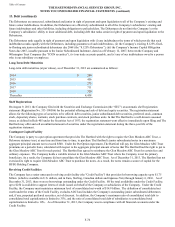

Derivative Commitments

Certain of the Company’s derivative agreements contain provisions that are tied to the financial strength ratings of the individual legal

entity that entered into the derivative agreement as set by nationally recognized statistical rating agencies. If the legal entity’s financial

strength were to fall below certain ratings, the counterparties to the derivative agreements could demand immediate and ongoing full

collateralization and in certain instances demand immediate settlement of all outstanding derivative positions traded under each

impacted bilateral agreement. The settlement amount is determined by netting the derivative positions transacted under each agreement.

If the termination rights were to be exercised by the counterparties, it could impact the legal entity’s ability to conduct hedging activities

by increasing the associated costs and decreasing the willingness of counterparties to transact with the legal entity. The aggregate fair

value of all derivative instruments with credit-risk-related contingent features that are in a net liability position as of December 31, 2013

was $1.2 billion. Of this $1.2 billion the legal entities have posted collateral of $1.4 billion in the normal course of business. In addition,

the Company has posted collateral of $44 associated with a customized GMWB derivative. Based on derivative market values as of

December 31, 2013, a downgrade of one level below the current financial strength ratings by either Moody’s or S&P could require

approximately an additional $12 to be posted as collateral. Based on derivative market values as of December 31, 2013, a downgrade by

either Moody’s or S&P of two levels below the legal entities’ current financial strength ratings could require approximately an additional

$33 of assets to be posted as collateral. These collateral amounts could change as derivative market values change, as a result of changes

in our hedging activities or to the extent changes in contractual terms are negotiated. The nature of the collateral that we would post, if

required, would be primarily in the form of U.S. Treasury bills, U.S. Treasury notes and government agency securities.

Guarantees

In the ordinary course of selling businesses or entities to third parties, the Company has agreed to indemnify purchasers for losses arising

out of breaches of representations and warranties with respect to the business or entities being sold, covenants and obligations of the

Company and/or its subsidiaries following the closing. These obligations are typically subject to various time limitations, defined by the

contract or by operation of law, such as statutes of limitation. In some cases, the maximum potential obligation is subject to contractual

limitations, while in other cases such limitations are not specified or applicable. The Company does not expect to make any payments on

these guarantees and is not carrying any liabilities associated with these guarantees.

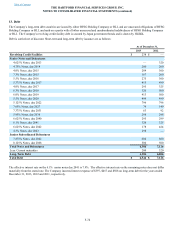

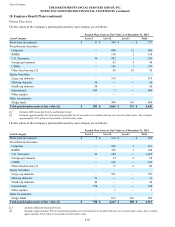

16. Equity

Series F Preferred Stock

On March 23, 2010, The Hartford issued 23 million depositary shares, each representing a 1/40th interest in The Hartford’s 7.25%

mandatory convertible preferred stock, Series F, at a price of $25 per depositary share and received net proceeds of approximately $556.

Cumulative dividends on each share of the mandatory convertible preferred stock were payable at a rate of 7.25% per annum on the

initial liquidation preference of $1,000 per share. On April 1, 2013 the mandatory convertible preferred stock converted to 21.2 million

shares of common stock.

Allianz SE Warrants

In connection with the Company’s October 17, 2008 investment agreement with Allianz SE, Allianz was issued warrants, with an initial

term of seven years, to purchase the Company’s Series B Non-Voting Contingent Convertible Preferred Stock and Series C Non-Voting

Contingent Convertible Preferred Stock, structured to entitle Allianz, upon receipt of necessary approvals, to purchase 69,115,324 shares

of common stock at an initial exercise price of $25.32 per share.

On March 30, 2012 the Company repurchased all of the outstanding Series B and Series C warrants held by Allianz for $300. These

warrants authorized Allianz to purchase 69,351,806 shares of the Company’s common stock at an exercise price of $25.23 per share. The

repurchase was settled on April 17, 2012.

Outstanding Capital Purchase Program Warrants

The Hartford has warrants outstanding and exercisable that expire on June 26, 2019. These warrants were originally issued on June 26,

2009 as part of the Capital Purchase Program (“CPP”) established by the U.S. Department of the Treasury (“Treasury”) under the

Emergency Economic Stabilization Act of 2008 (the “EESA”). In 2010, the Treasury sold its warrants to purchase approximately 52

million shares of The Hartford’s common stock in a secondary public offering for net proceeds of approximately $706.

The Hartford’s declaration of dividends on its common stock in excess of a threshold results in adjustments to the warrant exercise price.

The warrant exercise price was $9.504 , $9.599, and $9.699 at December 31, 2013, 2012 and 2011, respectively. The exercise price will

be paid by withholding by The Hartford of a number of shares of common stock issuable upon exercise of the warrants equal to the

value of the aggregate exercise price of the warrants so exercised determined by reference to the closing price of The Hartford’s common

stock on the trading day on which the warrants are exercised and notice is delivered to the warrant agent. Total warrants outstanding and

exercisable as of December 31, 2013, 2012, and 2011, were 32.4 million, 52.1 million, and 52.1 million, respectively. Warrant exercises

and repurchases under the Equity Repurchase Program in 2013 were 18.1 million and 1.6 million, respectively.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

15. Commitments and Contingencies (continued)