The Hartford 2013 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

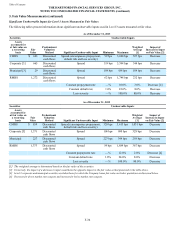

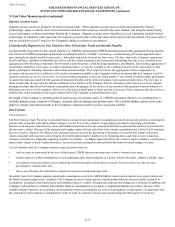

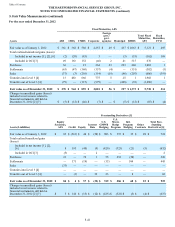

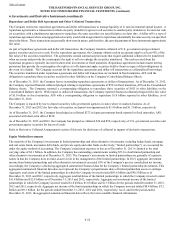

F-42

Assets

Limited Partnerships

and Other Alternative

Investments

Reinsurance

Recoverable

for U.S.

GMWB Separate Accounts

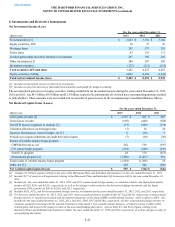

Fair value as of January 1, 2012 $ — $ 443 $ 1,031

Total realized/unrealized gains (losses)

Included in net income [1], [2], [6] (1)(280) 37

Included in OCI [3] — — —

Purchases 55 — 252

Settlements — 28 (1)

Sales — — (476)

Transfers into Level 3 [4] 260 — 443

Transfers out of Level 3 [4] — — (703)

Fair value as of December 31, 2012 $ 314 $ 191 $ 583

Changes in unrealized gains (losses) included in net income related to

financial instruments still held at December 31, 2012 [2] [7] $ (1) $ (280) $ 28

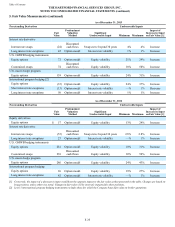

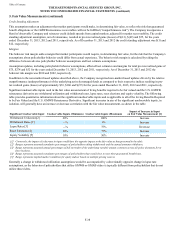

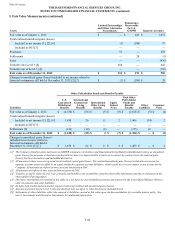

Other Policyholder Funds and Benefits Payable

Liabilities

U.S.

Guaranteed

Withdrawal

Benefits

International

Guaranteed

Living

Benefits

International

Other Living

Benefits

Equity

Linked

Notes

Total Other

Policyholder

Funds and

Benefits

Payable Other

Liabilities Consumer

Notes

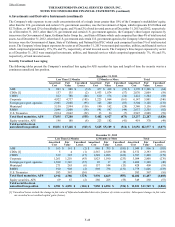

Fair value as of January 1, 2012 $ (2,538) $ (66) $ (5) $ (9) $ (2,618) $ (9) $ (4)

Total realized/unrealized gains (losses)

Included in net income [1], [2], [6] 1,430 26 11 2 1,469 (34) 2

Included in OCI [3] — — — — — — —

Settlements [8] (141) (10)(4) — (155) 43 —

Fair value as of December 31, 2012 $ (1,249) $ (50) $ 2 $ (7) $ (1,304) $ — $ (2)

Changes in unrealized gains (losses)

included in net income related to

financial instruments still held at

December 31, 2012 [2] [7] $ 1,430 $ 26 $ 11 $ 2 $ 1,469 $ — $ 2

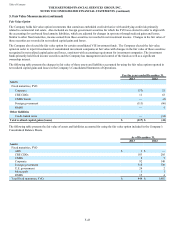

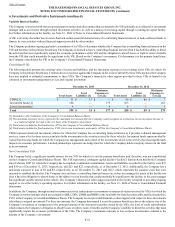

[1] The Company classifies gains and losses on GMWB reinsurance derivatives and Guaranteed Living Benefit embedded derivatives as unrealized

gains (losses) for purposes of disclosure in this table because it is impracticable to track on a contract-by-contract basis the realized gains

(losses) for these derivatives and embedded derivatives.

[2] All amounts in these rows are reported in net realized capital gains/losses. The realized/unrealized gains (losses) included in net income for

separate account assets are offset by an equal amount for separate account liabilities, which results in a net zero impact on net income for the

Company. All amounts are before income taxes and amortization DAC.

[3] All amounts are before income taxes and amortization of DAC.

[4] Transfers in and/or (out) of Level 3 are primarily attributable to the availability of market observable information and the re-evaluation of the

observability of pricing inputs.

[5] Derivative instruments are reported in this table on a net basis for asset/(liability) positions and reported in the Consolidated Balance Sheet in

other investments and other liabilities.

[6] Includes both market and non-market impacts in deriving realized and unrealized gains (losses).

[7] Amounts presented are for Level 3 only and therefore may not agree to other disclosures included herein.

[8] Settlements of other liabilities reflect the removal of liabilities carried at fair value upon the deconsolidation of a variable interest entity. See

note 6, Investments and Derivative Instruments for additional information.

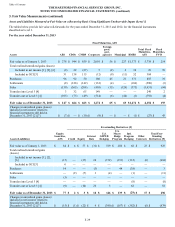

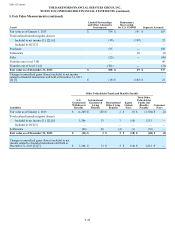

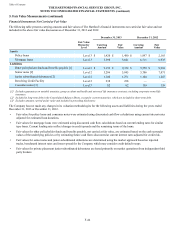

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

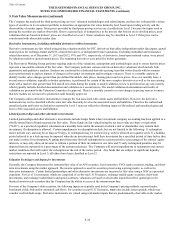

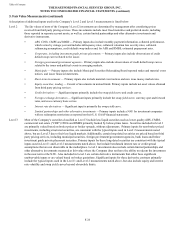

5. Fair Value Measurements (continued)