The Hartford 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

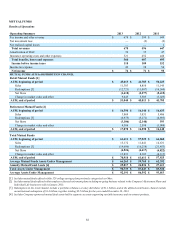

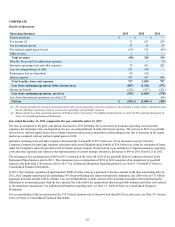

CORPORATE

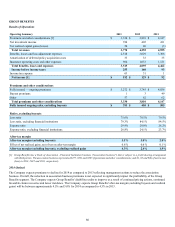

Results of Operations

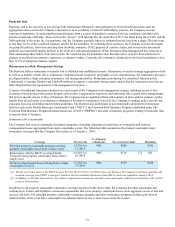

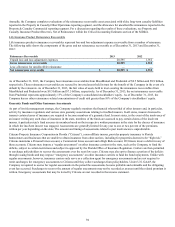

Operating Summary 2013 2012 2011

Earned premiums $ — $ — $ —

Fee income [1] 11 167 209

Net investment income 27 31 23

Net realized capital gains (losses) (89) 125 (96)

Other revenue 1 1 —

Total revenues (50) 324 136

Benefits, losses and loss adjustment expenses — — (3)

Insurance operating costs and other expenses 78 365 202

Loss on extinguishment of debt 213 910 —

Reinsurance loss on disposition 69 118 —

Interest expense 397 457 508

Total benefits, losses and expenses 757 1,850 707

Loss from continuing operations before income taxes (807)(1,526) (571)

Income tax benefit (252)(517) (201)

Loss from continuing operations, net of tax (555)(1,009) (370)

Loss from discontinued operations, net of tax [2] — — (64)

Net loss $ (555) $ (1,009) $ (434)

[1] Fee income includes the income associated with the sales of non-proprietary insurance products in the Company’s broker-dealer subsidiaries that

has an offsetting commission expense in insurance operating costs and other expenses.

[2] Represents the loss from operations and sale of Federal Trust Corporation. For additional information, see Note 20 Discontinued Operations of

Notes to Consolidated Financial Statements.

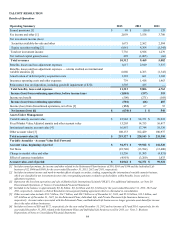

Year ended December 31, 2013 compared to the year ended December 31, 2012

Net loss, as compared to the prior year period, decreased in 2013 primarily due to decreases in insurance operating costs and other

expenses, the reinsurance loss on disposition, the loss on extinguishment of debt and interest expense. The net loss in 2013 was partially

driven by net realized capital losses due to higher long-term interest rates and global credit hedging losses due to increases in the equity

market as compared with net realized capital gains in 2012.

Insurance operating costs and other expenses decreased due to a benefit of $57, before tax, for an insurance recovery from the

Company's insurers for past legal expenses associated with closed litigation and a benefit of $19, before tax, from the resolution of items

under the Company's spin-off agreement with its former parent company. Restructuring costs, included in Corporate insurance operating

costs and other expenses and related to the implementation of certain strategic initiatives, decreased to $64 in 2013 from $121 in 2012.

The reinsurance loss on disposition of $69 in 2013 consisted of the write-off of all of the goodwill held in Corporate allocated to the

Retirement Plans business sold in 2013. The reinsurance loss on disposition of $118 in 2012 consisted of an impairment of goodwill

related to the Individual Life business sold in 2013. For additional information regarding goodwill, see Note 9 - Goodwill of Notes to

Consolidated Financial Statements.

In 2013, the Company repurchased approximately $800 of senior notes at a premium to the face amount of the then outstanding debt. In

2012, the Company repurchased all outstanding 10% fixed-to-floating rate junior subordinated debentures due 2068 with a $1.75 billion

aggregate principal amount held by Allianz. Loss on extinguishment of debt consists of the premium associated with repurchasing the

debentures at an amount greater than the face amount, the write-off of the unamortized discount and debt issuance and other costs related

to the repurchase transactions. For additional information regarding debt, see Note 13 - Debt of Notes to Consolidated Financial

Statements.

For a reconciliation of the tax provision at the U.S. Federal statutory rate to the provision (benefit) for income taxes, see Note 14 - Income

Taxes of Notes to Consolidated Financial Statements.