The Hartford 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

1. Basis of Presentation and Significant Accounting Policies (continued)

F-18

The Company reinsures a portion of its in-force GMDB and all of its UL secondary guarantees. The death and other insurance benefit

reserves, net of reinsurance, are established by estimating the expected value of net reinsurance costs and death and other insurance

benefits in excess of the projected account balance. The additional death and other insurance benefits and net reinsurance costs are

recognized ratably over the accumulation period based on total expected assessments.

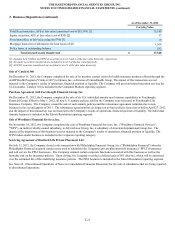

Reserve for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses

Property and Casualty Insurance Products

The Hartford establishes property and casualty insurance products reserves to provide for the estimated costs of paying claims under

insurance policies written by the Company. These reserves include estimates for both claims that have been reported and those that have

been incurred but not reported, and include estimates of all losses and loss adjustment expenses associated with processing and settling

these claims. Estimating the ultimate cost of future losses and loss adjustment expenses is an uncertain and complex process. This

estimation process is based significantly on the assumption that past developments are an appropriate predictor of future events, and

involves a variety of actuarial techniques that analyze experience, trends and other relevant factors. The uncertainties involved with the

reserving process have become increasingly difficult due to a number of complex factors including social and economic trends and

changes in the concepts of legal liability and damage awards. Accordingly, final claim settlements may vary from the present estimates,

particularly when those payments may not occur until well into the future.

The Hartford regularly reviews the adequacy of its estimated losses and loss adjustment expense reserves by line of business within the

various reporting segments. Adjustments to previously established reserves are reflected in the operating results of the period in which

the adjustment is determined to be necessary. Such adjustments could possibly be significant, reflecting any variety of new and adverse

or favorable trends.

Most of the Company’s property and casualty insurance products reserves are not discounted. However, the Company has discounted

liabilities funded through structured settlements and has discounted certain reserves for indemnity payments due to permanently disabled

claimants under workers’ compensation policies. Structured settlements are agreements that provide fixed periodic payments to

claimants and include annuities purchased to fund unpaid losses for permanently disabled claimants and, prior to 2008, agreements that

funded loss run-offs for unrelated parties. Most of the annuities have been issued by the Company and these structured settlements are

recorded at present value as annuity obligations, either within the reserve for future policy benefits if the annuity benefits are life-

contingent or within other policyholder funds and benefits payable if the annuity benefits are not life-contingent. If not funded through

an annuity, reserves for certain indemnity payments due to permanently disabled claimants under workers’ compensation policies are

recorded as property and casualty insurance products reserves and were discounted to present value at an average interest rate of 3.5% in

2013 and 4.0% in 2012.

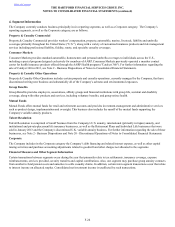

Life Insurance Products

Liabilities for future policy benefits are calculated by the net level premium method using interest, withdrawal and mortality

assumptions appropriate at the time the policies were issued. The methods used in determining the liability for unpaid losses and future

policy benefits are standard actuarial methods recognized by the American Academy of Actuaries. For the tabular reserves, discount

rates are based on the Company’s earned investment yield and the morbidity/mortality tables used are standard industry tables modified

to reflect the Company’s actual experience when appropriate. In particular, for the Company’s group disability known claim reserves, the

morbidity table for the early durations of claim is based exclusively on the Company’s experience, incorporating factors such as gender,

elimination period and diagnosis. These reserves are computed such that they are expected to meet the Company’s future policy

obligations. Future policy benefits are computed at amounts that, with additions from estimated premiums to be received and with

interest on such reserves compounded annually at certain assumed rates, are expected to be sufficient to meet the Company’s policy

obligations at their maturities or in the event of an insured’s death. Changes in or deviations from the assumptions used for mortality,

morbidity, expected future premiums and interest can significantly affect the Company’s reserve levels and related future operations.

Liabilities for the Company’s group life and disability contracts, as well as its individual term life insurance policies, include amounts

for unpaid losses and future policy benefits. Liabilities for unpaid losses include estimates of amounts to fully settle known reported

claims, as well as claims related to insured events that the Company estimates have been incurred but have not yet been reported. These

reserve estimates are based on known facts and interpretations of circumstances, and consideration of various internal factors including

The Hartford’s experience with similar cases, historical trends involving claim payment patterns, loss payments, pending levels of

unpaid claims, loss control programs and product mix. In addition, the reserve estimates are influenced by consideration of various

external factors including court decisions, economic conditions and public attitudes. The effects of inflation are implicitly considered in

the reserving process. Group life and disability contracts with long tail claim liabilities are discounted because the payment pattern and

the ultimate costs are reasonably fixed and determinable on an individual claim basis. These reserves were discounted to present value

using a weighted average interest rate of 4.71% in 2013 and 4.86% in 2012.