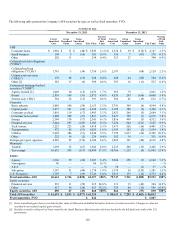

The Hartford 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.105

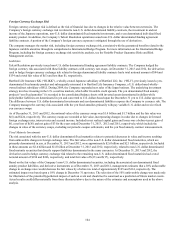

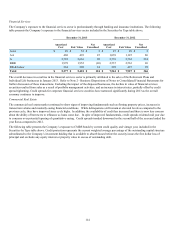

Financial Risk on Statutory Capital

Statutory surplus amounts and risk-based capital (“RBC”) ratios may increase or decrease in any period depending upon a variety of

factors and may be compounded in extreme scenarios or if multiple factors occur at the same time. At times the impact of changes in

certain market factors or a combination of multiple factors on RBC ratios can be counterintuitive. Factors include:

• In general, as equity market levels and interest rates decline, the amount and volatility of both our actual potential obligation, as

well as the related statutory surplus and capital margin for death and living benefit guarantees associated with U.S. variable

annuity contracts can be materially negatively affected, sometimes at a greater than linear rate. Other market factors that can

impact statutory surplus, reserve levels and capital margin include differences in performance of variable subaccounts relative to

indices and/or realized equity and interest rate volatilities. In addition, as equity market levels increase, generally surplus levels

will increase. RBC ratios will also tend to increase when equity markets increase. However, as a result of a number of factors and

market conditions, including the level of hedging costs and other risk transfer activities, reserve requirements for death and living

benefit guarantees and RBC requirements could increase with rising equity markets, resulting in lower RBC ratios. Non-market

factors, which can also impact the amount and volatility of both our actual potential obligation, as well as the related statutory

surplus and capital margin, include actual and estimated policyholder behavior experience as it pertains to lapsation, partial

withdrawals, and mortality.

• For guaranteed benefits (GMDB, GMIB, and GMWB) reinsured from our international operations to our U.S. insurance

subsidiaries, or guaranteed by our U.S. insurance subsidiaries, the Company hedges its aggregate economic exposure to the

various risks arising out of the product guarantees, with a focus on the underlying economics of the exposure to the entire

Company, rather than the direct liability of the underlying issuer of the related products. The Company believes that hedging

economic exposure in this manner is consistent with certain intercompany reinsurance agreements and guarantees, results in

increased capital efficiency and results in a better risk profile than taking alternative approaches to hedging that might emphasize

statutory or GAAP measures or considerations. The amount and volatility of both our actual potential obligation, as well as the

related statutory surplus and capital margin can be materially affected by a variety of factors, both market and non-market. Market

factors include declines in various equity market indices and interest rates, changes in value of the yen versus other global

currencies, difference in the performance of variable subaccounts relative to indices, and increases in realized equity, interest rate,

and currency volatilities. Non-market factors include actual and estimated policyholder behavior experience as it pertains to

lapsation, withdrawals, mortality, and annuitization. Risk mitigation activities, such as hedging, may also result in material and

sometimes counterintuitive impacts on statutory surplus and capital margin. Notably, as changes in these market and non-market

factors occur, both our potential obligation and the related statutory reserves and/or required capital can increase or decrease at a

greater than linear rate.

• As the value of certain fixed-income and equity securities in our investment portfolio decreases, due in part to credit spread

widening, statutory surplus and RBC ratios may decrease.

• As the value of certain derivative instruments that do not qualify for hedge accounting decreases, statutory surplus and RBC ratios

may decrease.

• The life insurance subsidiaries’ exposure to foreign currency exchange risk exists with respect to non-U.S. dollar denominated

assets and liabilities. Assets and liabilities denominated in foreign currencies are accounted for at their U.S. dollar equivalent

values using exchange rates at the balance sheet date. As foreign currency exchange rates vary in comparison to the U.S. dollar,

the remeasured value of those non-dollar denominated assets or liabilities will also vary, causing an increase or decrease to

statutory surplus.

• Our statutory surplus is also impacted by widening credit spreads as a result of the accounting for the assets and liabilities in our

fixed MVA annuities. Statutory separate account assets supporting the fixed MVA annuities are recorded at fair value. In

determining the statutory reserve for the fixed MVA annuities, we are required to use current crediting rates in the U.S. and

Japanese LIBOR in Japan. In many capital market scenarios, current crediting rates in the U.S. are highly correlated with market

rates implicit in the fair value of statutory separate account assets. As a result, the change in statutory reserve from period to

period will likely substantially offset the change in the fair value of the statutory separate account assets. However, in periods of

volatile credit markets, such as we have experienced, actual credit spreads on investment assets may increase sharply for certain

sub-sectors of the overall credit market, resulting in statutory separate account asset market value losses. As actual credit spreads

are not fully reflected in the current crediting rates in the U.S. or Japanese LIBOR in Japan, the calculation of statutory reserves

will not substantially offset the change in fair value of the statutory separate account assets resulting in reductions in statutory

surplus. This has resulted and may continue to result in the need to devote significant additional capital to support the product.

• With respect to our fixed annuity business, sustained low interest rates may result in a reduction in statutory surplus and an

increase in NAIC required capital.