The Hartford 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

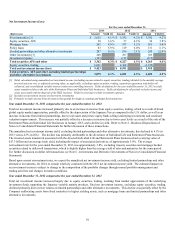

• A loss on extinguishment of debt of $213, before tax, in 2013, compared to $910, before tax in 2012. The loss in 2013 related to

the repurchase of approximately $800 of senior notes at a premium to the face amount of the then outstanding debt. The resulting

loss on extinguishment of debt consists of the repurchase premium, the write-off of the unamortized discount, and debt issuance

and other costs related to the repurchase transaction. The loss in 2012 related to the repurchase of all outstanding 10% fixed-to-

floating rate junior subordinated debentures due 2068 with a $1.75 billion aggregate principal amount all held by Allianz. The loss

in 2012 consisted of the premium associated with repurchasing the 10% Debentures at an amount greater than the face amount, the

write-off of the unamortized discount and debt issuance costs related to the 10% Debentures and other costs related to the

repurchase transaction.

• Reinsurance loss on disposition of $533, before tax, in 2012 consisting of an impairment of goodwill and a loss accrual for

premium deficiency related to the disposition of the Individual Life business, and losses in 2012 from the operations of the

Retirement Plans and Individual Life businesses sold in 2013. For further discussion of the sale of these businesses, see Note 2 -

Business Dispositions of Notes to Consolidated Financial Statements.

Partially offsetting the increase in net income were the following items:

• An increase of $853 in the Unlock charge, before tax, in 2013 compared to an Unlock benefit of $47, before tax, in 2012. The

Unlock charge in 2013 was primarily due to Japan hedge cost assumption changes associated with expanding the Japan variable

annuity hedging program in 2013, partially offset by actual separate account returns being above our aggregated estimated returns

during the period. The Unlock benefit in 2012 was driven primarily by actual separate account returns above our aggregated

estimated return, partially offset by assumption changes in connection with the annual policyholder behavior assumption study.

For further discussion of Unlocks, see MD&A - Critical Accounting Estimates, Estimated Gross Profits Used in the Valuation and

Amortization of Assets and Liabilities Associated with Variable Annuity and Other Universal Life-Type Contracts and MD&A -

Talcott Resolution.

• Net realized capital gains (losses), excluding the realized capital gain on business dispositions and OTTI, increased to a loss of

$995, before tax, from a loss in the prior year of $395, before tax, primarily due to losses on the international variable annuity

hedge program in 2013. The losses in 2013 primarily resulted from the weakening of the yen and rising equity markets. Certain

hedge assets generated realized capital losses on rising equity markets and weakening of the yen and are used to hedge liabilities

that are not carried at fair value. For further discussion of investment results, see MD&A - Key Performance Measures and Ratios,

Net Realized Capital Gains (Losses). For information on the related sensitivities of the variable annuity hedging program, see

Enterprise Risk Management, Variable Product Guarantee Risks and Risk Management.

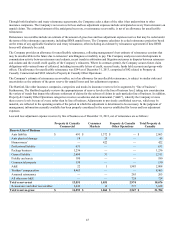

• Net asbestos reserve strengthening of $130, before tax in 2013, compared to $48, before tax in 2012, resulting from the Company's

annual review of its asbestos liabilities. For further information, see MD&A - Critical Accounting Estimates, Property & Casualty

Other Operations Claims with the Property and Casualty Insurance Product Reserves, Net of Reinsurance.

• The Company reported a loss from discontinued operations primarily due to the realized capital loss of $102, after-tax, on the sale

of Hartford Life International, Ltd. ("HLIL") in 2013.

• Differences between the Company's effective income tax rate and the U.S. statutory rate of 35% are due primarily to tax-exempt

interest earned on invested assets and the dividends received deduction ("DRD"). The $234 decrease in the income tax benefit in

2013 compared with the higher income tax benefit in 2012 was primarily due to the $644 increase in income (loss) from continuing

operations, before tax. The income tax benefit of $247 and $481 in 2013 and 2012, respectively, includes separate account DRD

benefits of $139 and $145, respectively.

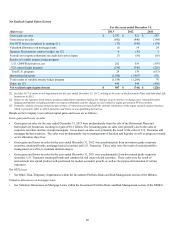

Year ended December 31, 2012 compared to the year ended December 31, 2011

The decrease in net income from 2011 to 2012 was primarily due to the following items:

• Net realized capital losses increased primarily due to losses in 2012 on the international variable annuity hedge program,

compared to gains in 2011. The losses resulted from rising equity markets and weakening of the yen. Certain hedge assets

generated realized capital losses on rising equity markets and weakening of the yen and are used to hedge liabilities that are not

carried at fair value. In addition, 2012 includes intent-to-sell impairments relating to the sales of the Retirement Plans and

Individual Life businesses.

• A loss on extinguishment of debt of $910, before tax in 2012 related to the repurchase of all outstanding 10% fixed-to-floating rate

junior subordinated debentures due 2068 with a $1.75 billion aggregate principal amount all held by Allianz. The loss consisted of

the premium associated with repurchasing the 10% Debentures at an amount greater than the face amount, the write-off of the

unamortized discount and debt issuance costs related to the 10% Debentures and other costs related to the repurchase transaction.