The Hartford 2013 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-96

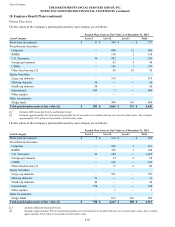

Cash Flows

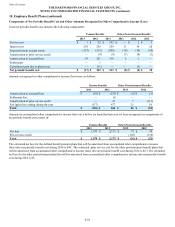

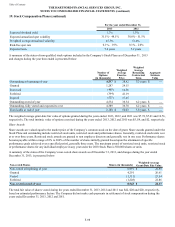

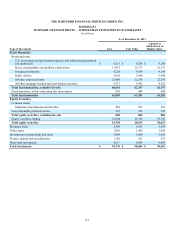

The following table illustrates the Company’s prior contributions.

Employer Contributions Pension Benefits Other Postretirement Benefits

2013 $ 101 $ —

2012 $ 201 $ —

In 2013, the Company, at its discretion, made $100 in contributions to the U.S. qualified defined benefit pension plan. The Company does

not have a 2014 required minimum funding contribution for the U.S. qualified defined benefit pension plan. The Company has not determined

whether, and to what extent, contributions may be made to the U. S. qualified defined benefit pension plan in 2014. The Company will

monitor the funded status of the U.S. qualified defined benefit pension plan during 2014 to make this determination.

Employer contributions in 2013 and 2012 were made in cash and did not include contributions of the Company’s common stock.

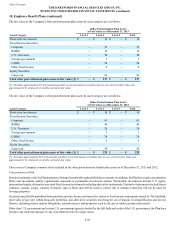

Benefit Payments

The following table sets forth amounts of benefits expected to be paid over the next ten years from the Company’s pension and other

postretirement plans as of December 31, 2013:

Pension Benefits Other Postretirement Benefits

2014 $ 324 $ 43

2015 310 40

2016 317 37

2017 324 34

2018 331 32

2019 - 2023 1,740 121

Total $ 3,346 $ 307

In addition, the following table sets forth amounts of other postretirement benefits expected to be received under the Medicare Part D

Subsidy over the next ten years as of December 31, 2013:

2014 $ 3

2015 3

2016 4

2017 4

2018 4

2019 - 2023 22

Total $ 40

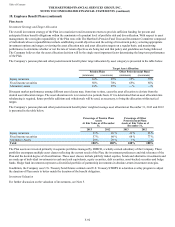

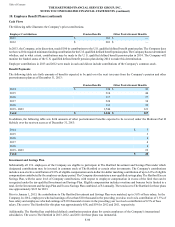

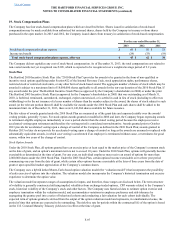

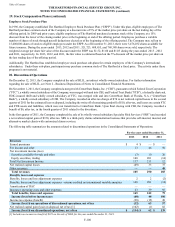

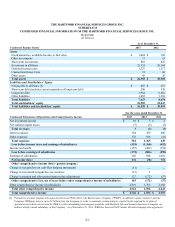

Investment and Savings Plan

Substantially all U.S. employees of the Company are eligible to participate in The Hartford Investment and Savings Plan under which

designated contributions may be invested in common stock of The Hartford or certain other investments. The Company's contributions

include a non-elective contribution of 2.0% of eligible compensation and a dollar-for-dollar matching contribution of up to 6.0% of eligible

compensation contributed by the employee each pay period. The Company also maintains a non-qualified savings plan, The Hartford Excess

Savings Plan, with the same level of Company contributions, with respect to employee compensation in excess of the limit that can be

recognized under the tax-qualified Investment and Savings Plan. Eligible compensation includes overtime and bonuses but is limited to a

total, for the Investment and Savings Plan and Excess Savings Plan combined, of $1 annually. The total cost to The Hartford for these plans

was approximately $123 for 2013.

Prior to January 1, 2013, the contributions to The Hartford Investment and Savings Plan were matched, up to 3.0% of base salary, by the

Company. In 2012, employees who had earnings of less than $110 thousand in the preceding year also received a contribution of 1.5% of

base salary and employees who had earnings of $110 thousand or more in the preceding year received a contribution of 0.5% of base

salary. The cost to The Hartford for this plan was approximately $58, and $59 for 2012 and 2011, respectively.

Additionally, The Hartford has established defined contribution pension plans for certain employees of the Company’s international

subsidiaries. The cost to The Hartford in 2013, 2012, and 2011 for these plans was immaterial.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

18. Employee Benefit Plans (continued)