The Hartford 2013 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-75

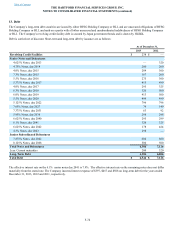

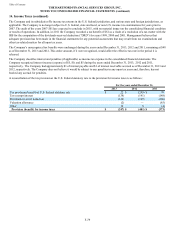

Collateralized Advances

Hartford Life Insurance Company (“HLIC”), an indirect wholly owned subsidiary, became a member of the Federal Home Loan Bank of

Boston (“FHLBB”) in May 2011. Membership allows HLIC access to collateralized advances, which may be used to support various

spread-based businesses and enhance liquidity management. The Connecticut Department of Insurance (“CTDOI”) will permit HLIC to

pledge up to $1.25 billion in qualifying assets to secure FHLBB advances for 2014. The amount of advances that can be taken are

dependent on the asset types pledged to secure the advances. The pledge limit is recalculated annually based on statutory admitted assets

and capital and surplus. HLIC would need to seek the prior approval of the CTDOI if there were a desire to exceed these limits. As of

December 31, 2013, HLIC had no advances outstanding under the FHLBB facility.

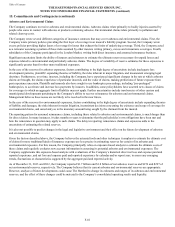

Senior Notes

On March 26, 2013, the Company repurchased principal amounts of approximately $800, plus a payment for unpaid interest on senior

notes due through the settlement date. The Company recognized a loss on extinguishment in 2013 of approximately $213, before tax,

representing the excess of the repurchase price over the principal repaid and the write-off of the unamortized discount and debt issuance

costs.

On April 18, 2013, the Company issued $300 aggregate principal amount of 4.3% Senior Notes (the "4.3% Notes") due April 15, 2043

for net proceeds of approximately $295, after deducting underwriting discounts and expenses from the offering. The 4.3% Notes bear

interest at an annual fixed rate of 4.3% from the date of issuance to April 15, 2043, payable semi-annually in arrears on April 15 and

October 15, commencing October 15, 2013. The Company, at its option, can redeem the 4.3% Notes at any time in whole, or from time

to time in part, at a redemption price at a discount rate of US Treasury due November 15, 2042 plus 25 basis points, or if greater, 100%

of the principal amount of notes to be redeemed, plus accrued and unpaid interest to the date of redemption.

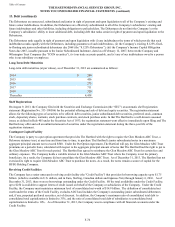

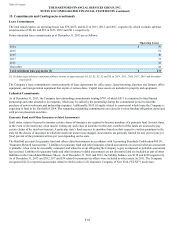

Junior Subordinated Debentures

On April 17, 2012, the Company (i) repurchased all outstanding 10% fixed-to-floating rate junior subordinated debentures due 2068 with

a $1.75 billion aggregate principal amount held by Allianz SE (“Allianz”) (the “10% Debentures”) for $2.125 billion (plus a payment by

the Company of unpaid interest on the 10% Debentures) and (ii) settled the repurchase of the Series B and Series C warrants held by

Allianz to purchase shares of the Company’s common stock, see Note 16. In addition, the 10% Debentures replacement capital covenant

(the “10% Debentures RCC”) was terminated on April 12, 2012 with the consent of the holders of a majority in aggregate principal

amount of the Company’s outstanding 6.1% senior notes due 2041. Upon closing, the Company recognized a loss on extinguishment in

the second quarter of 2012 of $587, after-tax, representing the premium associated with repurchasing the 10% Debentures at an amount

greater than the face amount, the write-off of the unamortized discount and debt issuance costs related to the 10% Debentures and other

costs related to the repurchase transaction. On April 5, 2012, the Company issued $600 aggregate principal amount of 7.875% fixed-to-

floating rate junior subordinated debentures due 2042 (the “Debentures”) for net proceeds of approximately $586, after deducting

underwriting discounts and offering expenses. The Company financed the repurchase of the 10% Debentures through the issuance of the

Senior Notes and the Debentures.

The Debentures bear interest from the date of issuance to but excluding April 15, 2022 at an annual rate of 7.875%, payable quarterly in

arrears on January 15, April 15, July 15 and October 15 of each year to and including April 15, 2022. Commencing on April 15, 2022 the

Debentures bear interest at an annual rate equal to three-month LIBOR, reset quarterly, plus 5.596%, payable quarterly in arrears on

January 15, April 15, July 15 and October 15 of each year, commencing on July 15, 2022. The Company has the right, on one or more

occasions, to defer the payment of interest on the Debentures. The Company may defer interest for up to ten consecutive years without

giving rise to an event of default. Deferred interest will accumulate additional interest at an annual rate equal to the annual interest rate

then applicable to the Debentures. If the Company defers interest payments on the Debentures, the Company generally may not make

payments on or redeem or purchase any shares of its capital stock or any of its debt securities or guarantees that rank upon liquidation,

dissolution or winding up equally with or junior to the Debentures, subject to certain limited exceptions.

The Company may elect to redeem the Debentures in whole at any time or in part from time to time on or after April 15, 2022, at a

redemption price equal to the principal amount of the Debentures being redeemed plus accrued and unpaid interest to but excluding the

date of redemption. If the Debentures are not redeemed in whole, at least $25 aggregate principal amount of the Debentures must remain

outstanding after giving effect to such redemption. The Debentures may be redeemed in whole at any time prior to April 15, 2022, within

90 days of the occurrence of a tax event or rating agency event, at a redemption price equal to the greater of (i) the principal amount of

the Debentures being redeemed, or (ii) the present value of the (a) outstanding principal and (b) remaining scheduled payments of

interest that would have been payable from the redemption date to and including April 15, 2022 on the Debentures to be redeemed (not

including any portion of such payments of interest accrued and unpaid to but excluding the redemption date), discounted from their

respective interest payment dates to but excluding the redemption date at a discount rate equal to the Treasury Rate plus a spread of

0.7%, in each case, plus accrued and unpaid interest to but excluding the redemption date.

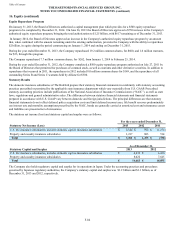

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

13. Debt (continued)