HSBC 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Capital Management (continued)

91

Pillar 2 and the ‘PRA buffer’

Under the Pillar 2 framework, banks are already required

to hold capital in respect of the internal capital adequacy

assessment and supervisory review which leads to a final

determination by the PRA of individual capital guidance

under Pillar 2A and Pillar 2B. Pillar 2A was previously met

by total capital, but since 1 January 2015, in accordance

with the PRA’s supervisory statement SS 5/13, is met

with at least 56 per cent CET1.

Pillar 2A guidance is a point in time assessment of the

amount of capital the PRA considers that a bank should

hold to meet the overall financial adequacy rule. It is

therefore subject to change pending annual assessment

and the supervisory review process.

In January 2015, the PRA published a consultation on the

Pillar 2 Framework. This sets out the methodologies that

the PRA proposed to use to inform its setting of firms’

Pillar 2 capital requirements, including proposing new

approaches for determining Pillar 2 requirements for

credit risk, operational risk, counterparty credit risk and

pension obligation risk.

As part of CRD IV implementation, the PRA proposed to

introduce a PRA buffer, to replace the previous capital

planning buffer (‘CPB’) (known as Pillar 2B), also to be

held in the form of CET1 capital. This was reconfirmed in

the recent PRA consultation on the Pillar 2 framework. It

is proposed that a PRA buffer will avoid duplication with

CRD IV buffers and be set for a particular firm given its

vulnerability in a stress scenario or where the PRA has

identified risk management and governance failings. In

order to address weaknesses in risk management and

governance, the PRA propose a scalar applied to firms’

CET1 Pillar 1 and Pillar 2A capital requirements. Where

the PRA considers there is overlap between the CRD IV

buffers and the PRA buffer assessment, the PRA

proposes to set the PRA buffer as the excess capital

required over and above the CCB and relevant systemic

buffers. The PRA buffer will however be in addition to

the CCyB and sectoral capital requirements.

The PRA expects to finalise the Pillar 2 framework in July

2015, with implementation expected from 1 January

2016. Until this consultation is finalised and revised rules

and guidance issued, there remains uncertainty as to the

exact buffer rate requirements, and their ultimate capital

impact.

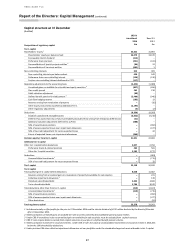

Overall capital requirements

Given the developments outlined above, details are

beginning to emerge as to the various elements of the

capital requirements framework. However there remains

residual uncertainty as to what the group’s precise end

point CET1 capital requirement will be.

In addition to the capital requirements set out above, it

is also necessary to consider the impact of FSB proposals

published in November 2014 in relation to total loss

absorbing capacity (‘TLAC’) requirements detailed below.

RWA developments

Throughout 2014, regulators issued a series of

recommendations and consultations designed to revise

the various components of the RWA regime and increase

related reporting and disclosures.

UK

In March 2014, the FPC published that it was minded to

recommend that firms report and disclose capital ratios

using the standardised approach to credit risk as soon as

practicable in 2015 following a Basel review of the

standardised approach.

In June 2014, the PRA issued its consultation CP12/14.

This proposed changes to the credit risk rules in two

areas. Firstly, a proposal that exposures on the advanced

internal ratings-based (‘AIRB’) approach for central

governments, public sector entities, central banks and

financial sector entities would be moved to the

foundation approach from June 2015. Secondly, a

proposal to introduce stricter criteria for the application

of the standardised risk weight for certain commercial

real estate (‘CRE’) exposures located in non-EEA

countries dependent upon loss rates in these

jurisdictions over a representative period. In October,

the PRA published a policy statement (‘PS 10/14’)

containing final rules on the second proposal, whereby

prior to implementation they would consult with the EBA

regarding the application of a more stringent risk

weights. The EBA will then publish any stricter criteria,

allowing for a six month implementation period from the

date of publication.

EU

In May 2014, the EBA published a consultation on

benchmarks of internal approaches for calculating own

funds requirements for credit and market risk exposures

(RWAs). This follows a series of benchmarking exercises

run in 2013 to better understand the drivers of

differences observed in RWAs across EU institutions. The

future annual benchmarking exercise outlined in the

consultation paper aims to improve the comparability of

capital requirements calculated using internal modelled

approaches and will be used by regulators to inform

their policy decisions.

In June 2014, the EBA published a consultation on

thresholds for the application of the Standardised

Approach for exposures treated under permanent partial

use and the IRB roll-out plan. The finalised RTS is yet to

be published.

In December 2014, the list of non-EEA countries deemed

to have equivalent regulatory regimes for CRD IV

purposes was published in the EU’s Official Journal. This

equivalence evaluation impacts the treatment of

exposures across a number of different areas in CRD IV,

such as the treatment of exposures to third country

investment firms, credit institutions and exchanges;

standardised risk weights applicable to exposures to

central governments, central banks, regional

governments, local authorities and public sector entities;

and the calculation of RWAs for exposures to corporates,

institutions, central governments and central banks

under the IRB approach.

International

Throughout 2014, the Basel Committee published

proposals across all Pillar 1 risk types, to update

standardised, non-modelled approaches for calculating

capital requirements and to provide the basis for the

application of a capital floor.