HSBC 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

154

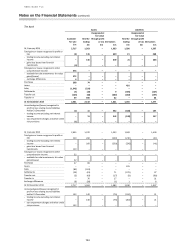

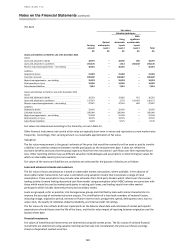

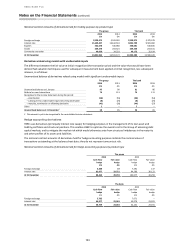

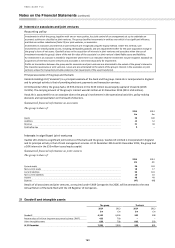

Fair value hedges

HSBC’s fair value hedges principally consist of interest rate swaps that are used to protect against changes in the fair value

of fixed-rate long-term financial instruments due to movements in market interest rates.

Fair value of derivatives designated as fair value hedges

2014

2013

Assets

Liabilities

Assets

Liabilities

£m

£m

£m

£m

The group

Foreign exchange

–

(1)

3

–

Interest rate

196

(1,841)

453

(1,250)

At 31 December

196

(1,842)

456

(1,250)

The bank

Interest rate

272

(1,321)

493

(995)

At 31 December

272

(1,321)

493

(995)

Gains or losses arising from fair value hedges

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Gains/(losses):

– on hedging instruments

(1,013)

472

(673)

514

– on the hedged items attributable to the hedged risk

1,033

(439)

687

(480)

Year ended 31 December

20

33

14

34

The gains and losses on ineffective portions of fair value hedges are recognised immediately in ‘Net trading income’.

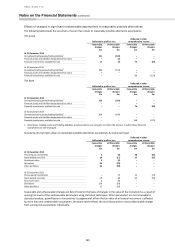

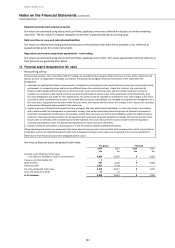

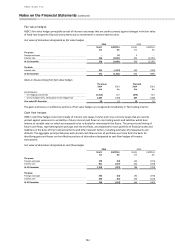

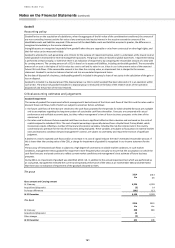

Cash flow hedges

HSBC’s cash flow hedges consist principally of interest rate swaps, futures and cross-currency swaps that are used to

protect against exposures to variability in future interest cash flows on non-trading assets and liabilities which bear

interest at variable rates or which are expected to be re-funded or reinvested in the future. The amounts and timing of

future cash flows, representing both principal and interest flows, are projected for each portfolio of financial assets and

liabilities on the basis of their contractual terms and other relevant factors, including estimates of prepayments and

defaults. The aggregate principal balances and interest cash flows across all portfolios over time form the basis for

identifying gains and losses on the effective portions of derivatives designated as cash flow hedges of forecast

transactions.

Fair value of derivatives designated as cash flow hedges

2014

2013

Assets

Liabilities

Assets

Liabilities

£m

£m

£m

£m

The group

Foreign exchange

378

(52)

242

(159)

Interest rate

841

(227)

544

(559)

At 31 December

1,219

(279)

786

(718)

The bank

Foreign exchange

336

(43)

192

(159)

Interest rate

408

(81)

253

(128)

At 31 December

744

(124)

445

(287)