HSBC 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

139

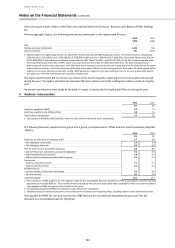

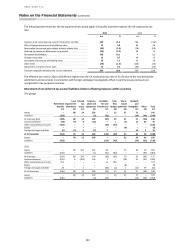

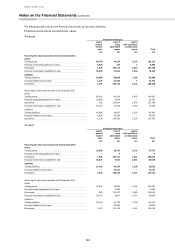

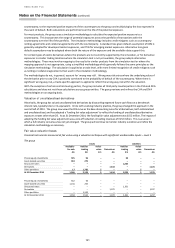

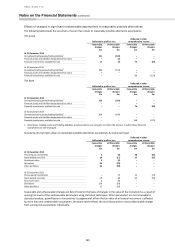

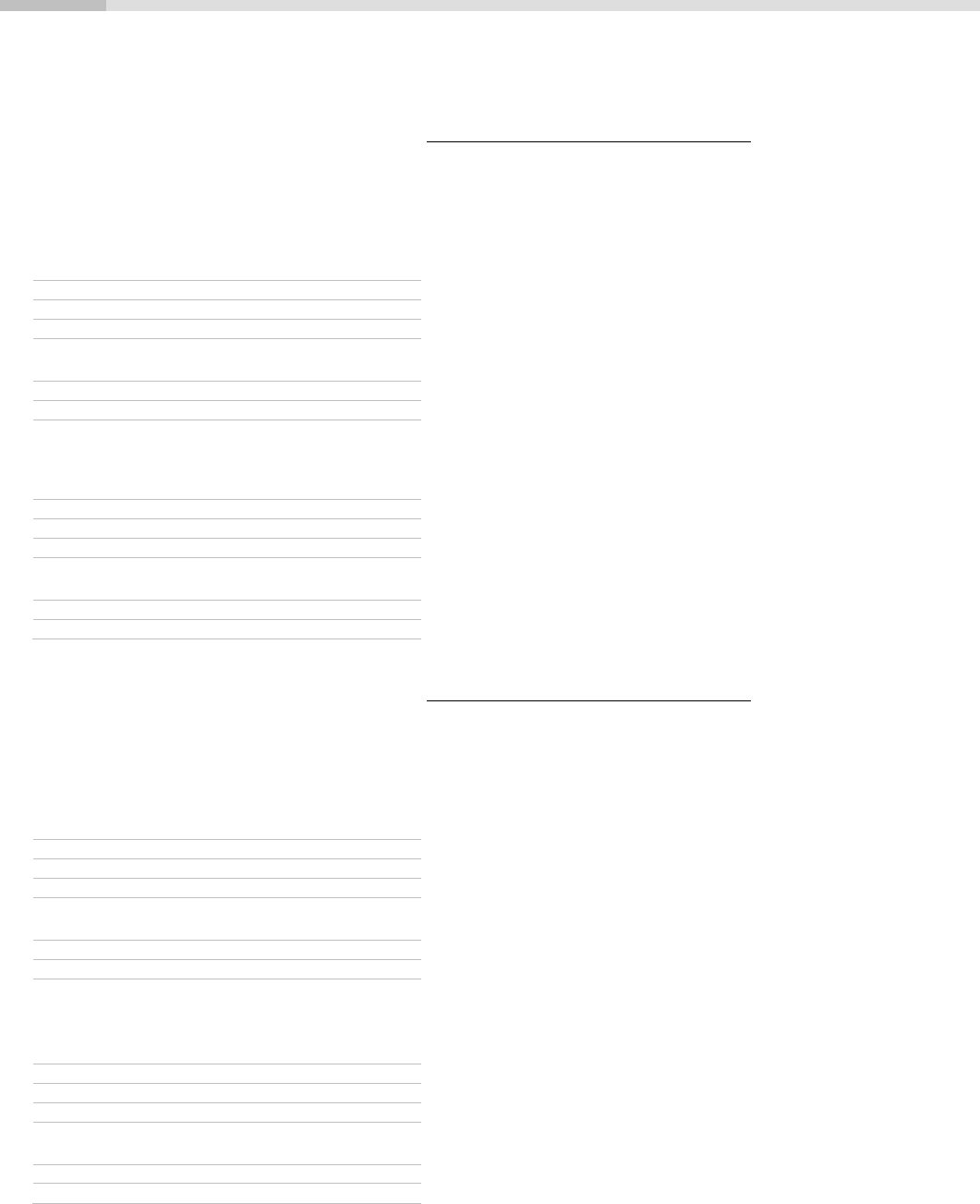

The following table sets out the financial instruments by fair value hierarchy

Financial instruments carried at fair value

The group

Valuation techniques

Level 1

quoted

market

price

Level 2

using

observable

inputs

Level 3

with significant

unobservable

inputs

Total

£m

£m

£m

£m

Recurring fair value measurement at 31 December 2014

Assets

Trading assets

83,749

44,225

2,153

130,127

Financial assets designated at fair value

6,618

276

5

6,899

Derivatives

1,949

184,173

1,614

187,736

Financial investments: available-for-sale

56,996

17,652

1,546

76,194

Liabilities

Trading liabilities

22,669

58,638

1,293

82,600

Financial liabilities at fair value

1,107

21,440

5

22,552

Derivatives

1,935

185,122

1,221

188,278

Recurring fair value measurement at 31 December 2013

Assets

Trading assets

83,241

49,294

1,562

134,097

Financial assets designated at fair value

10,818

5,843

–

16,661

Derivatives

323

135,844

1,072

137,239

Financial investments: available-for-sale

55,737

17,640

1,653

75,030

Liabilities

Trading liabilities

42,064

48,417

1,361

91,842

Financial liabilities at fair value

4,078

29,958

–

34,036

Derivatives

1,236

134,819

1,297

137,352

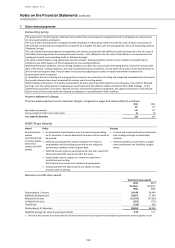

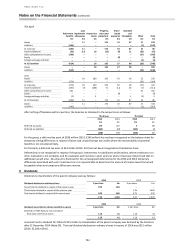

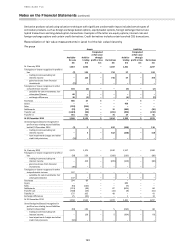

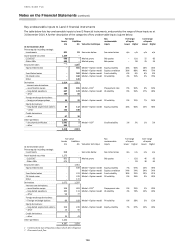

The bank

Valuation techniques

Level 1

quoted

market

price

Level 2

using

observable

inputs

Level 3

with significant

un-observable

inputs

Total

£m

£m

£m

£m

Recurring fair value measurement at 31 December 2014

Assets

Trading assets

56,908

38,717

2,132

97,757

Financial assets designated at fair value

–

9

–

9

Derivatives

1,900

156,711

1,621

160,232

Financial investments: available-for-sale

36,276

9,801

2,361

48,438

Liabilities

Trading liabilities

11,433

46,370

1,236

59,039

Financial liabilities at fair value

–

16,127

–

16,127

Derivatives

1,920

158,145

1,377

161,442

Recurring fair value measurement at 31 December 2013

Assets

Trading assets

47,843

51,881

1,563

101,287

Financial assets designated at fair value

–

3,983

–

3,983

Derivatives

283

111,257

1,083

112,623

Financial investments: available-for-sale

33,724

8,607

2,717

45,048

Liabilities

Trading liabilities

18,346

42,778

1,290

62,414

Financial liabilities at fair value

–

22,006

–

22,006

Derivatives

1,214

112,129

1,367

114,710