HSBC 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

77

takes functional direction from Group Security and Fraud

Risk. This enables management to identify and mitigate

the permutations of these and other non-financial risks

across the countries in which the group operates. All

group companies manage their risk in accordance with

standards set by Security and Fraud Risk, Europe, which

also provide expert advice and support.

Fiduciary risk

Business activities in which fiduciary risk is inherent are

only permitted within designated lines of business.

Fiduciary risk is managed within the designated

businesses via a comprehensive policy framework and

monitoring of key indicators. The Group’s principal

fiduciary businesses /activities are:

• HSBC Securities Services, where it is exposed to

fiduciary risk via its Funds Services and Corporate

Trust and loan agency activities;

• HSBC Global Asset Management, which is exposed to

fiduciary risks via its investment management

activities on behalf of clients;

• HSBC Global Private Banking, which is exposed to

fiduciary risks via its Private Wealth Services division

and discretionary investment management;

• HSBC Insurance, which is exposed to fiduciary risks via

the investment management activities it undertakes

when providing insurance products and services;

• RBWM Trust Investment Wrappers, required by

regulation for the provision of normal RBWM Wealth

Management products and services; and

• HSBC Employee Pension Scheme activities, where

fiduciary duties may arise as part of carrying out a

function of discretion or control over an HSBC

Employee pension scheme's operations.

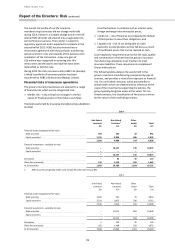

Risk management of insurance

operations

(Audited)

The majority of the risk in our insurance business derives

from manufacturing activities and can be categorised as

insurance risk and financial risk. Insurance risk is the risk,

other than financial risk, of loss transferred from the

holder of the insurance contract to the issuer (HSBC).

Financial risks include market risk, credit risk and

liquidity risk.

There have been no material changes to our policies and

practices for the management of risks arising in the

insurance operations.

The group’s bancassurance model

We operate an integrated bancassurance model which

provides wealth and protection insurance products

principally for customers with whom the group has a

banking relationship. Insurance products are sold

through all global businesses, predominantly by RBWM

and CMB, through branches and direct channels.

The insurance contracts the group sells relate to the

underlying needs of the group’s banking customers,

which it can identify from its point-of-sale contacts and

customer knowledge. The majority of sales are of savings

and investment products and term and credit life

contracts. By focusing largely on personal and SME lines

of business, the group is able to optimise volumes and

diversify individual insurance risks.

Where we have the operational scale and risk appetite,

mostly in life insurance, these insurance products are

manufactured by the group’s companies. Manufacturing

insurance allows the group to retain the risks and

rewards associated with writing insurance contracts as

both the underwriting profit and the commission paid by

the manufacturer to the bank distribution channel are

kept within the group.

Where we do not have the risk appetite or operational

scale to be an effective manufacturer, a small number of

leading external insurance companies are engaged in

order to provide insurance products to the group’s

customers through its banking network and direct

channels. These arrangements are generally structured

with the group’s exclusive strategic partners and earn

the group a combination of commissions, fees and a

share of profits.

Insurance manufacturers set their own control

procedures in addition to complying with guidelines

issued by the Group Insurance. Country level oversight is

exercised by local Risk Management Committees.

Country Chief Risk Officers have direct reporting lines

into local Insurance Chief Executive Officers and

functional reporting lines into the Group Insurance Chief

Risk Officer, who has overall accountability for risk

management in insurance operations. The Group

Insurance Executive Committee oversees the framework

globally and is accountable to the Group Risk

Management Committee on risk matters.

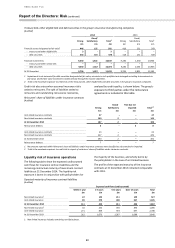

In addition, local ALCOs monitor and review the duration

and cash flow matching of insurance assets and

liabilities.

All insurance products, whether manufactured internally

or by a third party, are subjected to a product approval

process prior to introduction.

There have been no material changes to our policies and

practices for the management of risks arising in the

insurance operations.

Risk management of insurance operations

in 2014

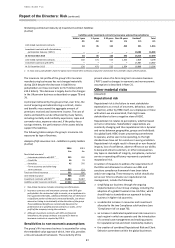

We measure the risk profile of our insurance

manufacturing businesses using an economic capital

approach, where assets and liabilities are measured on a

market value basis and a capital requirement is held to

ensure that there is less than a 1 in 200 chance of

insolvency over the next year, given the risks that the

businesses are exposed to. In 2014 we aligned the

measurement approach for market, credit and insurance

risks in the economic capital model to the new pan-

European Solvency II insurance capital regulations

applicable from 2016.