HSBC 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

78

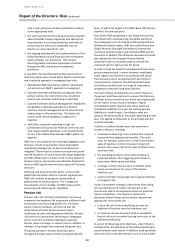

The overall risk profile of our life insurance

manufacturing businesses did not change materially

during 2014, however, a notable change arose in the UK

where HSBC Life (UK) Ltd entered into an agreement to

sell its Pensions business. The transfer is subject to

regulatory approvals and is expected to complete in the

second half of 2015. HSBC has also entered into a

reinsurance agreement with the purchaser transferring

certain economic risks and rewards of the business until

completion of the transaction. A day-one gain of

£25 million was recognised on entering into this

reinsurance and the assets and liabilities have been

reclassified as held-for-sale.

During 2014 the Irish insurance entity HSBC Life (Europe)

Limited’s portfolio of insurance policies has been

transferred to HSBC Life Assurance (Malta) Limited.

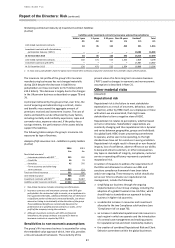

Financial risks of insurance operations

The group’s insurance businesses are exposed to a range

of financial risks which can be categorised into:

• Market risk – risks arising from changes in the fair

values of financial assets or their future cash flows

from fluctuations in variables such as interest rates,

foreign exchange rates and equity prices;

• Credit risk – risk of financial loss following the default

of third parties to meet their obligations; and

• Liquidity risk – risk of not being able to make

payments to policyholders as they fall due as a result

of insufficient assets that can be realised as cash.

Local regulatory requirements prescribe the type, quality

and concentration of assets that the group’s insurance

manufacturing companies must maintain to meet

insurance liabilities. These requirements complement

Group-wide policies.

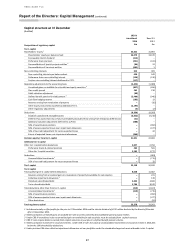

The following table analyses the assets held in the

group’s insurance manufacturing companies by type of

contract, and provides a view of the exposure to financial

risk. For unit-linked contracts, which pay benefits to

policyholders which are determined by reference to the

value of the investments supporting the policies, the

group typically designate assets at fair value; for non-

linked contracts, the classification of the assets is driven

by the nature of the underlying contract.

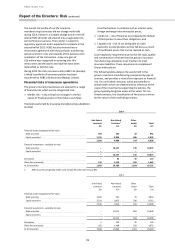

Financial assets held by insurance manufacturing subsidiaries

(Audited)

2014

Unit-linked

contracts

Non-linked

Contracts1

Other

assets

Total

£m

£m

£m

£m

Financial assets designated at fair value

Debt securities

369

554

28

951

Equity securities

1,315

3,854

686

5,855

1,684

4,408

714

6,806

Financial investments

- available-for-sale

Debt securities

–

10,157

716

10,873

Equity securities

–

–

–

–

–

10,157

716

10,873

Derivatives

–

65

45

110

Other financial assets

215

1,538

209

1,962

At 31 December

1,899

16,168

1,684

19,751

1 Debt securities designated at fair value include £3 million of Treasury Bills.

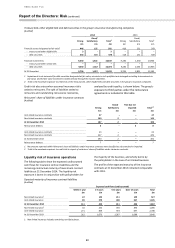

2013

Unit-linked

contracts

Non-linked

contracts

Other

assets

Total

£m

£m

£m

£m

Financial assets designated at fair value

Debt securities

2,265

544

25

2,834

Equity securities

5,311

3,871

530

9,712

7,576

4,415

555

12,546

Financial investments - available-for-sale

Debt securities

–

10,113

823

10,936

Equity securities

–

–

–

–

–

10,113

823

10,936

Derivatives

5

130

30

165

Other financial assets

262

1,408

203

1,873

At 31 December

7,843

16,066

1,611

25,520