HSBC 2014 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

180

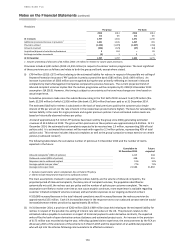

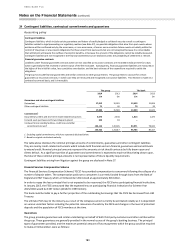

34 Contingent liabilities, contractual commitments and guarantees

Accounting policy

Contingent liabilities

Contingent liabilities, which include certain guarantees and letters of credit pledged as collateral security as well as contingent

liabilities related to legal proceedings or regulatory matters (see Note 37), are possible obligations that arise from past events whose

existence will be confirmed only by the occurrence, or non-occurrence, of one or more uncertain future events not wholly within the

control of the group; or are present obligations that have arisen from past events but are not recognised because it is not probable

that settlement will require the outflow of economic benefits, or because the amount of the obligations cannot be reliably measured.

Contingent liabilities are not recognised in the financial statements but are disclosed unless the probability of settlement is remote.

Financial guarantee contracts

Liabilities under financial guarantee contracts which are not classified as insurance contracts are recorded initially at their fair value,

which is generally the fee received or present value of the fee receivable. Subsequently, financial guarantee liabilities are measured at

the higher of the initial fair value, less cumulative amortisation, and the best estimate of the expenditure required to settle the

obligations.

The group has issued financial guarantees and similar contracts to other group entities. The group elects to account for certain

guarantees as insurance contracts, in which case they are measured and recognised as insurance liabilities. This election is made on a

contract by contract basis, and is irrevocable.

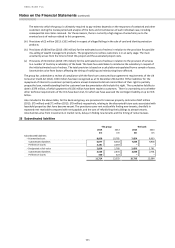

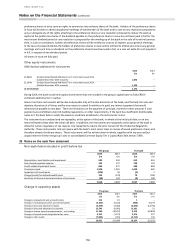

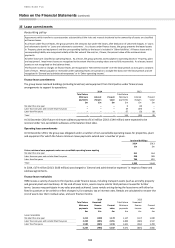

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

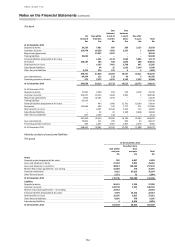

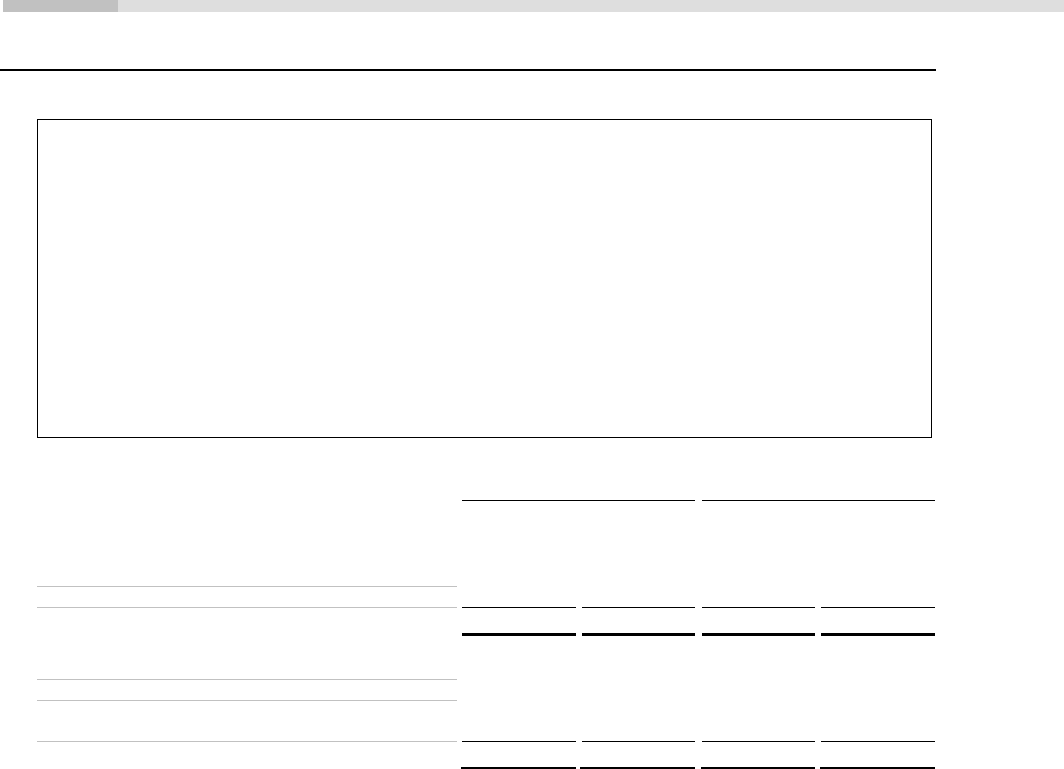

Guarantees and other contingent liabilities

Guarantees

17,012

15,529

13,459

11,606

Other contingent liabilities

71

40

70

39

17,083

15,569

13,529

11,645

Commitments1

Documentary credits and short-term trade-related transactions

3,073

2,814

1,814

1,475

Forward asset purchases and forward deposits placed

335

18

–

–

Undrawn formal standby facilities, credit lines and other

commitments to lend

2

132,114

120,185

94,971

78,942

135,522

123,017

96,785

80,417

1 Excluding capital commitments, which are separately disclosed below.

2 Based on original contractual maturity.

The table above discloses the nominal principal amounts of commitments, guarantees and other contingent liabilities.

They are mainly credit-related instruments which include both financial and non-financial guarantees and commitments

to extend credit. Nominal principal amounts represent the amounts at risk should contracts be fully drawn upon and

clients default. As a significant portion of guarantees and commitments is expected to expire without being drawn upon,

the total of these nominal principal amounts is not representative of future liquidity requirements.

Contingent liabilities arising from litigation against the group are disclosed in Note 37.

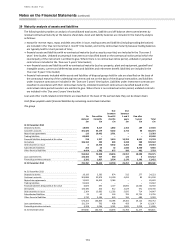

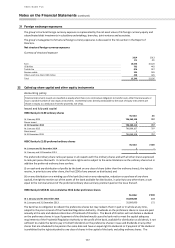

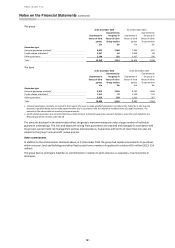

Financial Services Compensation Scheme

The Financial Services Compensation Scheme (‘FSCS’) has provided compensation to consumers following the collapse of a

number of deposit takers. The compensation paid out to consumers is currently funded through loans from the Bank of

England and HM Treasury which at 31 December 2014 stood at approximately £16 billion.

In order to repay the loan principal that is not expected to be recovered, the FSCS levies participating financial institutions.

In January 2015, the FSCS announced that the expected levy on participating financial institutions for Scheme Year

2015/2016 would be £347 million (2014/15: £399 million).

The bank could be liable to pay a further proportion of the outstanding borrowings that the FSCS has borrowed from HM

Treasury.

The ultimate FSCS levy to the industry as a result of the collapses cannot currently be estimated reliably as it is dependent

on various uncertain factors including the potential recoveries of assets by the FSCS and changes in the level of protected

deposits and the population of FSCS members at the time.

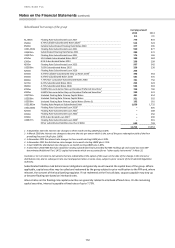

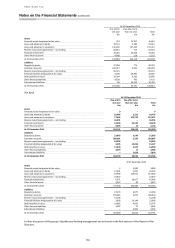

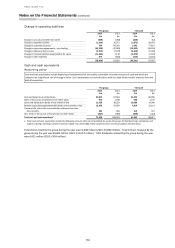

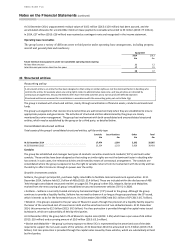

Guarantees

The group provides guarantees and similar undertakings on behalf of both third party customers and other entities within

the group. These guarantees are generally provided in the normal course of the group’s banking business. The principal

types of guarantees provided, and the maximum potential amount of future payments which the group could be required

to make at 31 December, were as follows: