HSBC 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

114

are possible within the next 12 months (‘12 month ECL’). In the event of a significant increase in credit risk,

allowance (or provision) is required for ECL resulting from all possible default events over the expected life of the

financial instrument (‘lifetime ECL’).

The assessment of whether credit risk has increased significantly since initial recognition is performed for each

reporting period by considering the change in the risk of default occurring over the remaining life of the financial

instrument, rather than by considering an increase in ECL.

The assessment of credit risk, and the estimation of ECL, are required to be unbiased and probability-weighted and

should incorporate all available information which is relevant to the assessment, including information about past

events, current conditions and reasonable and supportable forecasts of future events and economic conditions at the

reporting date. In addition, the estimation of ECL should take into account the time value of money. As a result, the

recognition and measurement of impairment is intended to be more forward-looking than under IAS 39 and the

resulting impairment charge will tend to be more volatile. It will also tend to result in an increase in the total level of

impairment allowances, since all financial assets will be assessed for at least 12-month ECL and the population of

financial assets to which lifetime ECL applies is likely to be larger than the population for which there is objective

evidence of impairment in accordance with IAS 39.

Hedge accounting

The general hedge accounting requirements aim to simplify hedge accounting, creating a stronger link with risk

management strategy and permitting hedge accounting to be applied to a greater variety of hedging instruments

and risks. The standard does not explicitly address macro hedge accounting strategies, which are being considered in

a separate project. To remove the risk of any conflict between existing macro hedge accounting practice and the new

general hedge accounting requirements, IFRS 9 includes an accounting policy choice to remain with IAS 39 hedge

accounting.

Transition

The classification and measurement and impairment requirements are applied retrospectively by adjusting the

opening balance sheet at the date of initial application, with no requirement to restate comparative periods. Hedge

accounting is generally applied prospectively from that date.

The mandatory application date for the standard as a whole is 1 January 2018, but it is possible to apply the revised

presentation for certain liabilities measured at fair value from an earlier date. The group intends to revise the

presentation of fair value gains and losses relating to the entity’s own credit risk on certain liabilities as soon as

permitted by EU law. If this presentation were applied at 31 December 2014, the effect would be to a decrease profit

before tax with the opposite effect on other comprehensive income based on the change in fair value attributable to

changes in the group’s credit risk for the year, with no effect on net assets. Further information on change in fair

value attributable to changes in credit risk, including the group’s credit risk, is disclosed in Note 12.

The group is assessing the impact that the rest of IFRS 9 will have on the financial statements through a group-wide

project which has been in place since 2012, but due to the complexity of the classification and measurement,

impairment, and hedge accounting requirements and their inter-relationships, it is not possible at this stage to

quantify the potential effect.

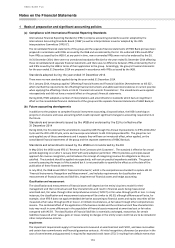

(c) Changes to the presentation of the Financial Statements and Notes on the Financial Statements

In order to make the financial statements and notes thereon easier to understand, the group has changed the

location and the wording used to describe certain accounting policies within the notes, removed certain immaterial

disclosures and changed the order of certain sections. In applying materiality to financial statement disclosures, we

consider both the amount and nature of each item. The main changes to the presentation of the financial statements

and notes thereon in 2014 are as follows:

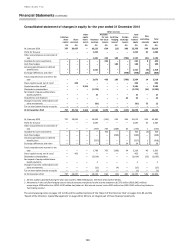

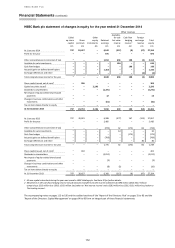

• Consolidated balance sheet and consolidated statement of changes in equity: rationalised separate line item

disclosure to focus on material information.

• Credit risk: changed the order of the section and certain disclosures to remove duplication and focus on material

information.

• Note 2 Summary of significant accounting policies: accounting policies have been placed, whenever possible,

within the relevant Notes on the Financial Statements, and the changes in wording are intended to more clearly

set out the accounting policies. These changes in the wording do not represent changes in accounting policies.

• Critical accounting policies: replaced ‘Critical accounting policies’ with ‘Critical accounting estimates and

judgements’ and placed them within the relevant notes alongside the significant accounting policy to which they

relate. The new approach meets the reporting requirements of IAS 1 ‘Presentation of Financial Statements’.

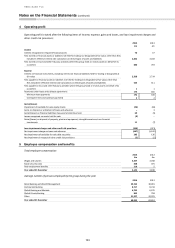

• Note 5 Employee compensation and benefits: rationalised to remove duplication and focus on material

information.

• Note 35 Lease commitments: rationalised to focus on material information.