HSBC 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

54

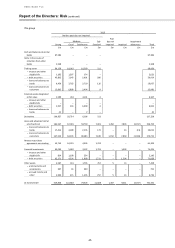

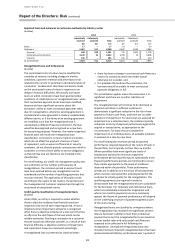

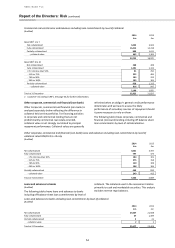

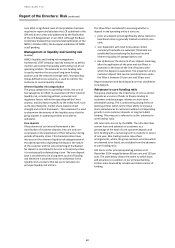

Commercial real estate loans and advances including loan commitments by level of collateral

(Audited)

2014

2013

£m

£m

Rated CRR1 1 to 7

Not collateralised

3,433

2,943

Fully collateralised

16,414

14,418

Partially collateralised

888

1,611

- collateral value

662

1,105

20,735

18,972

Rated CRR1 8 to 10

Not collateralised

260

408

Fully collateralised

1,001

1,132

LTV ratio less than 50%

91

250

- 51% to 75%

522

485

- 76% to 90%

193

232

- 90% to 100%

195

165

Partially collateralised

929

1,315

- collateral value

616

947

2,190

2,855

Total at 31 December

22,925

21,827

1 Customer risk rating (‘CRR’). See page 43 for further information.

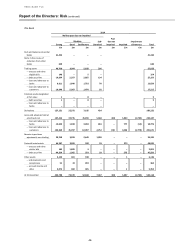

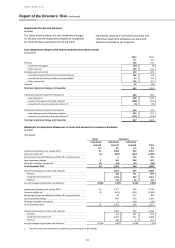

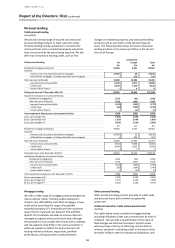

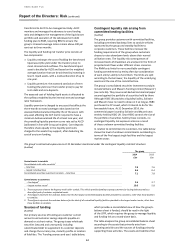

Other corporate, commercial and financial (non-bank)

Other Corporate, commercial and financial (non-bank) is

analysed separately below reflecting the difference in

collateral held on the portfolios. For financing activities

in corporate and commercial lending that are not

predominantly commercial real estate-oriented,

collateral value is not strongly correlated to principal

repayment performance. Collateral values are generally

refreshed when an obligor’s general credit performance

deteriorates and we have to assess the likely

performance of secondary sources of repayment should

it prove necessary to rely on them.

The following table shows corporate, commercial and

financial (non-bank) lending including off balance sheet

loan commitments by level of collateralisation.

Other corporate, commercial and financial (non-bank) loans and advances including loan commitments by level of

collateral rated CRR/EL 8 to 10 only

(Audited)

2014

2013

£m

£m

Not collateralised

4,001

3,397

Fully collateralised

797

473

- LTV ratio less than 50%

184

101

- 51% to 75%

275

158

- 76% to 90%

140

108

- 90% to 100%

198

106

Partially collateralised

468

819

- collateral value

249

415

Total at 31 December

5,266

4,689

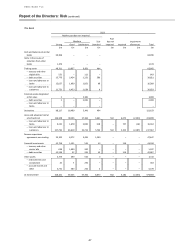

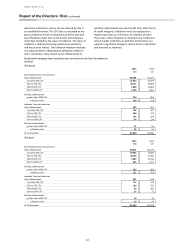

Loans and advances to banks

(Audited)

The following table shows loans and advances to banks

including off-balance sheet loan commitments by level of

collateral. The collateral used in the assessment relates

primarily to cash and marketable securities. This analysis

excludes reverse repo balances.

Loans and advances to banks including loan commitments by level of collateral

(Audited)

2014

2013

£m

£m

Not collateralised

25,607

21,928

Fully collateralised

67

1,499

Partially collateralised

3

41

- collateral value

2

2

Total at 31 December

25,677

23,468