HSBC 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

80

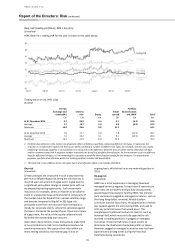

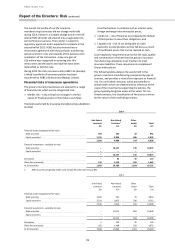

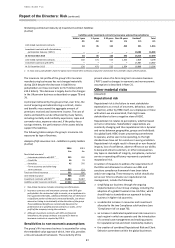

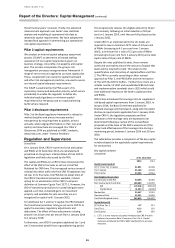

Treasury bills, other eligible bills and debt securities in the group’s insurance manufacturing companies

(Audited)

2014

2013

Strong

Good/

Satisfactory

Total

2

Strong

Good/

Satisfactory

Total

2

£m

£m

£m

£m

£m

£m

Financial assets designated at fair value1

446

135

581

418

151

569

– treasury and other eligible bills

3

-

3

–

–

–

– debt securities

443

135

578

418

151

569

Financial investments

9,350

1,522

10,872

9,286

1,650

10,936

– treasury and other similar bills

–

–

–

–

–

–

– debt securities

9,350

1,522

10,872

9,286

1,650

10,936

At 31 December

9,796

1,657

11,453

9,704

1,801

11,505

1 Impairment is not measured for debt securities designated at fair value, as assets in such portfolios are managed according to movements in

fair value, and the fair value movement is taken directly through the income statement.

2 Total is the maximum exposure to credit risk on the treasury bills, other eligible bills and debt securities in the group’s insurance companies.

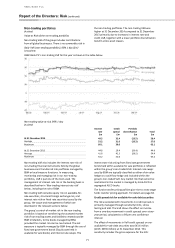

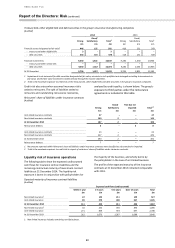

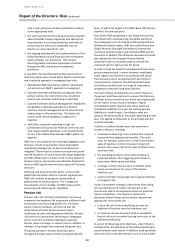

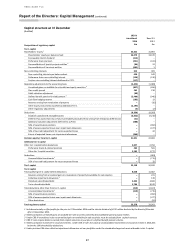

Credit risk also arises when assumed insurance risk is

ceded to reinsurers. The split of liabilities ceded to

reinsurers and outstanding reinsurance recoveries,

analysed by credit quality, is shown below. The group’s

exposure to third parties under the reinsurance

agreements is included in this table.

Reinsurers’ share of liabilities under insurance contracts

(Audited)

Strong

Good/

Satisfactory

Past due not

impaired

Total

1,2

£m

£m

£m

£m

Unit-linked insurance contracts

47

–

–

47

Non-linked insurance contracts

140

2

–

142

At 31 December 2014

187

2

–

189

Reinsurance debtors

4

–

4

8

Unit-linked insurance contracts

43

–

–

43

Non-linked insurance contracts

447

2

–

449

At 31 December 2013

490

2

–

492

Reinsurance debtors

7

–

–

7

1 No amounts reported within Reinsurers’ share of liabilities under insurance contracts were classified as sub-standard or impaired.

2 Total is the maximum exposure to credit risk in respect of reinsurers’ share of liabilities under insurance contracts.

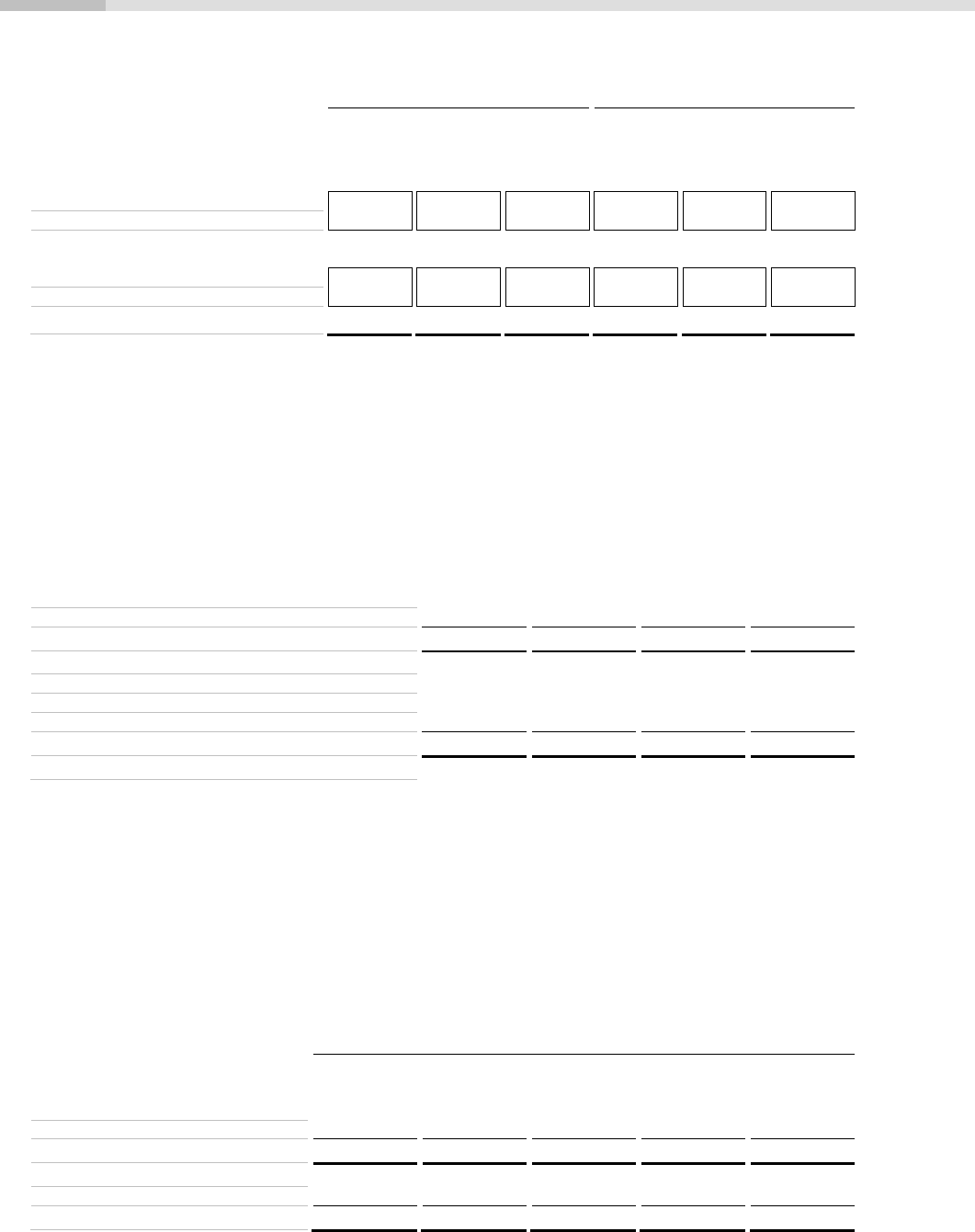

Liquidity risk of insurance operations

The following tables show the expected undiscounted

cash flows for insurance contract liabilities and the

remaining contractual maturity of investment contract

liabilities at 31 December 2014. The liquidity risk

exposure is borne in conjunction with policyholders for

the majority of the business, and wholly borne by

the policyholder in the case of unit-linked business.

The profile of the expected maturity of the insurance

contracts at 31 December 2014 remained comparable

with 2013.

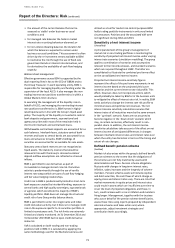

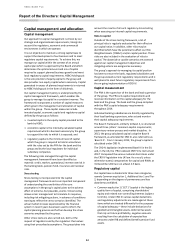

Expected maturity of insurance contract liabilities

(Audited)

Expected cash flows (undiscounted)

Within 1 year

1-5 years

5-15 years

Over 15 years

Total

£m

£m

£m

£m

£m

Non-linked insurance1

22

145

211

149

527

Unit-linked insurance

89

279

400

337

1,105

At 31 December 2014

111

424

611

486

1,632

Non-linked insurance1

44

234

394

393

1,065

Unit-linked insurance

271

839

973

697

2,780

At 31 December 2013

315

1,073

1,367

1,090

3,845

1 Non-linked insurance includes remaining non-life business.