HSBC 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

74

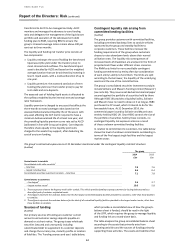

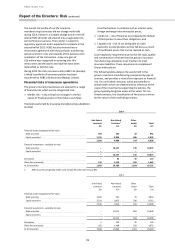

The present value of the group’s defined benefit pension

schemes’ liabilities was as follows:

2014

2013

£bn

£bn

At 31 December

Liabilities (present value)

20.1

18.5

%

%

Assets:

Equities

16

15

Debt securities

65

55

Other (including property)

19

30

100

100

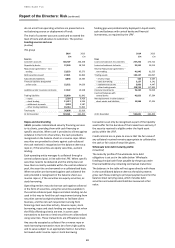

Operational risk

(Unaudited)

Operational risk is relevant to every aspect of our

business and covers a wide spectrum of issues, in

particular legal, compliance, security and fraud. Losses

arising from breaches of regulation and law,

unauthorised activities, error, omission, inefficiency,

fraud, systems failure or external events all fall within

the definition of operational risk.

Responsibility for minimising operational risk lies with

group’s management and staff. Each country, business

unit and function is required to implement appropriate

internal controls to manage the operational risks of the

business and operational activities for which they are

responsible.

Operational risk management framework

The Operational Risk function and the operational risk

management framework (‘ORMF’) directs business

management in discharging their responsibilities.

The ORMF defines minimum standards and processes,

and the governance structure for operational risk and

internal control across the Group. To implement the

ORMF, a ‘three lines of defence’ model is used for the

management of risk, as described below:

• The first line of defence is the business who are

responsible for ensuring that all key risks within their

operations are identified, mitigated and monitored by

appropriate internal controls within an overall control

environment. Every employee is responsible for the

risks that are a part of their day-to-day jobs.

• The second line of defence consists of the Functions,

such as Risk (including Regulatory and Financial Crime

Compliance), Finance and HR who are responsible for

providing oversight and challenge of the activities

conducted by the first line.

• The third line of defence covers the role of Internal

Audit, who provide independent assurance over the

first and second lines of defence.

• The ORMF consists of a number of components,

including:

• Risk and Control Assessments (‘RCAs’), which are used

to identify and assess the material business risks and

controls;

• Key Indicators, which are used to help monitor the

risks and controls;

• Principal Risk Analysis, which provide management

with a quantified view of specific operational risks;

• Internal incidents, which are used to forecast typical

losses; and

• External data, which is used to inform the group’s risk

assessments.

Activity to embed the use of our operational risk

management framework continued in 2014. At the same

time, we are streamlining operational risk management

processes and harmonising framework components and

risk management processes. This is expected to lead to a

stronger operational risk management culture and more

forward-looking risk insights to enable businesses to

determine whether material risks are being managed

within the Group’s risk appetite and whether further

action is required. In addition, the Security and Fraud

Risk and Financial Crime Compliance functions have built

a Financial Intelligence Unit (‘FIU’) which provides

intelligence on the potential risks of financial crime

posed by customers and business prospects to enable

better risk management decision-making. The FIU

provides context and expertise to identify, assess and

understand financial crime risks holistically in clients,

sectors and markets.

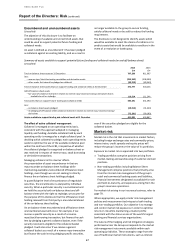

Articulating the risk appetite for material operational

risks helps the bank’s management understand the level

of risk that it is willing to accept. Monitoring operational

risk exposure against the approved risk appetite

measures on a regular basis, and implementing risk

acceptance processes, drives risk awareness in a

forward-looking manner. It assists management in

determining whether further action is required to

proactively manage operational risks within acceptable

levels.

Operational risk and control assessments are performed

by individual business units and functions. The risk and

control assessment process is designed to provide

business areas and functions with a forward looking view

of operational risks and an assessment of the

effectiveness of controls, and a tracking mechanism for

action plans so that they can proactively manage

operational risks within acceptable levels. Risk and

control assessments are reviewed and updated at least

annually.

Appropriate means of mitigation and controls include:

• making specific changes to strengthen the internal

control environment;

• investigating whether cost-effective insurance cover

is available to mitigate the risk; and

• other means of protecting us from loss.

A centralised database is used to record the results of

the operational risk management process. RCAs are

input and maintained by business units, and action plans

monitored. To ensure that operational risk losses are

consistently reported and monitored at country, regional

and group level, all business units/functions are required

to report individual losses when the net loss is expected

to exceed US$10,000. Reviews (for lessons learnt and

root causes) are performed around significant

incidents/losses or when trends arise, to improve

processes and controls.