HSBC 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Capital Management (continued)

86

three financial years’ revenues. Finally, the advanced

measurement approach uses banks’ own statistical

analysis and modelling of operational risk data to

determine capital requirements. We have adopted the

standardised approach in determining our operational

risk capital requirements.

Pillar 2 capital requirements

We conduct an internal capital adequacy assessment

process (‘ICAAP’) to determine a forward looking

assessment of our capital requirements given our

business strategy, risk profile, risk appetite and capital

plan. This process incorporates the group’s risk

management processes and governance framework. A

range of stress tests are applied to our base capital plan.

These, coupled with our economic capital framework

and other risk management practices, are used to assess

our internal capital adequacy requirements.

The ICAAP is examined by the PRA as part of its

supervisory review and evaluation process, which occurs

periodically to enable the regulator to define the

individual capital guidance or minimum capital

requirements for the group and our capital planning

buffer where required.

Pillar 3 disclosure requirements

Pillar 3 of the Basel regulatory framework is related to

market discipline and aims to increase market

transparency by requiring them to publish, at least

annually, wide-ranging information on their risks and

capital, and how these are managed. Our Pillar 3

Disclosures 2014 are published on HSBC’s website,

www.hsbc.com, under ‘Investor Relations’.

Regulation and Supervision

(Unaudited)

On 1 January 2014, CRD IV came into force and capital

and RWAs at 31 December 2014 are calculated and

presented on the group’s interpretation of final CRD IV

legislation and final rules issued by the PRA.

The capital and RWAs on a CRD IV basis incorporate the

effect of the PRA’s final rules as set out in the PRA

Rulebook for CRR firms. This transposed various areas of

national discretion within the final CRD IV legislation into

UK law. In its final rules, the PRA did not adopt most of

the CRD IV transitional provisions available, instead

opting for an acceleration of the CRD IV end point

definition of Common Equity Tier (‘CET’) 1. However, the

CRD IV transitional provisions for unrealised gains were

applied, such that unrealised gains on investment

property and available-for-sale securities are not

recognised for capital until 1 January 2015.

For additional tier 1 and tier 2 capital, the PRA followed

the transitional provisions timing as set out in CRD IV to

apply the necessary regulatory adjustments and

deductions. The effect of these adjustments is being

phased in at 20 per cent per annum from 1 January 2014

to 1 January 2018.

Furthermore, non-CRD IV compliant additional tier 1 and

tier 2 instruments benefit from a grandfathering period.

This progressively reduces the eligible amount by 10 per

cent annually, following an initial reduction of 20 per

cent on 1 January 2014, until they are fully phased out by

1 January 2022.

Under CRD IV, as implemented in the UK, banks are

required to meet a minimum CET1 ratio of 4.0 per cent

of RWAs (increasing to 4.5 per cent from 1 January

2015), a minimum tier 1 ratio of 5.5 per cent of RWAs

(increasing to 6 per cent from 1 January 2015) and a total

capital ratio of 8 per cent of RWAs.

Despite the rules published to date, there remains

continued uncertainty around the amount of capital that

banks will be required to hold. This relates to the

quantification and interaction of capital buffers and Pillar

2. The PRA is currently consulting on their revised

approach to Pillar 2, the PRA Buffer and the interaction

of this with the CRD IV buffers. Furthermore, there are a

notable number of draft and unpublished EBA technical

and implementation standards due in 2015 which could

have additional impacts on the bank’s capital position

and RWAs.

CRD IV also introduced the leverage ratio to supplement

risk-based capital requirements from 1 January 2018. In

January 2014, the Basel Committee published its

finalised leverage ratio framework, along with the public

disclosure requirements applicable from 1 January 2015.

Under CRD IV, the legislative proposals and final

calibration of the leverage ratio are expected to be

determined following a review of the revised Basel

proposals and the basis of the EBA’s assessment of the

impact and effectiveness of the leverage ratio during a

monitoring period, between 1 January 2014 and 30 June

2016.

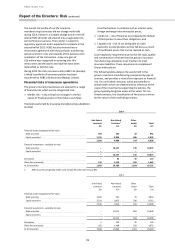

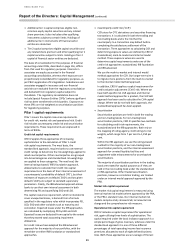

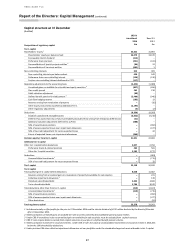

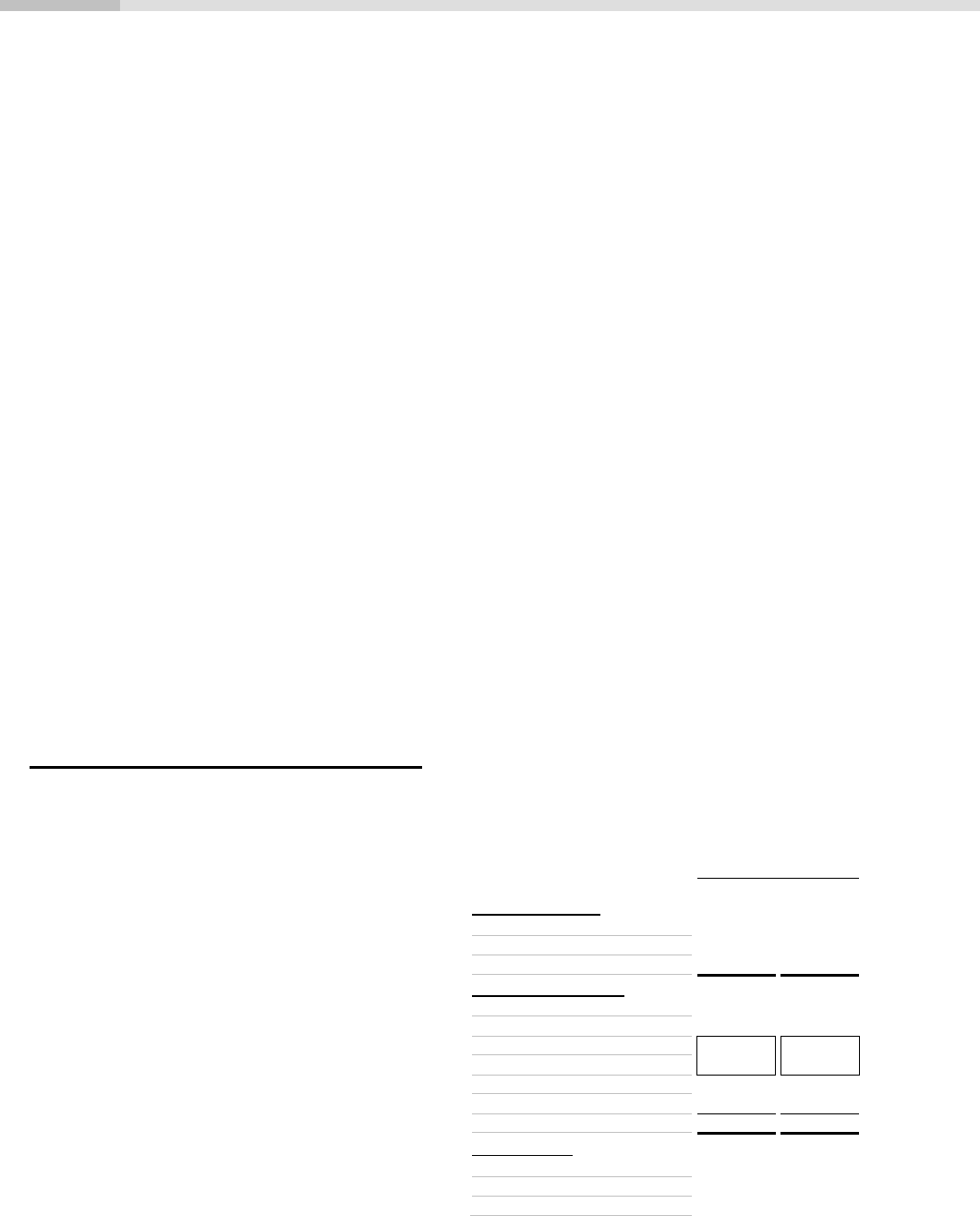

The table below provides a comparison of the key capital

numbers based on the applicable capital requirements

for each period.

Key capital numbers

(Unaudited)

At 31 December

2014

2013

Capital resources (£m)

CET 11 /Core Tier 1 Capital

21,091

22,438

Tier 1 Capital

25,138

24,108

Total Capital

33,556

33,543

Risk Weighted Assets (£m)

Counterparty Credit Risk

30,364

16,450

Non-Counterparty Credit Risk

168,600

129,459

- IRB

137,206

100,159

- Standardised

31,394

29,300

Market Risk

22,437

17,931

Operational Risk

22,251

22,039

Total Risk Weighted Assets

243,652

185,879

Capital Ratios (%)

CET 1/Core Tier 1

8.7

12.1

Total Tier 1

10.3

13.0

Total Capital

13.8

18.0

1 CET 1 is a new measure of capital introduced by CRD IV which

replaces the previous Basel 2 measure, Core Tier 1. Capital

measures introduced by CRD IV differ significantly to previous

measures.