HSBC 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Business Review

13

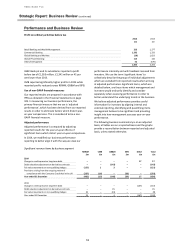

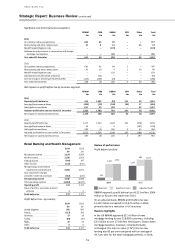

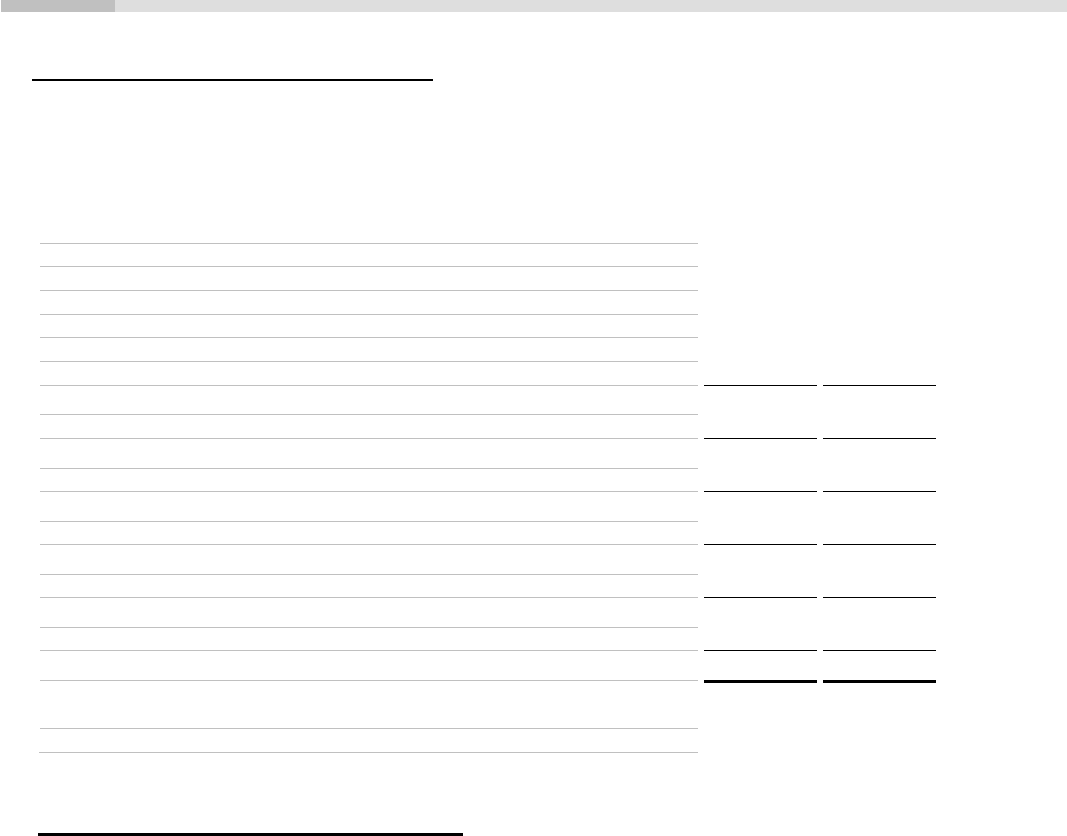

Financial summary

Summary consolidated income statement for the year ended

2014

2013

£m

£m

Net interest income

6,629

6,961

Net fee income

3,266

3,336

Trading income

1,609

2,373

Net income from financial instruments designated at fair value

371

900

Gains less losses from financial investments

321

100

Net insurance premium income

1,823

2,022

Other operating income

183

176

Total operating income

1

14,202

15,868

Net insurance claims, benefits paid and movement in liabilities to policyholders

(2,316)

(3,028)

Net operating income before loan impairment and other credit risk provisions

11,886

12,840

Loan impairment charges and other credit risk provisions

(449)

(971)

Net operating income

11,437

11,869

Total operating expenses

1

(9,487)

(8,575)

Operating profit

1,950

3,294

Share of profit in associates and joint ventures

3

–

Profit before tax

1,953

3,294

Tax expense

(564)

(754)

Profit for the year

1,389

2,540

Profit attributable to shareholders of the parent company

1,354

2,495

Profit attributable to non-controlling interests

35

45

1 Total operating income and expenses include significant items as detailed on pages 18 and 19.

Economic background

The UK recovery continued through the second half of

2014, though the pace of expansion moderated towards

the end of the year. Preliminary estimates indicate that

the annual rate of growth of real Gross Domestic Product

(‘GDP’) was 2.6 per cent. The unemployment rate fell to

5.7 per cent in the three months to December and wage

growth accelerated slightly from a very low level. The

annual Consumer Price Index (‘CPI’) measure of inflation

reached a 14-year low of 0.5 per cent in December. After

a period of rapid activity in 2013 and the early months of

2014, there were signs that both economic activity and

price inflation in the housing market were moderating as

the year ended. The Bank of England kept the Bank Rate

steady at 0.5 per cent.

The recovery in eurozone economic activity in 2014 was

slow and uneven across member states. Real GDP in the

region as a whole grew by 0.9 per cent in the year. The

German and Spanish economies grew by 1.6 per cent

and 1.5 per cent, respectively, while French GDP grew by

a more modest 0.4 per cent. Eurozone inflation fell to

minus 0.2 per cent in December, prompting fears that

the region could move towards a sustained period of

deflation. The likelihood that low growth and inflation

could persist for an extended period prompted the

European Central Bank (‘ECB’) to cut the main

refinancing rate and the deposit rate to 0.05 per cent

and minus 0.2 per cent, respectively, in September and

embark on a policy of balance sheet expansion starting

with purchases of covered bonds and asset-backed

securities.

In Turkey, the annual rate of GDP growth slowed in the

third quarter to 1.7 per cent largely driven by a

slowdown in private consumption. The annual rate of

private investment has been particularly weak

throughout 2014, averaging minus 1.6 per cent in the

first three quarters. CPI inflation remained elevated at

8.2 per cent in December, well above the Central Bank of

Turkey's (‘CBRT’) target of 5.0 per cent. Despite elevated

inflation and the sizeable deficit in Turkey’s current

account position, the CBRT began easing monetary policy

in the second quarter, cutting the key interest rate in

May, June and July to reach 8.25 per cent down from 10

per cent at the start of the year.