HSBC 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

65

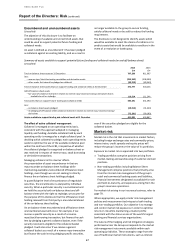

do not arise from operating activities are presented as a

net balancing source or deployment of funds.

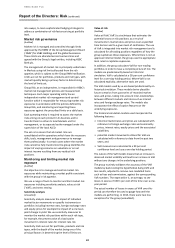

The level of customer accounts continued to exceed the

level of loans and advances to customers. The positive

funding gap was predominantly deployed in liquid assets;

cash and balances with central banks and financial

investments, as required by the LFRF.

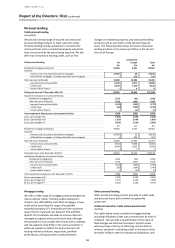

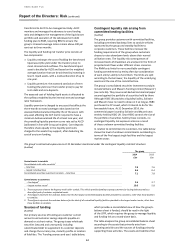

Funding sources and uses

(Audited)

The group

2014

2013

2014

2013

£m

£m

£m

£m

Sources

Uses

Customer accounts

346,507

346,358

Loans and advances to customers

257,252

273,722

Deposits by banks

27,590

28,769

Loans and advances to banks

25,262

23,013

Repurchase agreements – non-

trading

23,353

65,573

Reverse Repurchase agreements –

non-trading

41,945

61,525

Debt securities issued

27,921

32,895

Trading assets

130,127

134,097

Subordinated liabilities

8,858

10,785

– reverse repos

444

5,607

Financial liabilities designated

– stock borrowing

5,137

6,241

at fair value

22,552

34,036

– settlement accounts

3,803

4,447

– other trading assets

120,743

117,802

Liabilities under insurance contracts

17,522

19,228

Financial investments

76,194

75,030

Cash and balances with

Trading liabilities

82,600

91,842

central banks

42,853

67,584

– repos

2,339

9,426

Net deployment in other balance

– stock lending

11,617

6,936

sheet assets and liabilities

19,968

27,434

– settlement accounts

3,628

3,587

– other trading liabilities

65,016

71,893

Total equity

36,698

32,919

At 31 December

593,601

662,405

At 31 December

593,601

662,405

Repos and stock lending

GB&M provides collateralised security financing services

to its clients, providing them with cash financing or

specific securities. When cash is provided to clients against

collateral in the form of securities, the cash provided is

recognised on the balance sheet as a reverse repo. When

securities are provided to clients against cash collateral

the cash received is recognised on the balance sheet as a

repo or, if the securities are equity securities, as stock

lending.

Each operating entity manages its collateral through a

central collateral pool, in line with the LFRF. When specific

securities need to be delivered and the entity does not

have them currently available within the central collateral

pool, the securities are borrowed on a collateralised basis.

When securities are borrowed against cash collateral the

cash provided is recognised on the balance sheet as a

reverse repo or, if the securities are equity securities, as

stock borrowing.

Operating entities may also borrow cash against collateral

in the form of securities, using the securities available in

the central collateral pool. Repos and stock lending can be

used in this way to fund the cash requirement arising from

securities owned outright by Markets to facilitate client

business, and the net cash requirement arising from

financing client securities activity. Reverse repos, stock

borrowing, repos and stock lending are reported net when

the IFRSs offsetting criteria are met. In some cases

transactions to borrow or lend securities are collateralised

using securities. These transactions are off-balance sheet.

Any security accepted as collateral for a reverse repo or

stock borrowing transaction must be of very high quality

and its value subject to an appropriate haircut. Securities

borrowed under reverse repo or stock borrowing

transactions can only be recognised as part of the liquidity

asset buffer for the duration of the transactions and only if

the security received is eligible under the liquid asset

policy within the LFRF.

Credit controls are in place to ensure that the fair value of

any collateral received remains appropriate to collateralise

the cash or fair value of securities given.

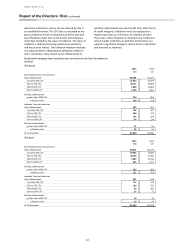

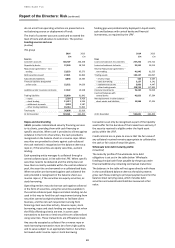

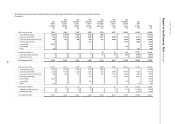

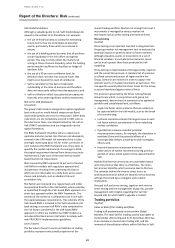

Wholesale term debt maturity profile

(Unaudited)

The maturity profile of the wholesale term debt

obligations is set out in the table below ‘Wholesale

funding principal cash flows payable by the group under

financial liabilities by remaining contractual maturities’.

The balances in the table will not agree directly with those

in the consolidated balance sheet as the table presents

gross cash flows relating to principal payments and not the

balance sheet carrying value, which includes debt

securities and subordinated liabilities measured at fair

value.