HSBC 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Strategic Priorities (continued)

10

five-year US DPA. The Group looks forward to

maintaining a strong, collaborative relationship with the

Monitor and his team.

Streamline processes and

procedures

We continue to refine our operational processes,

develop our functions, implement consistent business

models and strengthen IT. The Group’s aim is to achieve

a cost efficiency ratio in the mid 50’s.

Since 2011, the Group has changed how HSBC is

managed by introducing a leaner reporting structure and

establishing an operating model with global businesses

and functions. These changes - together with

improvements in software development productivity,

process optimisation, and HSBC’s property portfolio –

realised US$5.7 billion in Group wide sustainable savings,

equivalent to US$6.1 billion on an annualised (run rate)

basis. This exceeded our commitment to deliver

US$2.5–3.5 billon of sustainable savings at the outset of

the organisational effectiveness programme included in

the first phase of our strategy.

Sustainable savings arise from the reduction or

elimination of complexity, inefficiencies or unnecessary

activities, and release capital that can be reinvested in

growing our business as well as increasing returns to

shareholders.

The reorganisation of the Group into four global

businesses and eleven global functions further allows

HSBC to run globally consistent operating models. This

establishes the foundation for the next stage of

streamlining.

From 2014 to 2016, the Group will continue to

streamline processes and procedures with a target to

realise an additional US$2-3 billion of sustainable

savings. This programme will be applied to:

• improving the end-to-end optimisation of processes

and servicing channels;

• technology simplification, reducing the number of

applications used across the Group; and

• enhancing infrastructure, including optimising our

real estate utilisation and the location where certain

activities are carried out.

Streamlining is expected to be achieved through a

combination of simplifying and globalising our processes,

products, systems and operations. ‘Simplifying’ involves

identifying inefficiencies or excessive complexity and

redesigning or rationalising processes to make them

easier to understand and manage and more efficient.

‘Globalising’ involves developing standard global

processes and implementing them around the Group.

Strategic direction

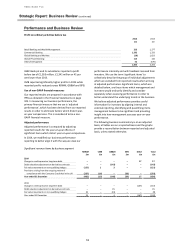

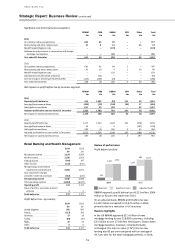

Retail Banking and Wealth Management

RBWM provides retail banking and wealth management

services for personal customers in markets where we

have, or can build, the scale in our target customer

segments to do so cost effectively.

We focus on three strategic imperatives:

• building a consistent, high standard, customer needs-

driven wealth management service for retail

customers drawing on our Insurance and Asset

Management businesses;

• using our global expertise to improve customer

service and productivity, to provide a high standard of

banking solutions and service to our customers

efficiently; and

• simplifying and re-shaping the RBWM portfolio of

businesses globally, to focus our capital and resources

on key markets.

Our three growth priorities are customer growth in

target segments, deepening customer relationships

through wealth management and relationship-led

lending, and enhancing distribution capabilities,

including digital.

Implementing Global Standards, enhancing risk

management control models and simplifying processes

also remain top priorities for RBWM.

Commercial Banking

CMB aims to be the banking partner of choice for our

customers building on our rich heritage, international

capabilities and relationships to enable global

connectivity.

We have four growth priorities:

• providing consistency and efficiency for our

customers through a business model organised

around global customer segments and products;

• utilising our distinctive geographical network to

support and facilitate global trade and capital flows;

• delivering excellence in our core flow products –

specifically in Trade and Payments and Cash

Management; and

• enhancing collaboration with other global businesses.

Implementing Global Standards, enhancing risk

management controls and simplifying processes also

remain top priorities for CMB.

Global Banking and Markets

GB&M’s business model and strategy is well established

with the objective of being a ‘top 5’ bank to our priority

clients and in our chosen products and geographies.

We focus on the following growth priorities:

• connecting clients to international growth

opportunities;

• continuing to be well positioned in products that will

benefit from global trends; and

• leveraging our distinctive International expertise and

geographical network which connects developed and

faster-growing regions;

Enhancing risk management controls, implementing

Global Standards and collaborating with other global

businesses also remain top priorities for GB&M.

Global Private Banking

GPB aims to build on HSBC’s commercial banking

heritage to be the leading private bank for high net

worth business owners by: