HSBC 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

71

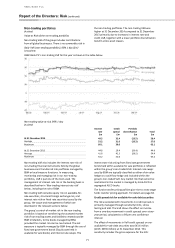

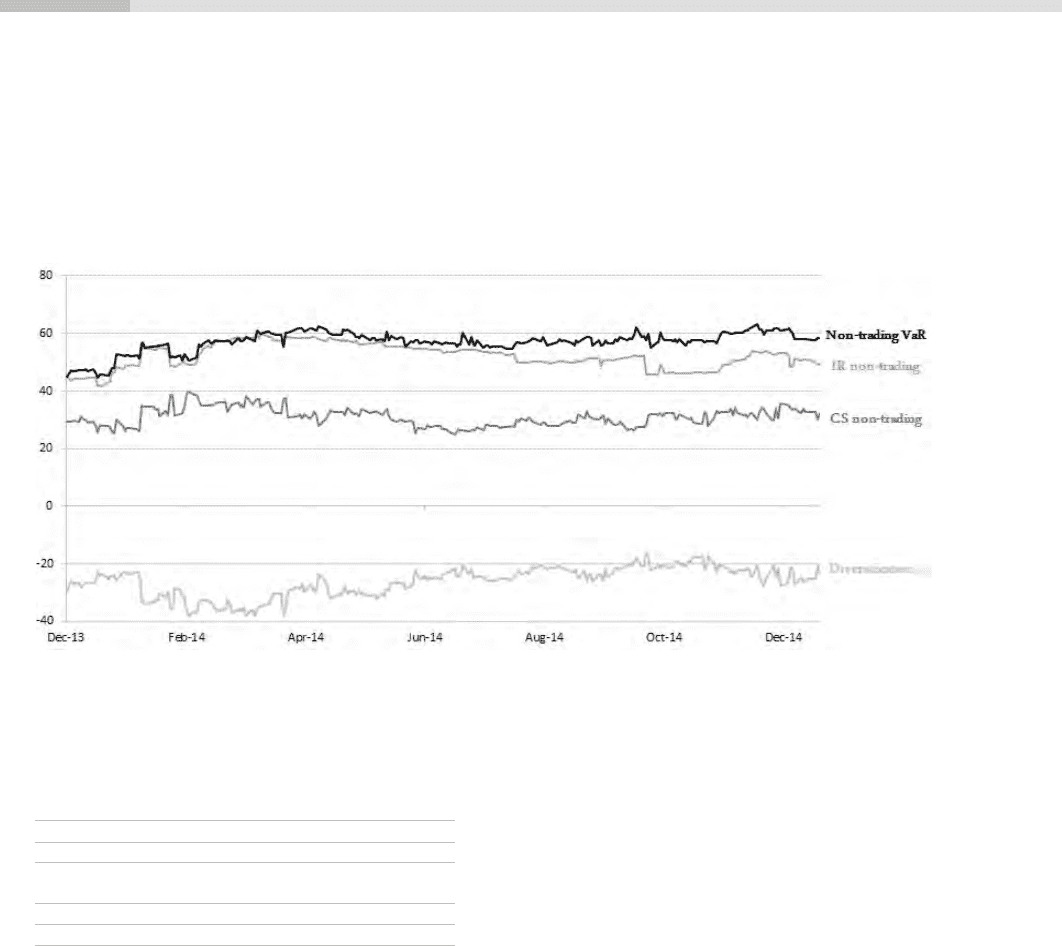

Non-trading portfolios

(Audited)

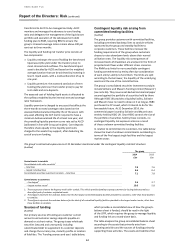

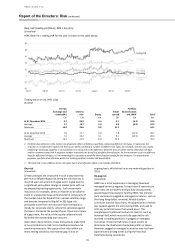

Value at Risk of the non-trading portfolios

Non-trading VaR of the group includes contributions

from all global businesses. There is no commodity risk in

the non-trading portfolios. The non-trading VAR was

higher at 31 December 2014 compared to 31 December

2013 primarily due to increases in interest rate and

credit VaR, together with a lower portfolio diversification

benefit across asset classes.

Daily VaR (non-trading portfolios), 99% 1 day (£m)

(Unaudited)

HSBC Bank Plc’s non-trading VaR for the year is shown in the table below.

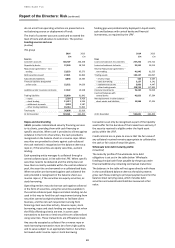

Non-trading value at risk, 99% 1 day

(Audited)

Interest

rate

Credit

spread

Portfolio

diversification

Total

£m

£m

£m

£m

At 31 December 2014

49.5

32.4

(23.5)

58.4

Average

52.2

31.0

(26.2)

57.0

Maximum

60.1

39.6

63.1

At 31 December 2013

44.8

29.4

(29.4)

44.8

Average

41.6

41.3

(28.5)

54.4

Maximum

63.2

52.6

65.4

Non-trading VaR also includes the interest rate risk of

non-trading financial instruments held by the global

businesses and transferred into portfolios managed by

BSM or local treasury functions. In measuring,

monitoring and managing risk in our non-trading

portfolios, VaR is just one of the tools used. The

management of interest rate risk in the banking book is

described further in ‘Non-trading interest rate risk’

below, including the role of BSM.

Non-trading VaR excludes equity risk on available-for-

sale securities, structural foreign exchange risk, and

interest rate risk on fixed rate securities issued by the

group, the scope and management of which are

described in the relevant sections below.

The group’s control of market risk in the non-trading

portfolios is based on transferring the assessed market

risk of non-trading assets and liabilities created outside

BSM or Markets, to the books managed by BSM,

provided the market risk can be neutralised. The net

exposure is typically managed by BSM through the use of

fixed rate government bonds (liquid asset held in

available for sale books) and interest rate swaps. The

interest rate risk arising from fixed rate government

bonds held within available for sale portfolios is reflected

within the group’s non-traded VaR. Interest rate swaps

used by BSM are typically classified as either a fair value

hedge or a cash flow hedge and included within the

group’s non-traded VaR. Any market risk that cannot be

neutralised in the market is managed by local ALCO in

segregated ALCO books.

The funds transfer pricing policies give rise to a two stage

funds transfer pricing approach. For details see page 63.

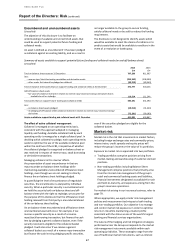

Credit spread risk for available-for-sale debt securities

The risk associated with movements in credit spreads is

primarily managed through sensitivity limits, stress

testing and VaR. The VaR shows the effect on income

from a one-day movement in credit spreads over a two-

year period, calculated to a 99 per cent confidence

interval.

The effect of movements in VaR credit spreads on our

available-for-sale debt securities was £43.6 million

(2013: £49.8 million) at 31 December 2014. This

sensitivity includes the gross exposure for the SICs