HSBC 2014 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

151

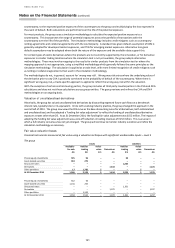

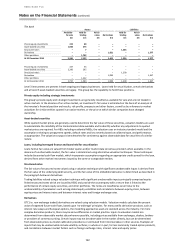

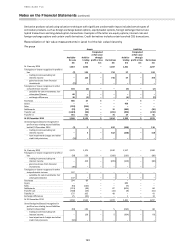

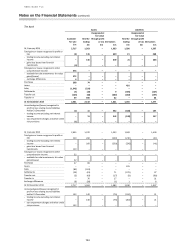

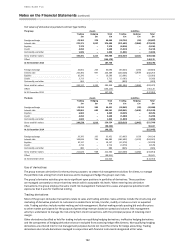

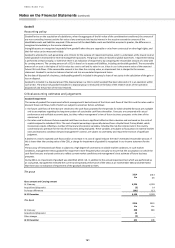

15 Derivatives

Accounting policy

Derivatives

Derivatives are initially recognised, and are subsequently remeasured, at fair value. Fair values of derivatives are obtained either from

quoted market prices or by using valuation techniques. Derivative assets and liabilities arising from different transactions are only

offset for accounting purposes if the offsetting criteria presented in Note 30 are met.

Embedded derivatives are bifurcated from the last contract when their economic characteristics and risks are not clearly and closely

related to those of the host non-derivative contract, their contractual terms would otherwise meet the definition of a stand-alone

derivative and the combined contract is not held for trading or designated at fair value. The bifurcated embedded derivatives are

measured at fair value with changes therein recognised in the income statement.

Derivatives are classified as assets when their fair value is positive, or as liabilities when their fair value is negative.

Gains and losses from changes in the fair value of derivatives, including the contractual interest, that do not qualify for hedge

accounting are reported in ‘Net trading income’ except for derivatives managed in conjunction with financial instruments designated

at fair value, where gains and losses are reported in ‘Net income from financial instruments designated at fair value’ together with the

gains and losses on the economically hedged items. Where the derivatives are managed with debt securities issued by HSBC and

designated at fair value, the contractual interest is shown in ‘Interest expense’ together with the interest payable on the issued debt.

When derivatives are designated as hedges, HSBC classifies them as either: (i) hedges of the change in fair value of recognised assets

or liabilities or firm commitments (‘fair value hedges’); (ii) hedges of the variability in highly probable future cash flows attributable to

a recognised asset or liability, or a forecast transaction (‘cash flow hedges’); or (iii) a hedge of a net investment in a foreign operation

(‘net investment hedges’).

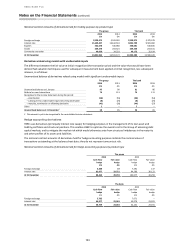

Hedge accounting

At the inception of a hedging relationship, HSBC documents the relationship between the hedging instruments and the hedged items,

its risk management objective and its strategy for undertaking the hedge. HSBC requires documented assessment, both at hedge

inception and on an ongoing basis, of whether or not the hedging instruments are highly effective in offsetting the changes

attributable to the hedged risks in the fair values or cash flows of the hedged items.

Fair value hedge

Changes in the fair value of derivatives that are designated and qualify as fair value hedging instruments are recorded in the income

statement, along with changes in the fair value of the hedged assets, liabilities or group that contain the hedged risk. If a hedging

relationship no longer meets the criteria for hedge accounting, the hedge accounting is discontinued: the cumulative adjustment to

the carrying amount of the hedged item is amortised to the income statement on a recalculated effective interest rate over the

residual period to maturity, unless the hedged item has been derecognised.

Cash flow hedge

The effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges is recognised in

other comprehensive income; the ineffective portion of the change in fair value is recognised immediately in the income statement.

The accumulated gains and losses recognised in other comprehensive income are reclassified to the income statement in the periods

in which the hedged item affects profit or loss. In hedges of forecasted transactions that result in recognition of a non-financial asset

or liability, previous gains and losses recognised in other comprehensive income are included in the initial measurement of the asset

or liability.

When a hedging relationship is discontinued, any cumulative gain or loss recognised in other comprehensive income remains in equity

until the forecast transaction is recognised in the income statement. When a forecast transaction is no longer expected to occur, the

cumulative gain or loss previously recognised in other comprehensive income is immediately reclassified to the income statement.

Net investment hedge

Hedges of net investments in foreign operations are accounted for in a similar way to cash flow hedges. A gain or loss on the effective

portion of the hedging instrument is recognised in other comprehensive income; the residual change in fair value is recognised

immediately in the income statement. Gains and losses previously recognised in other comprehensive income are reclassified to the

income statement on the disposal, or part disposal, of the foreign operation.

Hedge effectiveness testing

To qualify for hedge accounting, HSBC requires that at the inception of the hedge and throughout its life each hedge must be expected

to be highly effective, both prospectively and retrospectively, on an ongoing basis.

The documentation of each hedging relationship sets out how the effectiveness of the hedge is assessed and the method adopted by

an entity to assess hedge effectiveness will depend on its risk management strategy. For prospective effectiveness, the hedging

instrument must be expected to be highly effective in offsetting changes in fair value or cash flows attributable to the hedged risk

during the period for which the hedge is designated, with the effectiveness range being defined as 80% to 125%. Hedge ineffectiveness

is recognised in the income statement in ‘Net trading income’.

Derivatives that do not qualify for hedge accounting

Non-qualifying hedges are economic hedges entered into as part of documented interest rate management strategies for which hedge

accounting was not applied. Changes in fair value of non-qualifying hedges do not alter the cash flows expected as part of the

documented management strategies for both the non-qualifying hedge instruments and the related assets and liabilities.