HSBC 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

155

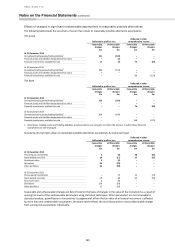

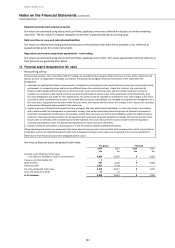

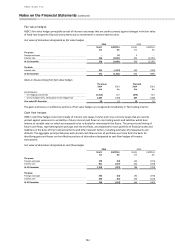

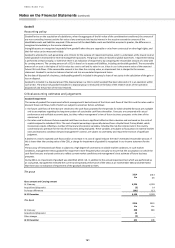

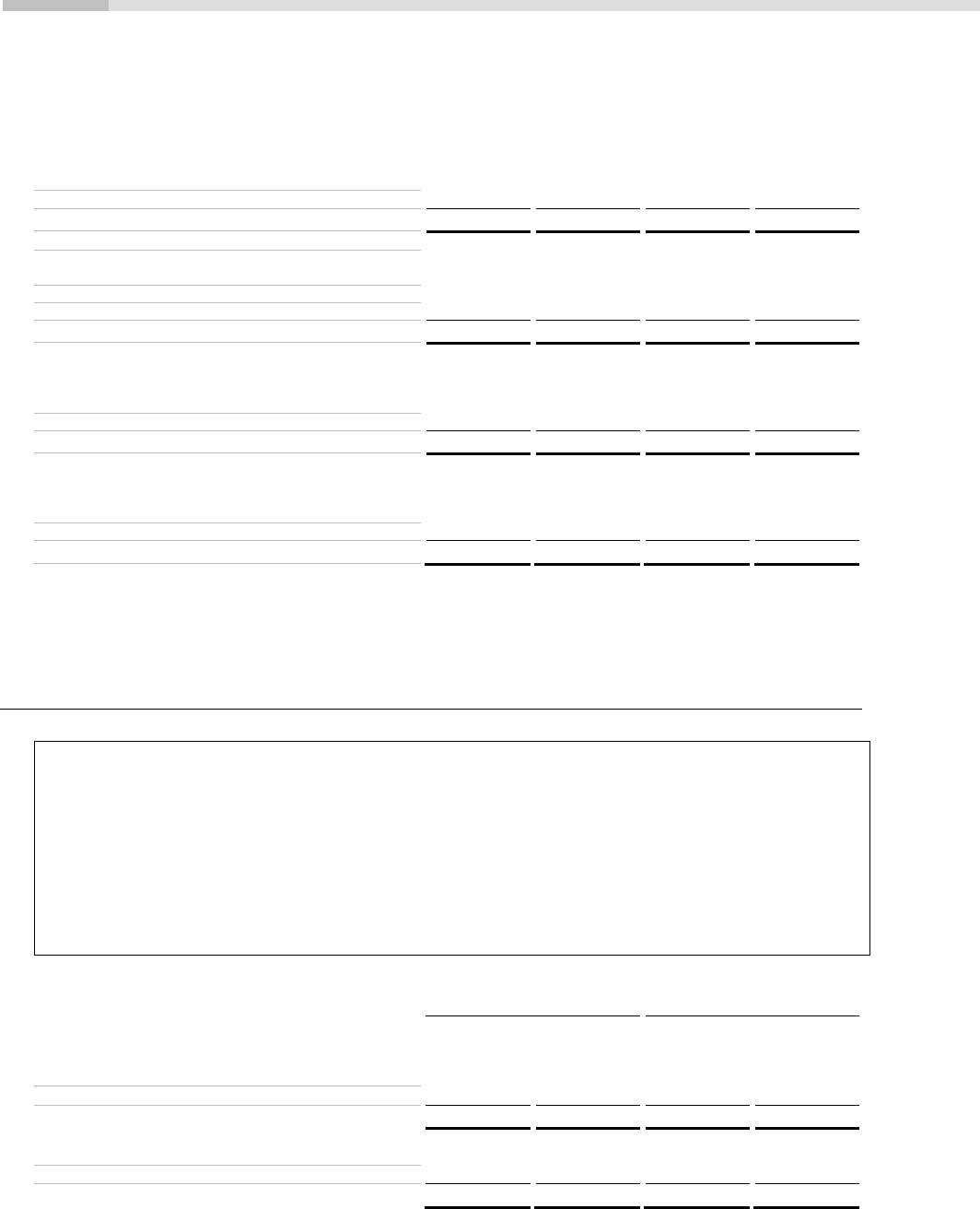

Forecast principal balances on which interest cash flows are expected to arise

3 months

or less

More than 3

months but less

than 1 year

5 years or less

but more than

1 year

More than

5 years

£m

£m

£m

£m

The group

Net cash inflows/(outflows) exposure

Assets

59,995

54,091

33,947

251

Liabilities

(17,824)

(13,609)

(10,388)

(3,380)

At 31 December 2014

42,171

40,482

23,559

(3,129)

The bank

Net cash inflows/(outflows) exposure

Assets

44,485

44,458

30,842

41

Liabilities

(5,315)

(5,226)

(4,741)

(1,235)

At 31 December 2014

39,170

39,232

26,101

(1,194)

The group

Net cash inflows/(outflows) exposure

Assets

64,230

56,681

38,577

909

Liabilities

(19,893)

(12,262)

(10,481)

(4,807)

At 31 December 2013

44,337

44,419

28,096

(3,898)

The bank

Net cash inflows/(outflows) exposure

Assets

43,498

42,862

34,489

–

Liabilities

(6,343)

(6,223)

(4,539)

(322)

At 31 December 2013

37,155

36,639

29,950

(322)

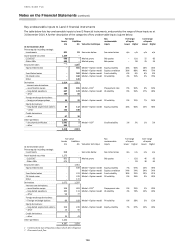

This table reflects the interest rate repricing profile of the underlying hedged items.

The gains and losses on ineffective portions of derivatives designated as cash flow hedges are recognised immediately in

‘Net trading income’. During the year to 31 December 2014 a gain of £8 million (2013: loss of £8 million) was recognised

due to hedge ineffectiveness.

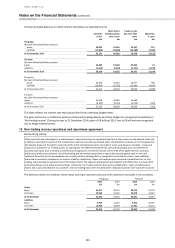

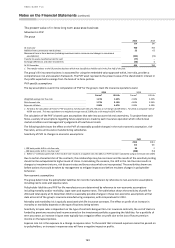

16 Non-trading reverse repurchase and repurchase agreement

Accounting policy

When securities are sold subject to a commitment to repurchase them at a predetermined price, they remain on the balance sheet and

a liability is recorded in respect of the consideration received. Securities purchased under commitments to resale are not recognised on

the balance sheet and the right to receive back the initial consideration paid is recorded in ‘Loans and advances to banks’, ‘Loans and

advances to customers’ or ‘Trading assets’ as appropriate. The difference between the sale and repurchase price or between the

purchase and resale price is treated as interest and recognised in net interest income over the life of the agreement for loans and

advances to banks and customers. Securities lending and borrowing transactions are generally secured against cash or non-cash

collateral. Securities lent or borrowed do not normally result in derecognition or recognition on the balance sheet. Cash collateral

advanced or received is recorded as an asset or a liability respectively. Repos and reverse repos measured at amortised cost, or non-

trading, are presented as separate lines in the balance sheet. This separate presentation was adopted with effect from 1 January 2014

and comparatives are re-presented accordingly. Previously, non-trading reverse repos were included within ‘Loans and advances to

banks’ and ‘Loans and advances to customers’ and non-trading repos were included within ‘Deposits by banks’ and ‘Customer accounts’.

The extent to which non-trading reverse repos and repos represent amounts with customers and banks is set out below.

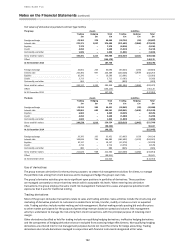

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Assets

Banks

22,477

30,215

20,713

25,234

Customers

19,468

31,310

15,678

22,613

At 31 December

41,945

61,525

36,391

47,847

Liabilities

Banks

9,793

21,914

6,302

20,057

Customers

13,560

43,659

11,991

31,141

At 31 December

23,353

65,573

18,293

51,198