HSBC 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

40

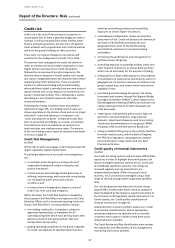

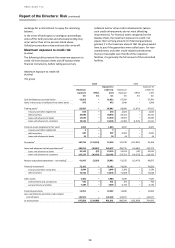

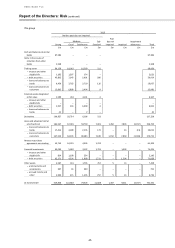

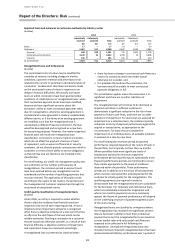

Maximum exposure to credit risk

(Audited)

The bank

2014

2013

Maximum

exposure

Offset

Exposure to

credit risk

(net)

Maximum

exposure

Offset

Exposure to

credit risk

(net)

£m

£m

£m

£m

£m

£m

Cash and balances at central banks

41,424

–

41,424

60,996

–

60,996

Items in the course of collection from other banks

630

–

630

1,374

–

1,374

Trading assets1

55,858

–

55,858

66,865

(1,075)

65,790

treasury and other eligible bills

154

–

154

643

–

643

debt securities

25,150

–

25,150

28,821

–

28,821

loans and advances to banks

13,039

–

13,039

16,568

–

16,568

loans and advances to customers

17,515

–

17,515

20,833

(1,075)

19,758

Financial assets designated at fair value1

9

–

9

3,983

–

3,983

debt securities

9

–

9

3,983

–

3,983

loans and advances to banks

–

–

–

–

–

–

Derivatives2

160,232

(136,187)

24,045

112,623

(77,990)

34,633

Loans and advances held at amortised cost3

220,447

(35,607)

184,840

233,899

(53,637)

180,262

loans and advances to banks

18,776

–

18,776

16,332

–

16,332

loans and advances to customers

201,671

(35,607)

166,064

217,567

(53,637)

163,930

Reverse repurchase agreements – non-trading3

36,391

(628)

35,763

47,847

(5,924)

41,923

Financial investments1

48,001

–

48,001

44,594

–

44,594

treasury and other similar bills

2,081

–

2,081

1,927

–

1,927

debt securities

45,920

–

45,920

42,667

–

42,667

Other assets

6,126

–

6,126

4,722

–

4,722

endorsements and acceptances

364

–

364

343

–

343

accrued income and other

5,762

–

5,762

4,379

–

4,379

Financial guarantees

10,968

–

10,968

9,366

–

9,366

Loan commitments and other credit-related

commitments

96,785

–

96,785

80,417

–

80,417

At 31 December

676,871

(172,422)

504,449

666,686

(138,626)

528,060

1 Reported amounts exclude equity instruments.

2 The derivative offset amount in the ‘maximum exposure to credit risk table’ relates to exposures where the counterparty has an offsetting

derivative exposure with the group, a master netting agreement is in place and the credit risk exposure is managed on a net basis, or the

position is specifically collateralised, normally in the form of cash. At 31 December 2014, the total amount of such offsets was £174 billion

(2013: £113 billion), of which £147 billion (2013: £93 billion) were offsets under a master netting arrangement, £24 billion (2013: £17 billion)

were received in cash and £3 billion (2013: £3 billion) were other collateral. These amounts do not qualify for net presentation for accounting

purposes as settlement may not actually be made on a net basis.

3 The loans and advances offset adjustment primarily relates to customer loans and deposits, and balances arising from repo and reverse repo

transactions. The offset relates to balances where there is a legally enforceable right of offset in the event of counterparty default, and where,

as a result there is a net exposure for credit risk management purposes. As there is no intention to settle these balances on a net basis under

normal circumstances, they do not qualify for net presentation for accounting purposes. No offset has been applied to off balance sheet

collateral.