HSBC 2014 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

156

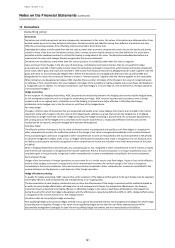

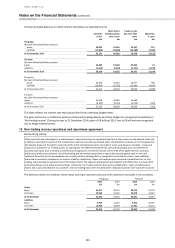

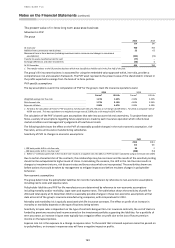

17 Financial investments

Accounting policy: financial investments

Treasury bills, debt securities and equity securities intended to be held on a continuing basis, other than those designated at fair value,

are classified as available for sale or held to maturity. They are recognised on trade date when the group enters into contractual

arrangements to purchase those instruments, and are normally derecognised when either the securities are sold or redeemed.

(i) Available-for-sale financial assets are initially measured at fair value plus direct and incremental transaction costs. They are

subsequently remeasured at fair value, and changes therein are recognised in other comprehensive income until they are either

sold or become impaired. When available-for-sale financial assets are sold, cumulative gains or losses previously recognised in

other comprehensive income are recognised in the income statement as ‘Gains less losses from financial investments’.

Interest income is recognised over the debt asset’s expected life. Premiums and/or discounts arising on the purchase of dated debt

securities are included in the interest recognised. Dividends from equity assets are recognised in the income statement when the

right to receive payment is established.

(ii) Held-to-maturity investments are non-derivative financial assets with fixed or determinable payments and fixed maturities that

HSBC positively intends and is able to hold to maturity. Held-to-maturity investments are initially recorded at fair value plus any

directly attributable transaction costs, and are subsequently measured at amortised cost, less any impairment losses.

The accounting policy relating to impairments of available-for-sale securities is presented in Note 1(j).

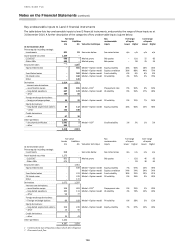

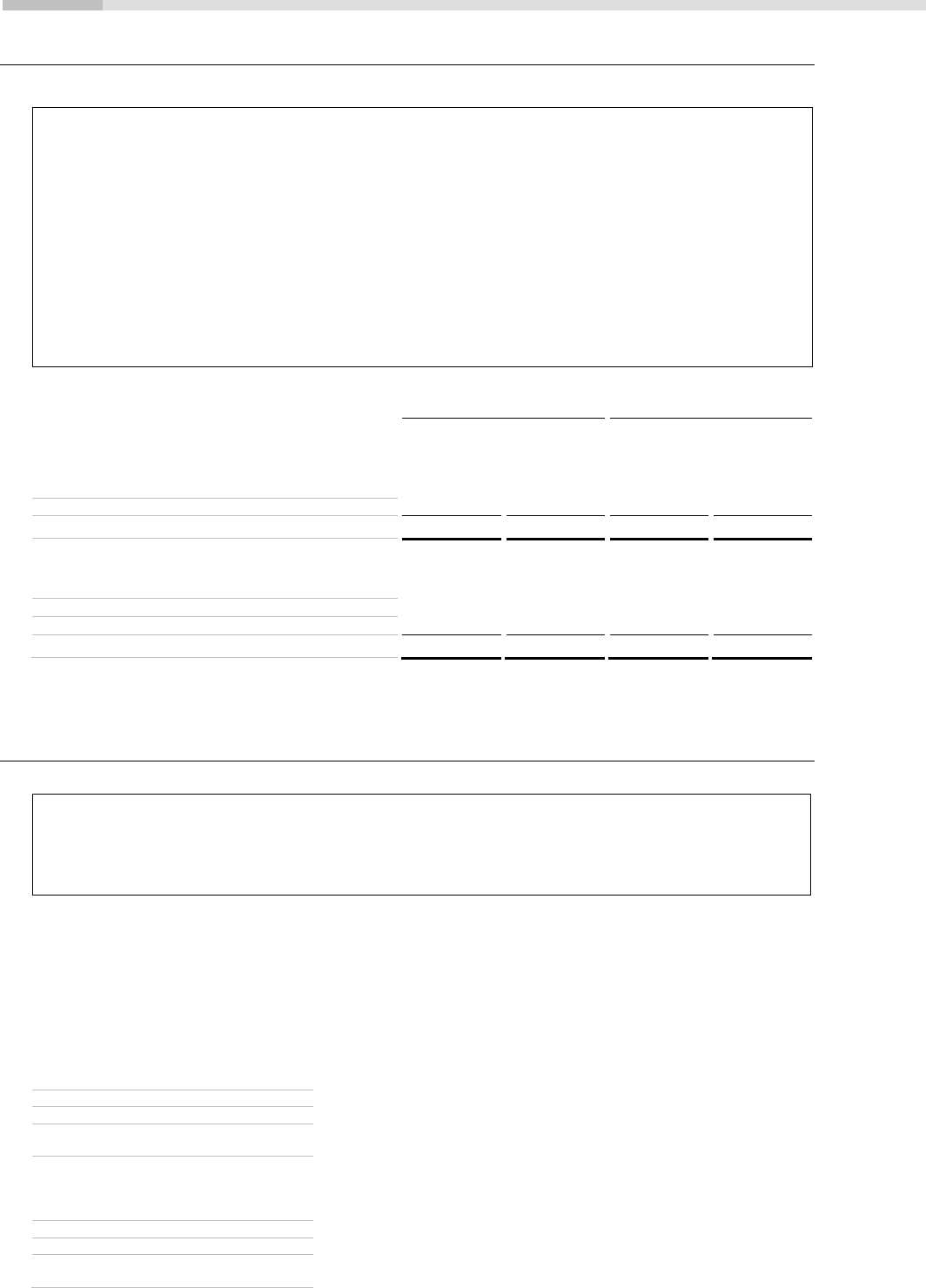

Financial investments:

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Financial investments:

– which may be repledged or resold by counterparties

14,831

11,435

13,552

8,583

– not subject to repledge or resale by counterparties

61,363

63,595

34,886

36,465

At 31 December

76,194

75,030

48,438

45,048

Treasury and other eligible bills – available for sale

2,849

2,196

2,081

1,927

Debt securities – available for sale

72,336

71,828

45,920

42,667

Equity securities – available for sale

1,009

1,006

437

454

At 31 December

76,194

75,030

48,438

45,048

For the group, £6,172 million (2013: £2,936 million), and for the bank, £4,131 million (2013: £865 million), of the debt

securities issued by banks and other financial institutions are guaranteed by various governments.

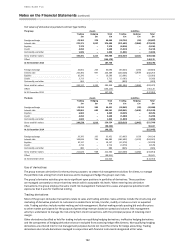

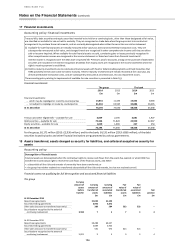

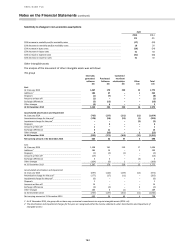

18 Assets transferred, assets charged as security for liabilities, and collateral accepted as security for

assets

Accounting policy

Derecognition of financial assets

Financial assets are derecognised when the contractual rights to receive cash flows from the assets has expired; or when HSBC has

transferred its contractual right to receive the cash flows of the financial assets, and either:

• substantially all the risks and rewards of ownership have been transferred; or

• the group has neither retained nor transferred substantially all the risks and rewards, but has not retained control.

Financial assets not qualifying for full derecognition and associated financial liabilities

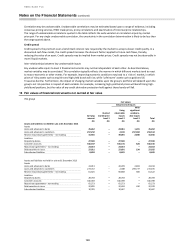

The group

Carrying

amount of

assets

before

transfer

Carrying

amount of

transferred

assets

Carrying

amount of

associated

liabilities

Fair

value of

transferred

assets

Fair

value of

associated

liabilities

Net

position

£m

£m

£m

£m

£m

At 31 December 2014

Repurchase agreements

31,030

31,550

Securities lending agreements

6,992

5,872

Other sales (recourse to transferred asset only)

389

564

533

533

–

Securitisations recognised to the extent of

continuing involvement

3,590

7

3

7

3

4

At 31 December 2013

Repurchase agreements

60,288

60,657

Securities lending agreements

4,989

4,945

Other sales (recourse to transferred asset only)

581

674

624

624

–

Securitisations recognised to the extent of

continuing involvement

5,021

9

5

9

5

4