HSBC 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

146

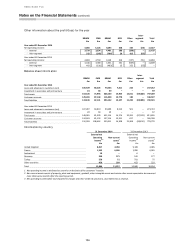

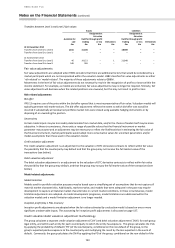

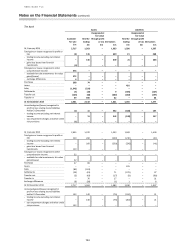

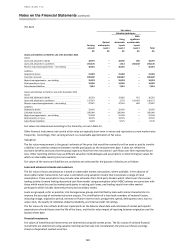

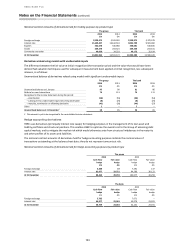

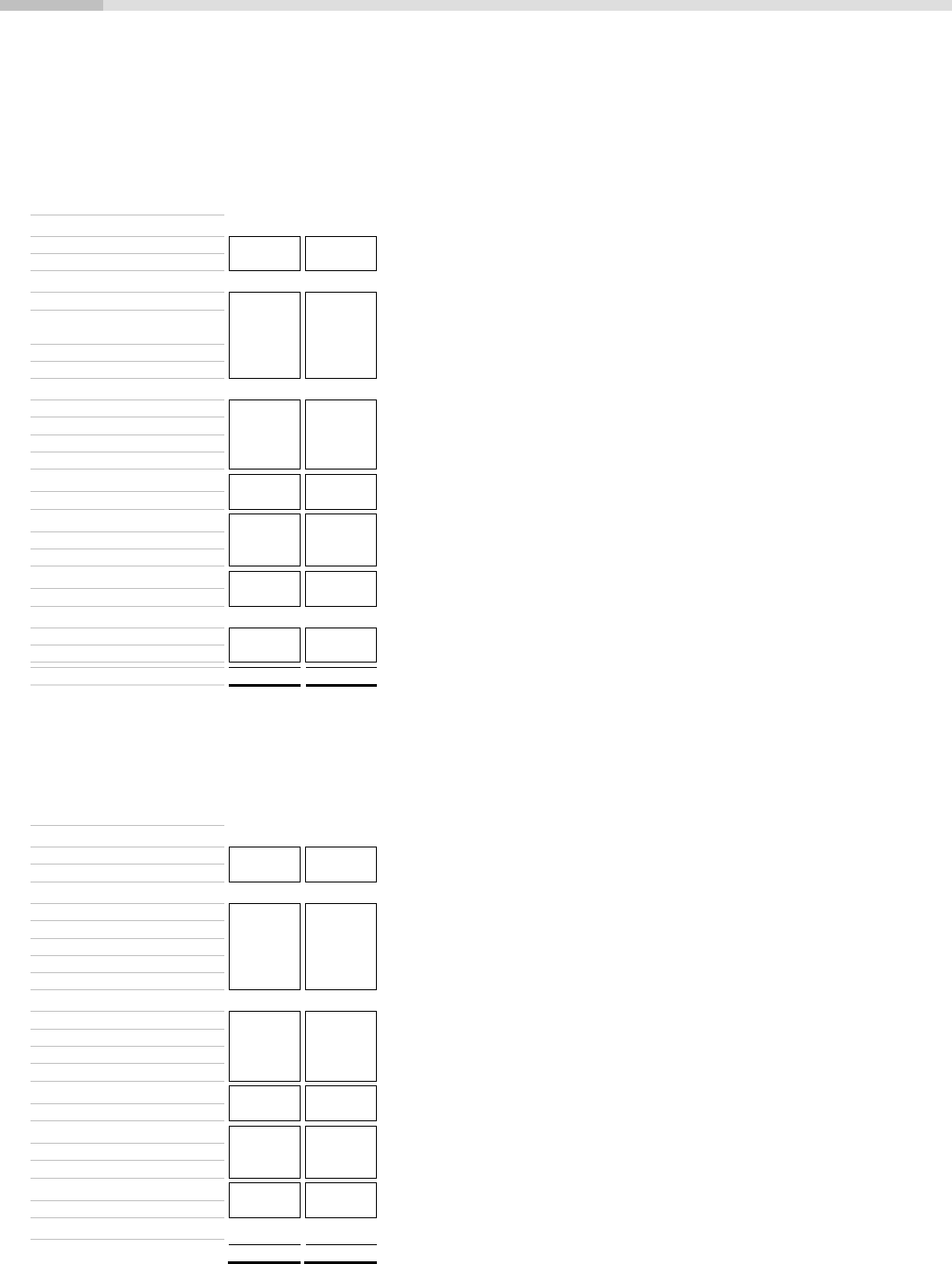

Key unobservable inputs to Level 3 financial instruments

The table below lists key unobservable inputs to level 3 financial instruments, and provides the range of those inputs as at

31 December 2014. A further description of the categories of key unobservable inputs is given below.

Fair value

Key

Full range

Core range

Assets

Liabilities

unobservable

of inputs

of inputs

£m

£m

Valuation technique

inputs

Lower

Higher

Lower

Higher

At 31 December 2014

Private equity including strategic

investments

691

28

See notes below

See notes below

n/a

n/a

n/a

n/a

Asset-backed securities

1,209

–

CLO/CDO1

600

–

Market proxy

Bid quotes

–

101

55

85

Other ABSs

609

–

Market proxy

Bid quotes

–

96

25

53

949

0

Structured notes

–

1,265

Equity-linked notes

–

601

Model – Option model

Equity volatility

10%

66%

16%

43%

Model – Option model

Equity correlation

38%

88%

44%

79%

Fund-linked notes

–

362

Model – Option model

Fund volatility

6%

8%

6%

8%

FX-linked notes

–

182

Model – Option model

FX volatility

3%

70%

3%

70%

Other

–

120

Derivatives

1,614

1,221

Interest rate derivatives:

– securitisation swaps

288

655

Model – DCF2

Prepayment rate

0%

50%

6%

18%

– long-dated swaptions

667

123

Model – Option model

IR volatility

8%

59%

17%

38%

– other

309

84

Foreign exchange derivatives:

– foreign exchange options

64

29

Model – Option model

FX volatility

0%

70%

7%

26%

Equity derivatives:

– long-dated single stock options

87

112

Model – Option model

Equity volatility

10%

66%

14%

38%

– other

132

188

Credit derivatives:

– other

67

30

Other portfolios

1,804

5

– structured certificates

1,001

5

Model – DCF2

Credit volatility

1%

3%

1%

3%

– other

803

–

5,318

2,519

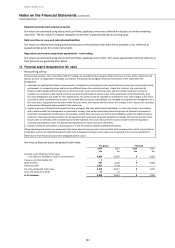

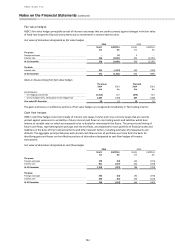

Fair value

Key

Full range

Core range

Assets

Liabilities

unobservable

of inputs

of inputs

£m

£m

Valuation technique

inputs

Lower

Higher

Lower

Higher

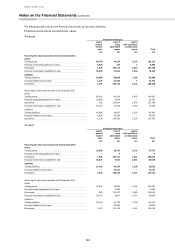

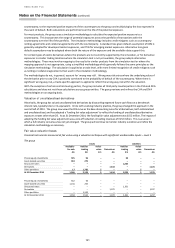

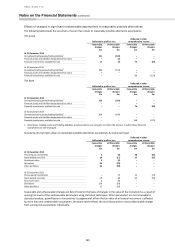

At 31 December 2013

Private equity including strategic

investments

698

-

See notes below

See notes below

n/a

n/a

n/a

n/a

Asset-backed securities

1,275

-

CLO/CDO1

601

-

Market proxy

Bid quotes

-

102

46

95

Other ABSs

674

-

-

99

30

82

Structured notes

-

1,361

Equity-linked notes

-

649

Model – Option model

Equity volatility

7%

67%

13%

39%

Model – Option model

Equity correlation

54%

54%

54%

54%

Fund-linked notes

-

311

Model – Option model

Fund volatility

18%

22%

19%

21%

FX-linked notes

-

229

Model – Option model

FX volatility

0%

28%

0%

28%

Other

-

172

Derivatives

1,072

1,297

Interest rate derivatives:

– securitisation swaps

166

681

Model – DCF2

Prepayment rate

0%

22%

2%

20%

– long-dated swaptions

384

111

Model – Option model

IR volatility

4%

78%

13%

40%

– other

99

77

Foreign exchange derivatives:

– Foreign exchange options

89

109

Model – Option model

FX volatility

0%

28%

5%

13%

Equity derivatives:

– long-dated single stock options

226

228

Model – Option model

Equity volatility

7%

67%

13%

39%

– other

14

50

Credit derivatives:

– other

94

41

Other portfolios

1,242

-

4,287

2,658

1 Collateralised loan obligation/collateralised debt obligation

2 Discounted cash flow