HSBC 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

73

• the amount of the current balance that can be

assessed as ‘stable’ under business-as-usual

conditions; and

• for managed rate balances the historic market

interest rate re-pricing behaviour observed; or

• for non-interest bearing balances the duration for

which the balance is expected to remain under

business-as-usual conditions. This assessment is often

driven by the re-investment tenors available to BSM

to neutralise the risk through the use of fixed rate

government bonds or interest rate derivatives, and

for derivatives the availability of cash flow hedging

capacity.

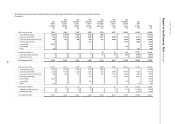

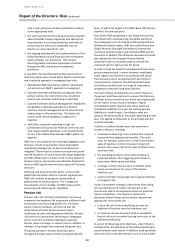

Balance sheet management

Effective governance across BSM is supported by the

dual reporting lines it has to the CEO of GB&M and to

the Group Treasurer. In each operating entity, BSM is

responsible for managing liquidity and funding under the

supervision of the local ALCO. It also manages the non-

trading interest rate positions transferred to it within a

Global Markets limit structure.

In executing the management of the liquidity risk on

behalf of ALCO, and managing the non-trading interest

rate positions transferred to it, BSM invests in highly-

rated liquid assets in line with the Group’s liquid asset

policy. The majority of the liquidity is invested in central

bank deposits and government, supranational and

agency securities with most of the remainder held in

short-term interbank and central bank loans.

Withdrawable central bank deposits are accounted for as

cash balances. Interbank loans, statutory central bank

reserves and loans to central banks are accounted for as

loans and advances to banks. BSM’s holdings of

securities are accounted for as available-for-sale assets.

Statutory central bank reserves are not recognised as

liquid assets. The statutory reserves that would be

released in line with the Group’s stressed customer

deposit outflow assumptions are reflected as stressed

inflows.

BSM is permitted to use derivatives as part of

its mandate to manage interest rate risk. Derivative

activity is predominantly through the use of vanilla

interest rate swaps which are part of cash flow hedging

and fair value hedging relationships.

Credit risk in BSM is predominantly limited to short-term

bank exposure created by interbank lending, exposure to

central banks and high quality sovereigns, supranationals

or agencies which constitute the majority of BSM’s

liquidity portfolio. BSM does not manage the structural

credit risk of any Group entity balance sheets.

BSM is permitted to enter into single name and index

credit derivatives activity, but it does so to manage credit

risk on the exposure specific to its securities portfolio in

limited circumstances only. The risk limits are extremely

limited and closely monitored. At 31 December 2014 and

31 December 2013 BSM had no open credit derivative

index risk.

VaR is calculated on both trading and non-trading

positions held in BSM. It is calculated by applying the

same methodology used for the Markets business and

utilised as a tool for market risk control purposes.BSM

holds trading portfolio instruments in only very limited

circumstances. Positions and the associated VaR were

not significant during 2014 and 2013.

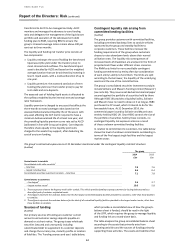

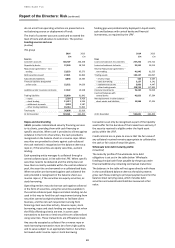

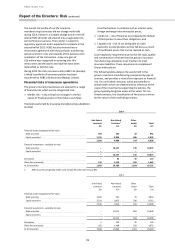

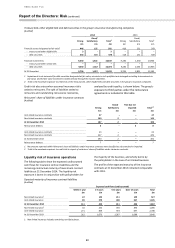

Sensitivity of net interest income

(Unaudited)

A principal element of the group’s management of

market risk in non-trading portfolios is monitoring the

sensitivity of projected net interest income under varying

interest rate scenarios (simulation modelling). The group

applies a combination of scenarios and assumptions

relevant to their local businesses, and standard scenarios

which are required throughout HSBC. The latter are

consolidated to illustrate the combined pro forma effect

on the consolidated net interest income.

Projected net interest income sensitivity figures

represent the effect of the pro forma movements in net

interest income based on the projected yield curve

scenarios and the current interest rate risk profile. This

effect, however, does not incorporate actions which

would probably be taken by BSM or in the business units

to mitigate the effect of interest rate risk. In reality, BSM

seeks actively to change the interest rate risk profile to

minimise losses and optimise net revenues. The net

interest income sensitivity calculations assume that

interest rates of all maturities move by the same amount

in the ‘up-shock’ scenario. Rates are not assumed to

become negative in the ‘down-shock’ scenario which

may, in certain currencies, effectively result in non-

parallel shock. In addition, the net interest income

sensitivity calculations take account of the effect on net

interest income of anticipated differences in changes

between interbank interest rates and interest rates over

which the entity has discretion in terms of the timing and

extent of rate changes.

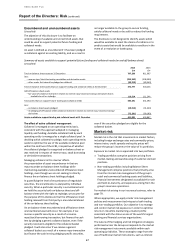

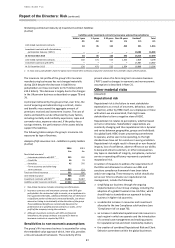

Defined benefit pension scheme

(Audited)

Market risk also arises within the group’s defined benefit

pension schemes to the extent that the obligations of

the schemes are not fully matched by assets with

determinable cash flows. Pension scheme obligations

fluctuate with changes in long-term interest rates,

inflation, salary increases and the longevity of scheme

members. Pension scheme assets will include equities

and debt securities, the cash flows of which change as

equity prices and interest rates vary. There are risks that

market movements in equity prices and interest rates

could result in assets which are insufficient over time to

cover the level of projected obligations and these, in

turn, could increase with a rise in inflation and members

living longer. Management, together with the trustees

who act on behalf of the pension scheme beneficiaries,

assess these risks using reports prepared by independent

external actuaries and takes action and, where

appropriate, adjust investment strategies and

contribution levels accordingly.