HSBC 2014 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

159

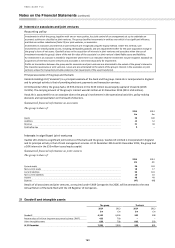

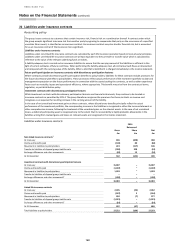

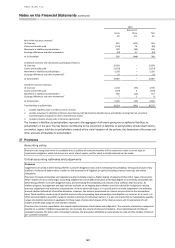

19 Prepayments, accrued income and other assets

Accounting policy

Assets held for sale

Assets and liabilities of disposal groups and non-current assets are classified as held for sale (‘HFS’) when their carrying amounts will

be recovered principally through sale rather than through continuing use. HFS assets are generally measured at the lower of their

carrying amount and fair value less cost to sell, except for those assets and liabilities that are not within the scope of the measurement

requirements of IFRS 1 ‘Non-current Assets Held for Sale and Discontinued Operations’.

Immediately before the initial classification as held for sale, the carrying amounts of the relevant assets and liabilities are measured in

accordance with applicable IFRSs. On subsequent remeasurement of a disposal group, the carrying amounts of any assets and

liabilities that are not within the scope of the measurement requirements of IFRS 1, but are included in a disposal group classified as

held for sale, shall be remeasured under applicable IFRSs before the fair value less costs to sell of the disposal group is determined.

Property, plant and equipment

Land and buildings are stated at historical cost, or fair value at the date of transition to IFRSs (‘deemed cost’), less impairment losses

and depreciation over their estimated useful lives, as follows:

• freehold land is not depreciated;

• freehold buildings are depreciated at the greater of 1% per annum on a straight-line basis or over their remaining useful lives; and

• leasehold land and buildings are depreciated over the shorter of their unexpired terms of the leases or their remaining useful lives.

Equipment, fixtures and fittings (including equipment on operating leases where the group is the lessor) are stated at cost less

impairment losses and depreciation over their useful lives, which are generally between 1 year and 11 years.

Property, plant and equipment is subject to an impairment review if their carrying amount may not be recoverable.

HSBC holds certain properties as investments to earn rentals or for capital appreciation, or both, and those investment properties are

included on balance sheet at fair value.

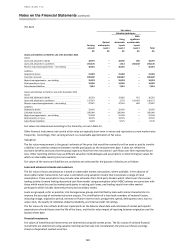

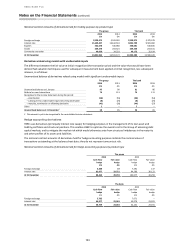

Prepayments, accrued income and other assets

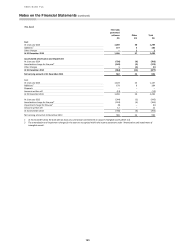

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Prepayments and accrued income

2,353

2,584

1,184

1,185

Assets held for sale

4,378

33

15

20

Bullion

2,736

928

2,733

880

Reinsurers’share of liabilities under insurance contracts

189

492

–

–

Endorsements and acceptances

591

703

364

343

Employee benefit assets

3,059

1,234

3,059

1,234

Other accounts

5,399

4,465

4,741

3,315

Property, plant and equipment

1,614

2,004

812

1,224

At 31 December

20,319

12,443

12,908

8,201

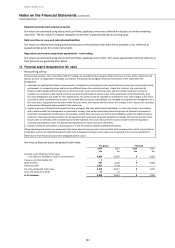

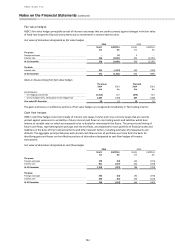

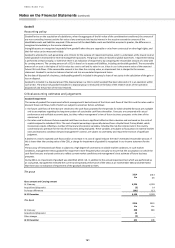

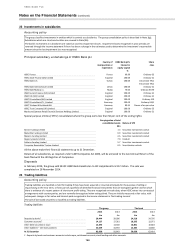

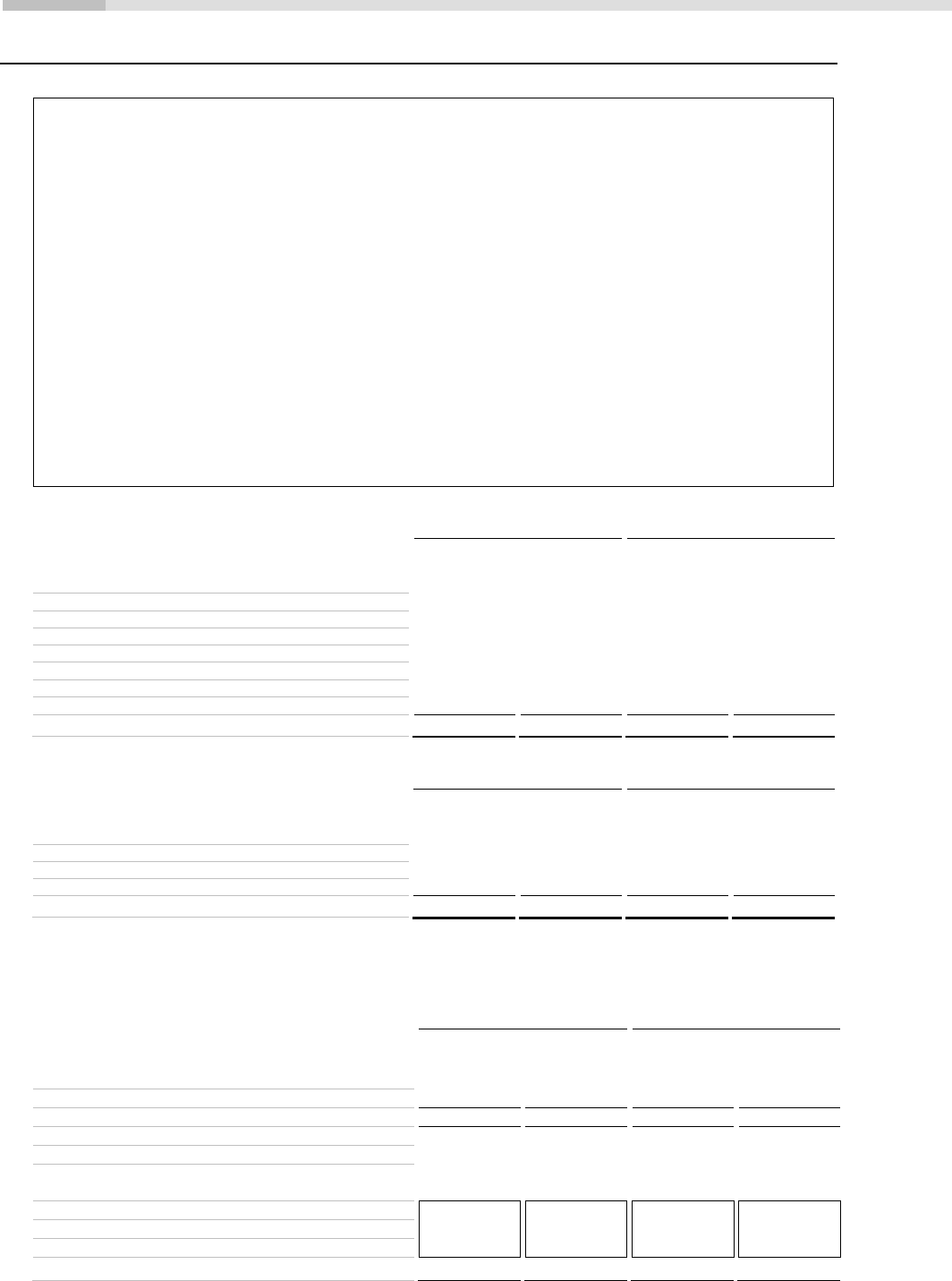

Assets held for sale

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Non-current assets held for sale:

- property, plant and equipment

25

32

15

20

- Assets of disposal groups held for sale

4,353

–

–

–

- other

–

1

–

–

Total assets classified as held for sale

4,378

33

15

20

Also included within property, plant and equipment classified as held for sale is repossessed property that had been

pledged as collateral by customers. These repossessed assets are expected to be disposed of within 12 months of

acquisition.

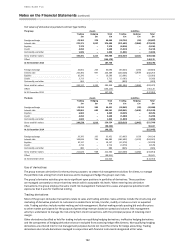

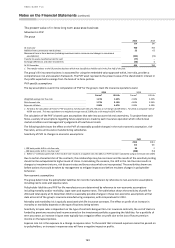

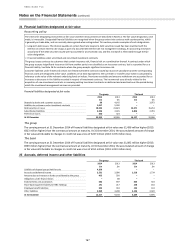

Property, plant and equipment – selected information

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Cost or fair value

4,400

4,937

2,930

3,452

Accumulated depreciation and impairment

(2,786)

(2,933)

(2,118)

(2,228)

Net carrying amount at 31 December

1,614

2,004

812

1,224

Additions - cost

411

322

260

227

Disposals - cost

(148)

(189)

(100)

(161)

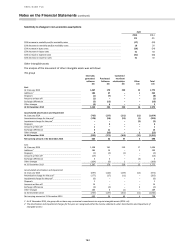

Property plant and equipment includes

Land and buildings

913

1,044

390

588

Freehold

661

794

132

339

Long leasehold

101

93

105

95

Short leasehold

151

157

153

154

Investment properties1

344

271

–

–

1 Investment properties are valued on a market value basis as at 31 December each year by independent professional valuers who have recent

experience in the location and type of property.