HSBC 2014 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

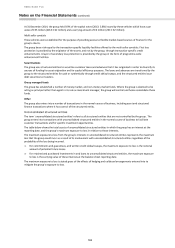

HSBC BANK PLC

Notes on the Financial Statements (continued)

174

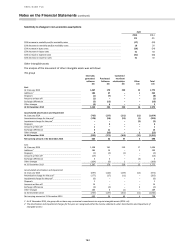

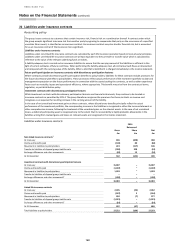

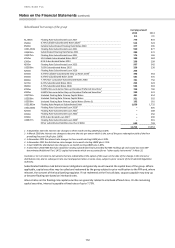

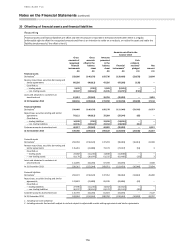

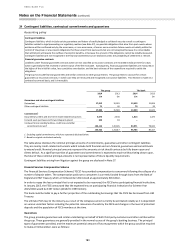

The bank

On

demand

Due within

3 months

Due

between

3 and 12

months

Due

between

1 and 5

years

Due after

5 years

Total

£m

£m

£m

£m

£m

£m

At 31 December 2014

Deposits by banks

20,529

7,661

897

386

3,155

32,628

Customer accounts

254,978

18,258

7,850

2,353

1

283,440

Repurchase Agreements

–

15,667

2,657

–

–

18,324

Trading liabilities

59,039

–

–

–

–

59,039

Financial liabilities designated at fair value

–

1,242

3,178

7,660

5,092

17,172

Derivatives

160,185

183

683

1,602

268

162,921

Debt securities in issue

–

4,195

7,461

2,768

842

15,266

Subordinated liabilities

–

44

25

1,562

7,149

8,780

Other financial liabilities

3,970

576

313

6

4

4,869

498,701

47,826

23,064

16,337

16,511

602,439

Loan commitments

96,504

112

118

46

5

96,785

Financial guarantee contracts

473

2,575

3,531

2,130

2,259

10,968

At 31 December 2014

595,678

50,513

26,713

18,513

18,775

710,192

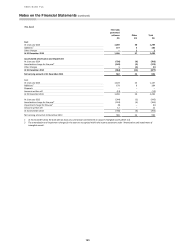

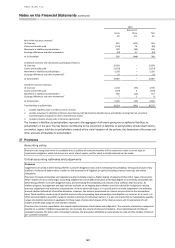

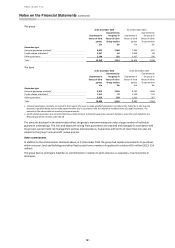

At 31 December 2013

Deposits by banks

17,962

5,948

833

544

4,449

29,736

Customer accounts

255,257

19,124

5,844

4,332

1

284,558

Repurchase agreements

7,852

42,181

1,193

–

–

51,226

Trading liabilities

62,414

–

–

–

–

62,414

Financial liabilities designated at fair value

–

493

1,460

12,761

10,100

24,814

Derivatives

113,683

203

912

1,717

571

117,086

Debt securities in issue

–

4,391

10,543

4,244

713

19,891

Subordinated liabilities

–

44

23

1,108

9,668

10,843

Other financial liabilities

827

4,149

148

–

–

5,124

457,995

76,533

20,956

24,706

25,502

605,692

Loan commitments

79,605

111

259

409

33

80,417

Financial guarantee contracts

462

1,637

3,307

1,907

2,053

9,366

At 31 December 2013

538,062

78,281

24,522

27,022

27,588

695,475

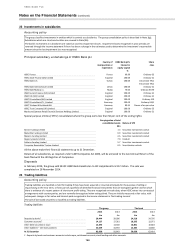

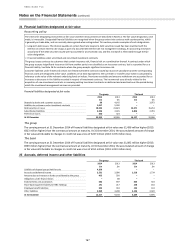

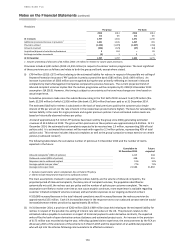

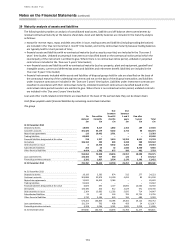

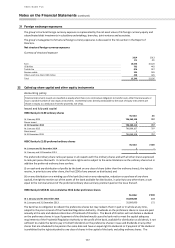

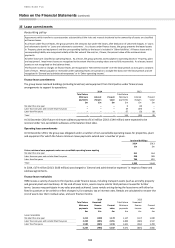

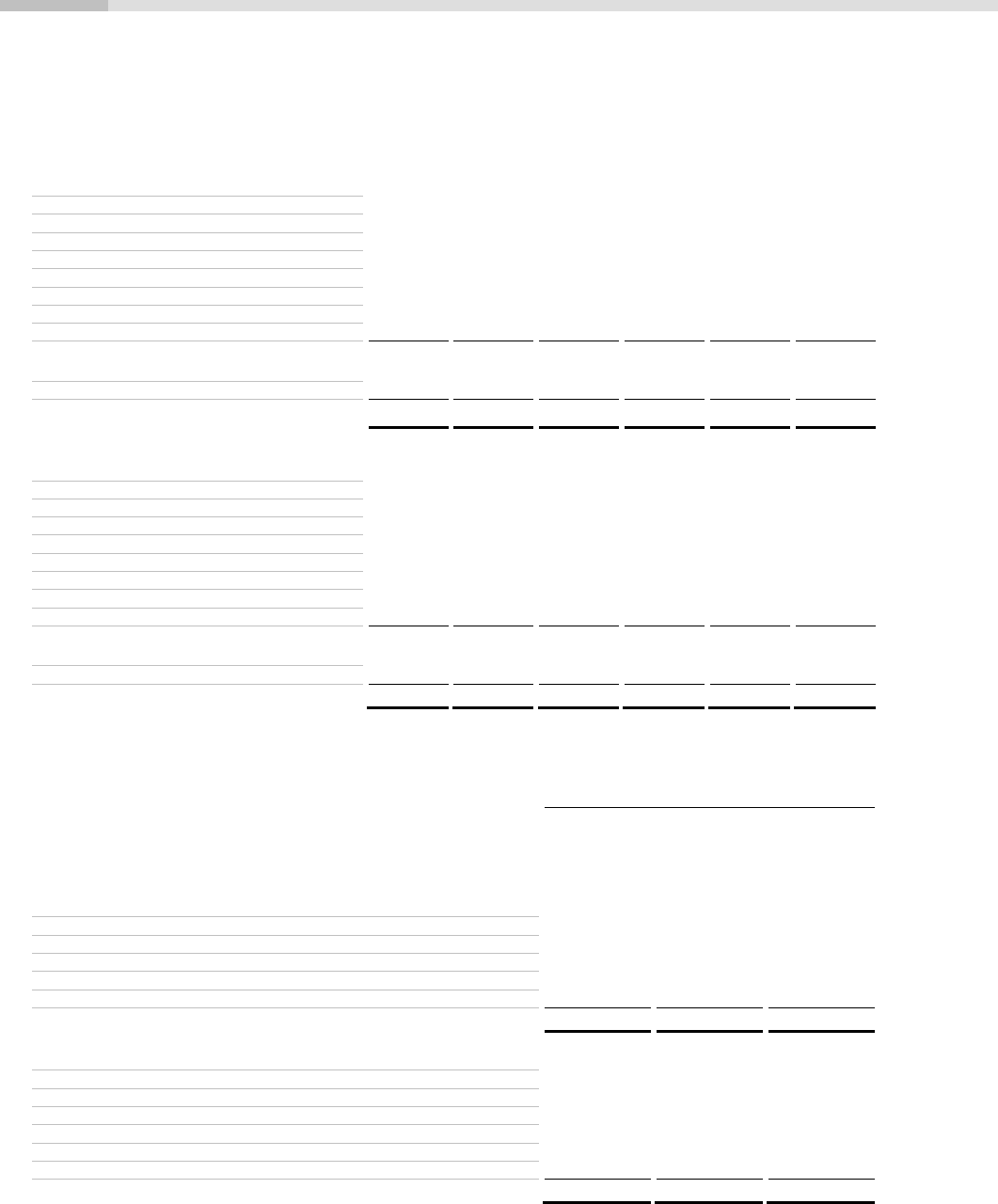

Maturity analysis of assets and liabilities

The group

At 31 December 2014

Due within

one year

Due after more

than

one year

Total

£m

£m

£m

Assets

Financial assets designated at fair value

202

6,697

6,899

Loans and advances to banks

21,359

3,903

25,262

Loans and advances to customers

98,613

158,639

257,252

Reverse Repurchase agreements- non trading

41,669

276

41,945

Financial investments

9,181

67,013

76,194

Other financial assets

5,772

72

5,844

At 31 December 2014

176,796

236,600

413,396

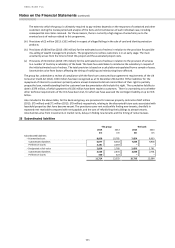

Liabilities

Deposits by banks

26,191

1,399

27,590

Customer accounts

343,724

2,783

346,507

Reverse repurchase agreements – non trading

23,353

–

23,353

Financial liabilities designated at fair value

3,449

19,103

22,552

Debt securities in issue

22,106

5,815

27,921

Other financial liabilities

8,836

370

9,206

Subordinated liabilities

4

8,854

8,858

At 31 December 2014

427,663

38,324

465,987