HSBC 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

134

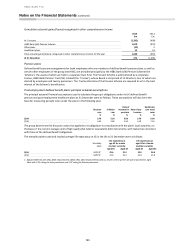

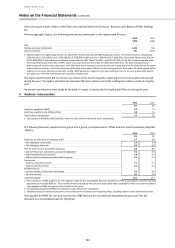

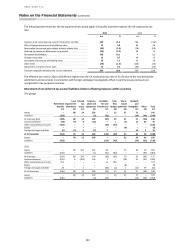

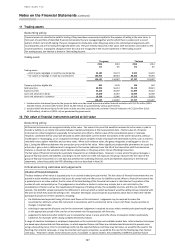

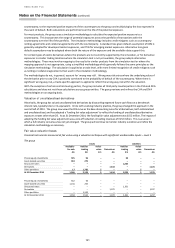

The bank

Retirement

benefits

Loan

impairment

allowances

Unused tax

losses

Property,

plant and

equipment

Share-

based

payments

Goodwill

and

intangibles

Other

Total

£m

£m

£m

£m

£m

£m

£m

£m

Assets

–

11

–

176

42

87

17

333

Liabilities

(246)

–

–

–

–

–

(1)

(247)

At 1 January

(246)

11

–

176

42

87

16

86

Income statement

(30)

(11)

18

(13)

(6)

11

(20)

(51)

Other comprehensive income

(338)

–

–

–

–

–

(27)

(365)

Equity

–

–

–

–

(9)

–

–

(9)

Foreign exchange and other

–

–

–

–

–

–

(1)

(1)

At 31 December

(614)

-

18

163

27

98

(32)

(340)

Assets

–

–

18

163

27

98

–

306

Liabilities

(614)

–

–

–

–

–

(32)

(646)

2013

Assets

–

18

280

105

62

38

23

526

Liabilities

(274)

–

–

–

–

–

(50)

(324)

At 1 January

(274)

18

280

105

62

38

(27)

202

Income statement

(220)

(7)

(285)

71

(11)

48

(7)

(411)

Other comprehensive income:

250

–

–

–

–

–

52

302

Equity

–

–

–

–

(9)

–

–

(9)

Foreign exchange and other

(2)

–

5

–

–

1

(2)

2

At 31 December

(246)

11

–

176

42

87

16

86

Assets

–

11

–

176

42

87

17

333

Liabilities

(246)

–

–

–

–

–

(1)

(247)

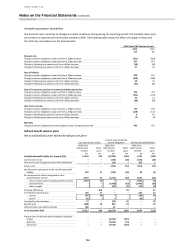

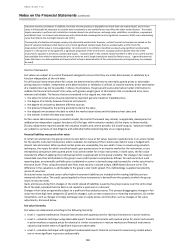

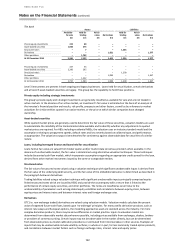

After netting off balances within countries, the balances as disclosed in the accounts are as follows:

The Group

The Bank

2014

2013

2014

2013

£m

£m

£m

£m

Deferred tax assets

176

222

5

88

Deferred tax liabilities

(364)

(24)

(345)

(2)

(188)

198

(340)

86

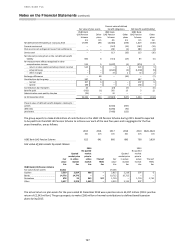

For the group, a deferred tax asset of £298 million (2013: £246 million) has not been recognised on the balance sheet for

temporary timing differences in respect of losses and unused foreign tax credits where the recoverability of potential

benefits is not considered likely.

For the bank, a deferred tax asset of £43 million (2013: £nil) has not been recognised on the balance sheet.

Deferred tax is not recognised in respect of the group’s investments in subsidiaries and branches, where remittance is or

other realisation is not probable, and for associates and interests in joint ventures where it has been determined that no

additional tax will arise. No amount is disclosed for the unrecognised deferred tax for the 2014 and 2013 temporary

differences associated with such investments as it is impracticable to determine the amount of income taxes that would

be payable when any temporary differences reverse.

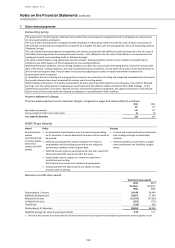

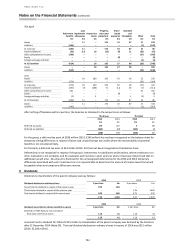

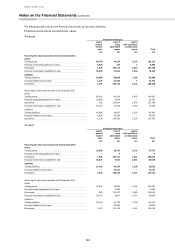

9 Dividends

Dividends to shareholders of the parent company were as follows:

2014

2013

Dividends declared on ordinary shares

£ per share

£m

£ per share

£m

Second interim dividend in respect of the previous year

0.79

630

–

–

Third interim dividend in respect of the previous year

–

–

1.76

1,400

First interim dividend in respect of the current year

0.75

600

0.71

570

1.54

1,230

2.47

1,970

2014

2013

Dividends on preference shares classified as equity

£ per share

£m

£ per share

£m

Dividend on HSBC Bank plc non

-cumulative

third dollar preference shares

1.16

41

1.16

41

1.16

41

1.16

41

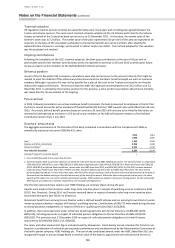

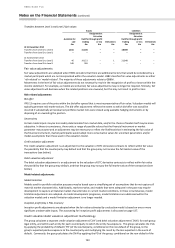

A second interim dividend for 2014 of £315 million to shareholders of the parent company was declared by the Directors

after 31 December 2014 (Note 39). The total dividend declared on ordinary shares in respect of 2014 was £915 million

(2013: £1,200 million).