HSBC 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

132

8 Tax

Accounting policy

Income tax comprises current tax and deferred tax. Income tax is recognised in the income statement except to the extent that it

relates to items recognised in other comprehensive income or directly in equity, in which case it is recognised in the same statement in

which the related item appears.

Current tax is the tax expected to be payable on the taxable profit for the year, calculated using tax rates enacted or substantively

enacted by the balance sheet date, and any adjustment to tax payable in respect of previous years. Current tax assets and liabilities are

offset when the group intends to settle on a net basis and the legal right to offset exists.

Deferred tax is recognised on temporary differences between the carrying amounts of assets and liabilities in the balance sheet and

the amounts attributed to such assets and liabilities for tax purposes. Deferred tax liabilities are generally recognised for all taxable

temporary differences and deferred tax assets are recognised to the extent that it is probable that future taxable profits will be

available against which deductible temporary differences can be utilised.

Deferred tax is calculated using the tax rates expected to apply in the periods in which the assets will be realised or the liabilities

settled based on tax rates and laws enacted, or substantively enacted, by the balance sheet date. Deferred tax assets and liabilities are

offset when they arise in the same tax reporting group and relate to income taxes levied by the same taxation authority, and when the

group has a legal right to offset.

Deferred tax relating to actuarial gains and losses on post-employment benefits is recognised in other comprehensive income.

Deferred tax relating to share-based payment transactions is recognised directly in equity to the extent that the amount of the

estimated future tax deduction exceeds the amount of the related cumulative remuneration expense. Deferred tax relating to fair

value remeasurements of available-for-sale investments and cash flow hedging instruments is credited or charged directly to other

comprehensive income and is subsequently recognised in the income statement when the deferred fair value gain or loss is recognised

in the income statement.

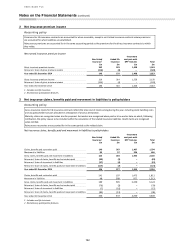

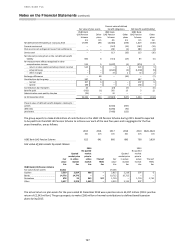

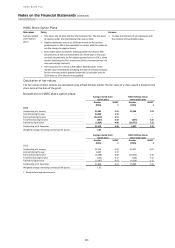

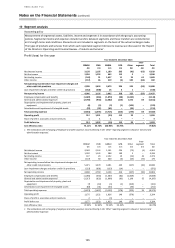

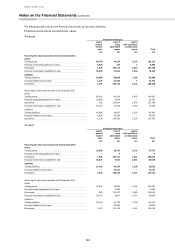

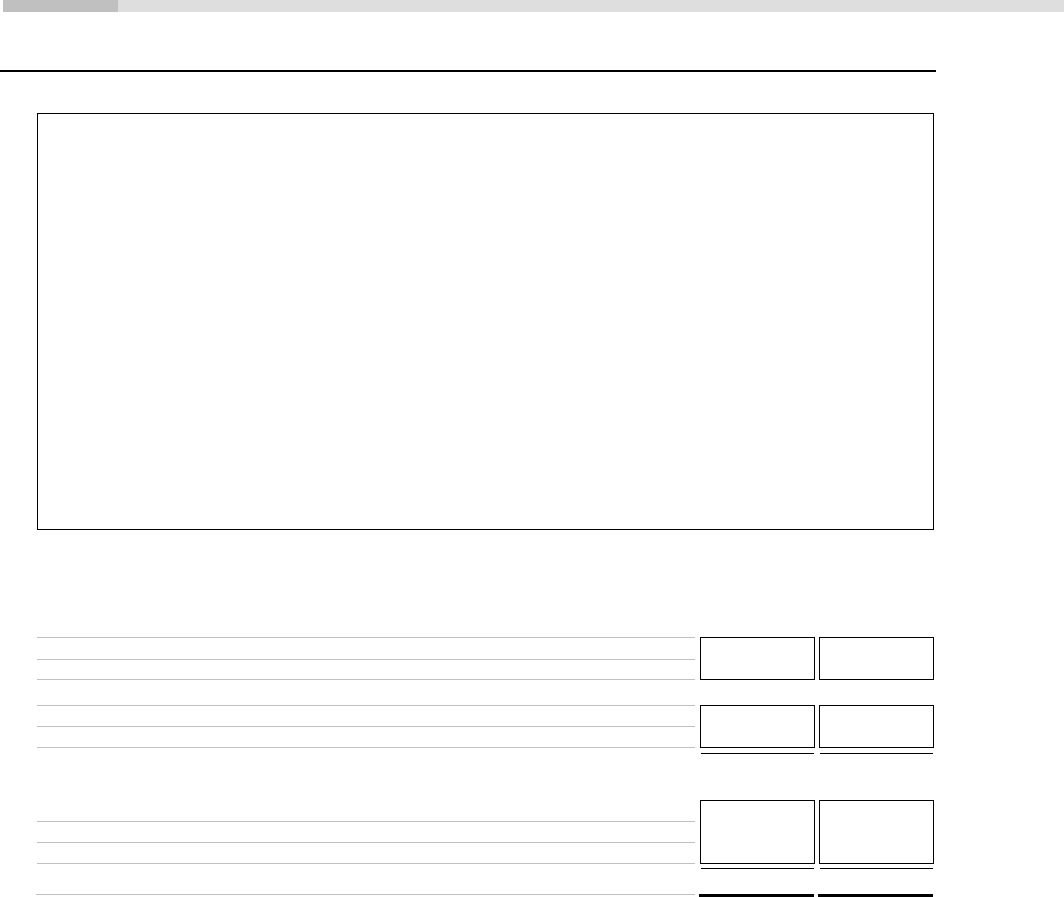

2014

2013

£m

£m

Current tax

UK corporation tax

249

64

– for this year

225

176

– adjustment in respect of prior years

24

(112)

Overseas tax

349

360

– for this year

344

361

– adjustment in respect of prior years

5

(1)

598

424

Deferred tax

(34)

330

origination and reversal of temporary differences

(2)

254

– effect of changes in the tax rates

(13)

47

– adjustment in respect of prior years

(19)

29

Total tax expense for the year ended 31 December

564

754

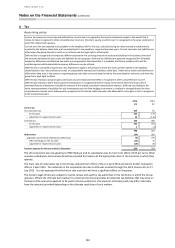

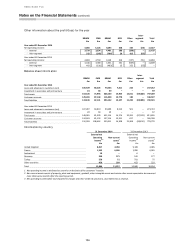

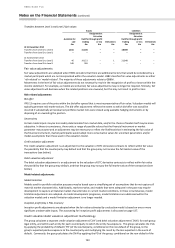

The UK corporation tax rate applying to HSBC Bank plc and its subsidiaries was 21.5 per cent (2013: 23.25 per cent). Other

overseas subsidiaries and overseas branches provided for taxation at the appropriate rates in the countries in which they

operate.

The main rate of corporation tax in the UK was reduced from 23% to 21% on 1 April 2014 and will be further reduced to

20% on 1 April 2015. The reduction in the corporation tax rate to 20% was enacted through the 2013 Finance Act on 17

July 2013. It is not expected that the future rate reduction will have a significant effect on the group.

The Group’s legal entities are subject to routine review and audit by tax authorities in the territories in which the Group

operates. Where the ultimate tax treatment is uncertain the Group provides for potential tax liabilities that may arise on

the basis of the amounts expected to be paid to the tax authorities. The amounts ultimately paid may differ materially

from the amounts provided depending on the ultimate resolution of such matters.