HSBC 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

145

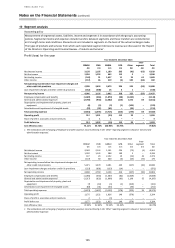

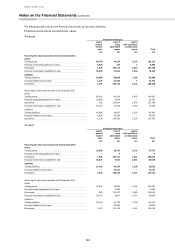

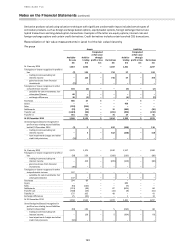

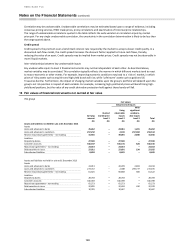

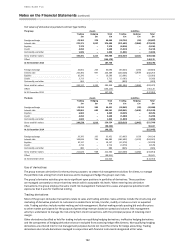

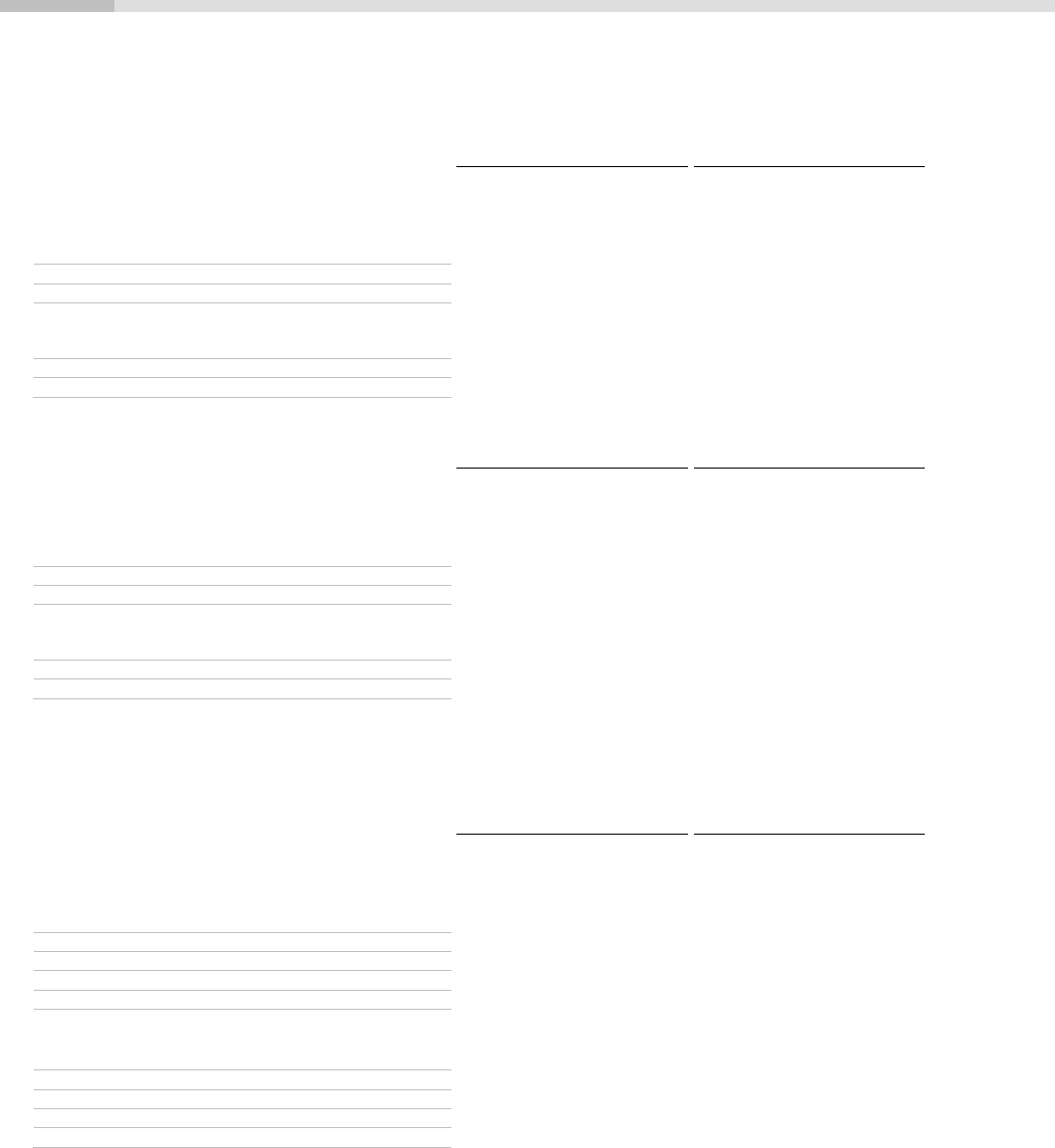

Effects of changes in significant unobservable assumptions to reasonably possible alternatives

The following table shows the sensitivity of Level 3 fair values to reasonably possible alternative assumptions:

The group

Reflected in profit or loss

Reflected in other

comprehensive income

Favourable

changes

Unfavourable

changes

Favourable

changes

Unfavourable

changes

£m

£m

£m

£m

At 31 December 2014

Derivatives/trading assets/trading liabilities1

161

(140)

–

–

Financial assets and liabilities designated at fair value

–

(1)

–

–

Financial investments: available-for-sale

11

(7)

73

(95)

At 31 December 2013

Derivatives/trading assets/trading liabilities1

180

(133)

–

–

Financial assets and liabilities designated at fair value

–

–

–

–

Financial investments: available-for-sale

–

–

89

(133)

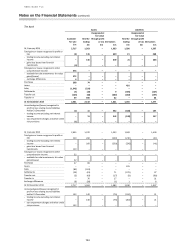

The bank

Reflected in profit or loss

Reflected in other

comprehensive income

Favourable

changes

Unfavourable

changes

Favourable

changes

Unfavourable

changes

£m

£m

£m

£m

At 31 December 2014

Derivatives/trading assets/trading liabilities1

162

(150)

–

–

Financial assets and liabilities designated at fair value

–

–

–

–

Financial investments: available-for-sale

–

–

76

(90)

At 31 December 2013

Derivatives/trading assets/trading liabilities1

209

(146)

–

–

Financial assets and liabilities designated at fair value

–

–

–

–

Financial investments: available-for-sale

–

–

238

(276)

1 Derivatives, trading assets and trading liabilities are presented as one category to reflect the manner in which these financial

instruments are risk-managed.

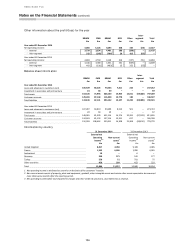

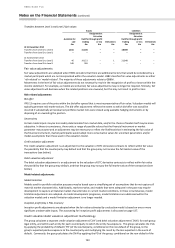

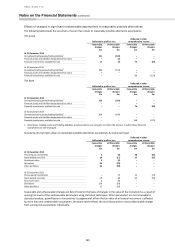

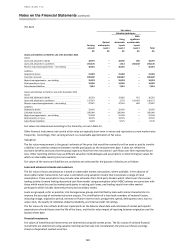

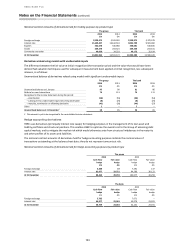

Sensitivity of Level 3 fair values to reasonably possible alternative assumptions by instrument type

Reflected in profit or loss

Reflected in other

comprehensive income

Favourable

changes

Unfavourable

changes

Favourable

changes

Unfavourable

changes

£m

£m

£m

£m

At 31 December 2014

Private equity investments

6

(6)

38

(60)

Asset-backed securities

28

(11)

35

(35)

Structured notes

6

(6)

–

–

Derivatives

69

(75)

–

–

Other portfolios

63

(50)

–

–

At 31 December 2013

Private equity investments

–

(7)

24

(74)

Asset-backed securities

28

(8)

65

(59)

Structured notes

6

(6)

–

–

Derivatives

129

(93)

–

–

Other portfolios

17

(19)

–

–

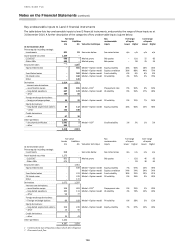

Favourable and unfavourable changes are determined on the basis of changes in the value of the instrument as a result of

varying the levels of the unobservable parameters using statistical techniques. When parameters are not amenable to

statistical analysis, quantification of uncertainty is judgemental. When the fair value of a financial instrument is affected

by more than one unobservable assumption, the above table reflects the most favourable or most unfavourable change

from varying the assumptions individually.