HSBC 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

58

Securitisation exposures and other

structured products

(Audited)

This section contains information about our exposure to

asset-backed securities (‘ABSs’), some of which are held

through consolidated structured entities and

summarised in the table below.

Also included within this section is information on the

Global Banking and Markets legacy credit activities in

respect of Solitaire and the securities investment

conduits (‘SICs’).

For further information on structured entities please

refer to note 36.

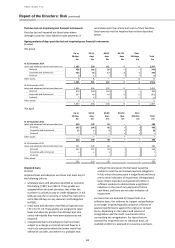

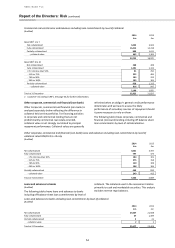

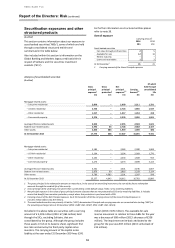

Overall exposure

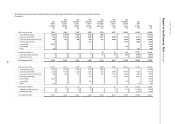

Carrying amount1

2014

2013

£bn

£bn

Asset-backed securities

Fair value through profit and loss

2

5

Available for sale

12

14

Held to maturity

–

–

Loans and receivables

1

2

At 31 December1

15

21

1 Carrying amount of the Gross Principal exposure

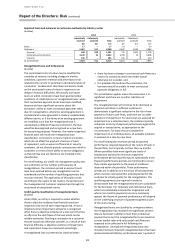

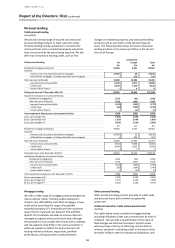

Analysis of asset-backed securities

(Audited)

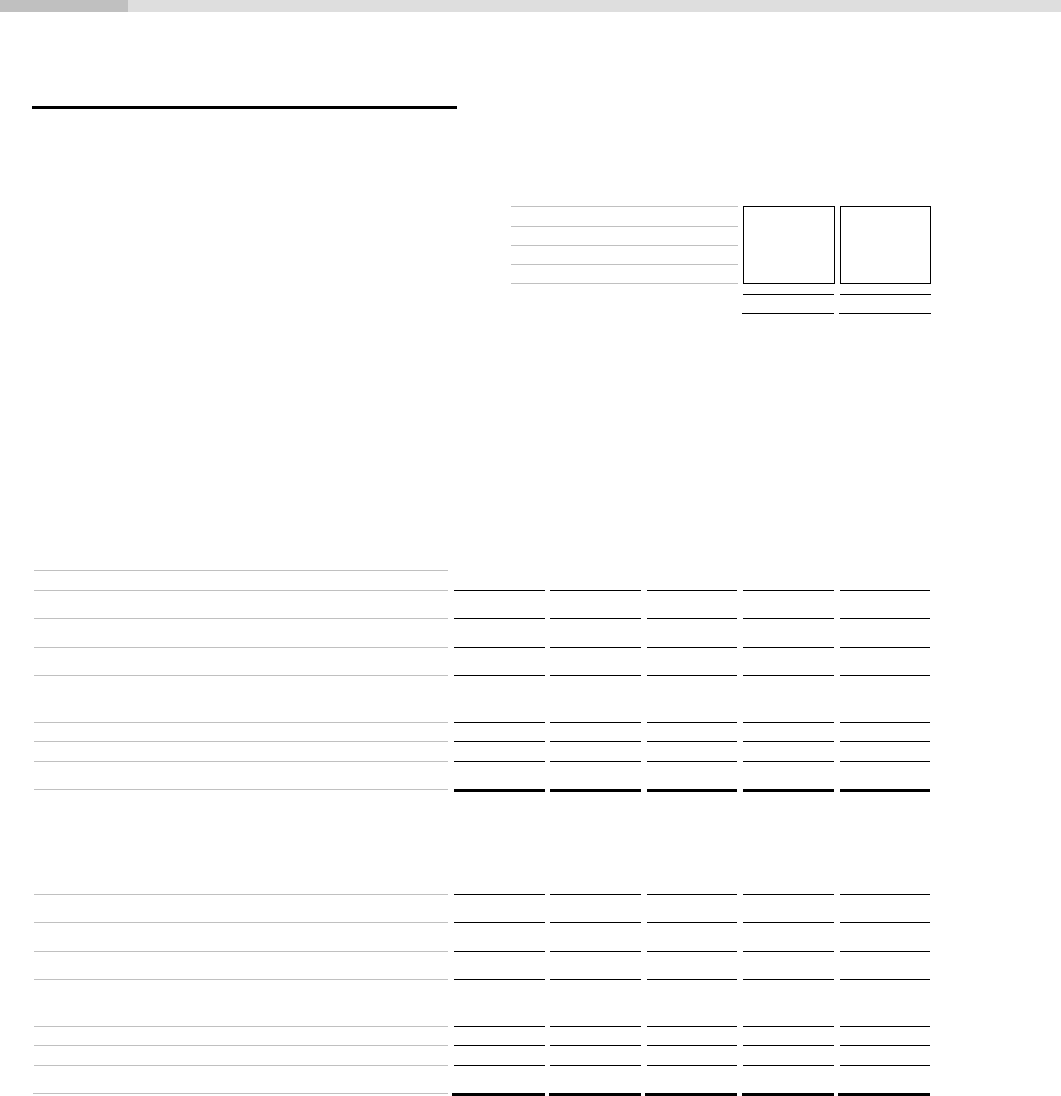

Gross

principal

exposure

1

Gross

principal

protection

2

Net

principal

exposure

3,5

Carrying

Amount

4,5

Of which

held through

consolidated

SEs

£m

£m

£m

£m

£m

Mortgage-related assets:

– Sub-prime residential

2,609

–

2,609

2,211

1,331

– US Alt-A residential

2,723

–

2,723

1,965

1,547

– Other residential

1,517

–

1,517

1,454

418

– Commercial property

3,276

–

3,276

3,050

1,831

Leveraged finance-related assets:

2,555

–

2,555

2,503

1,621

Student loan-related assets:

2,792

64

2,728

2,382

2,107

Other assets:

2,303

384

1,919

1,490

486

At 31 December 2014

17,775

448

17,327

15,055

9,341

Mortgage-related assets:

– Sub-prime residential

2,583

–

2,583

2,080

1,683

– US Alt-A residential

3,204

–

3,204

2,083

1,770

– Other residential

2,234

–

2,234

1,608

915

– Commercial property

4,273

–

4,273

3,899

3,113

Leveraged finance-related assets:

3,301

–

3,301

3,196

2,607

Student loan-related assets:

2,876

60

2,816

2,329

2,114

Other assets:

6,786

4,585

2,201

1,587

598

At 31 December 2013

25,257

4,645

20,612

16,782

12,800

1 The gross principal is the redemption amount on maturity or, in the case of an amortising instrument, the sum of the future redemption

amounts through the residual life of the security.

2 Gross principal of the underlying instrument that is protected by credit default swaps (‘CDSs’) or by matching liabilities.

3 Net principal exposure is the value of gross principal amount of assets that are not protected by CDSs or by matching liabilities. It includes

assets that benefit from monoline protection, except where this protection is purchased with a CDS.

4 Carrying amount of the Net Principal exposure. As at 31 December 2014 the carrying amount of the Gross Principal Exposure is

£ 15,471 million (2013: £21,367 million).

5 The asset backed securities are primarily US dollar (‘USD’) denominated. Principal and carrying amounts are converted into sterling (‘GBP’) at

the prevailing exchange rates at 31 December (2014: 1GBP: USD 1.5587; 2013: 1GBP: USD 1.6531).

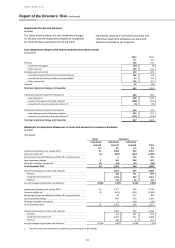

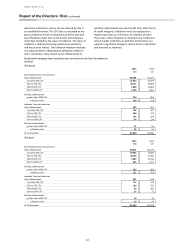

Included in the above table are securities with a carrying

amount of £ 4,205 million (2013: £7,364 million) held

through the SICs, excluding Solitaire, that are

consolidated by the group. Although the group includes

these assets in full on its balance sheet, significant first

loss risks are borne by the third party capital notes

investors. The carrying amount of the capital notes

liability at the year ended 31 December 2014 was £241

million (2013: £276 million). The available-for-sale

reserve movement in relation to these ABSs for the year

was a decrease of £68 million (2013: decrease of £358

million). The impairment write-back attributed to the

group for the year was £67 million (2013: write-back of

£13 million).