HSBC 2014 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

167

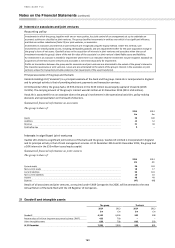

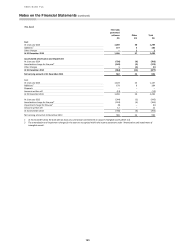

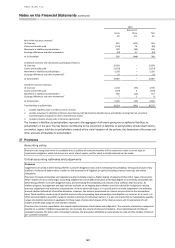

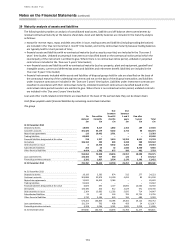

24 Financial liabilities designated at fair value

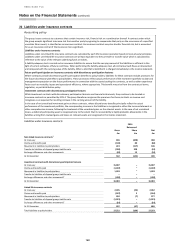

Accounting policy

The criteria for designating instruments at fair value and their measurement are described in Note 14. The fair value designation, once

made, is irrevocable. Designated financial liabilities are recognised when the group enters into contracts with counterparties, which

is generally on trade date, and are normally derecognised when extinguished. This section provides examples of such designations:

• Long-term debt issues. The interest payable on certain fixed rate long-term debt securities issued has been matched with the

interest on certain interest rate swaps as part of a documented interest rate risk management strategy. An accounting mismatch

would arise if the debt securities issued were accounted for at amortised cost, and this mismatch is eliminated through the fair

value designation.

• Financial liabilities under unit-linked and non-linked investment contracts.

The group issues contracts to customers that contain insurance risk, financial risk or a combination thereof. A contract under which

the group accepts insignificant insurance risk from another party is not classified as an insurance contract, but is accounted for as a

financial liability. See Note 26 for contracts where the group accepts significant insurance risk.

Customer liabilities under linked and certain non-linked investment contracts issued by insurance subsidiaries and the corresponding

financial assets are designated at fair value. Liabilities are at least equivalent to the surrender or transfer value which is calculated by

reference to the value of the relevant underlying funds or indices. Premiums receivable and amounts withdrawn are accounted for as

increases or decreases in the liability recorded in respect of investment contracts. The incremental costs directly related to the

acquisition of new investment contracts or renewing existing investment contracts are deferred and amortised over the period during

which the investment management services are provided.

Financial liabilities designated at fair value

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Deposits by banks and customer accounts

86

4,145

–

3,972

Liabilities to customers under investment contracts

1,017

5,300

–

–

Debt securities in issue

18,593

21,823

13,271

15,253

Subordinated liabilities

2,526

2,445

2,856

2,781

Preference shares

330

323

–

–

At 31 December

22,552

34,036

16,127

22,006

The group

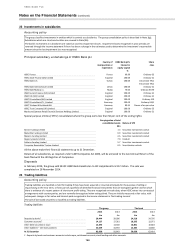

The carrying amount at 31 December 2014 of financial liabilities designated at fair value was £1,496 million higher (2013:

£823 million higher) than the contractual amount at maturity. At 31 December 2014, the accumulated amount of change

in fair value attributable to changes in credit risk was a loss of £247 million (2013: £276 million loss).

The bank

The carrying amount at 31 December 2014 of financial liabilities designated at fair value was £1,082 million higher (2013:

£699 million higher) than the contractual amount at maturity. At 31 December 2014, the accumulated amount of change

in fair value attributable to changes in credit risk was a loss of £151 million (2013: £223 million loss).

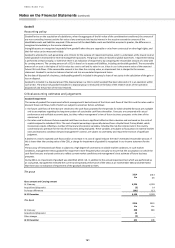

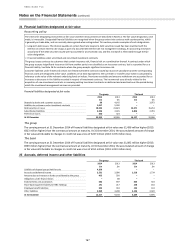

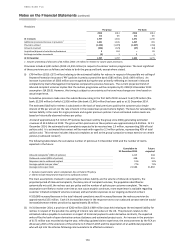

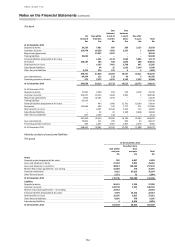

25 Accruals, deferred income and other liabilities

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Liabilities of disposal groups held for sale

4,356

–

–

–

Accruals and deferred income

2,531

2,990

1,518

1,724

Amounts due to investors in funds consolidated by the group

455

550

–

–

Obligations under finance leases

–

88

–

–

Endorsements and acceptances

582

697

364

343

Share-based payment liability to HSBC Holdings

191

217

148

164

Employee benefit liabilities

333

318

133

144

Other liabilities

3,969

4,298

3,126

3,320

At 31 December

12,417

9,158

5,289

5,695