HSBC 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

48

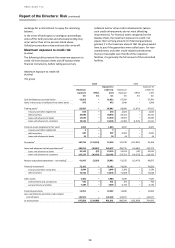

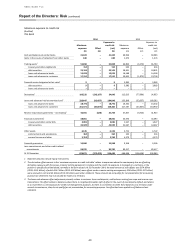

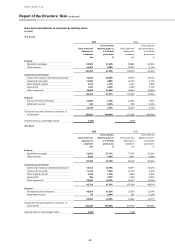

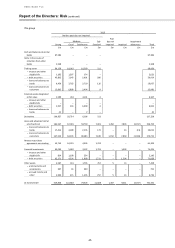

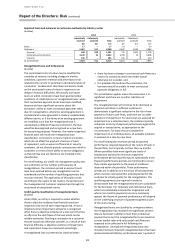

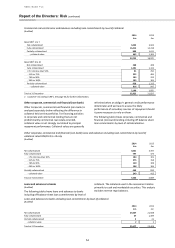

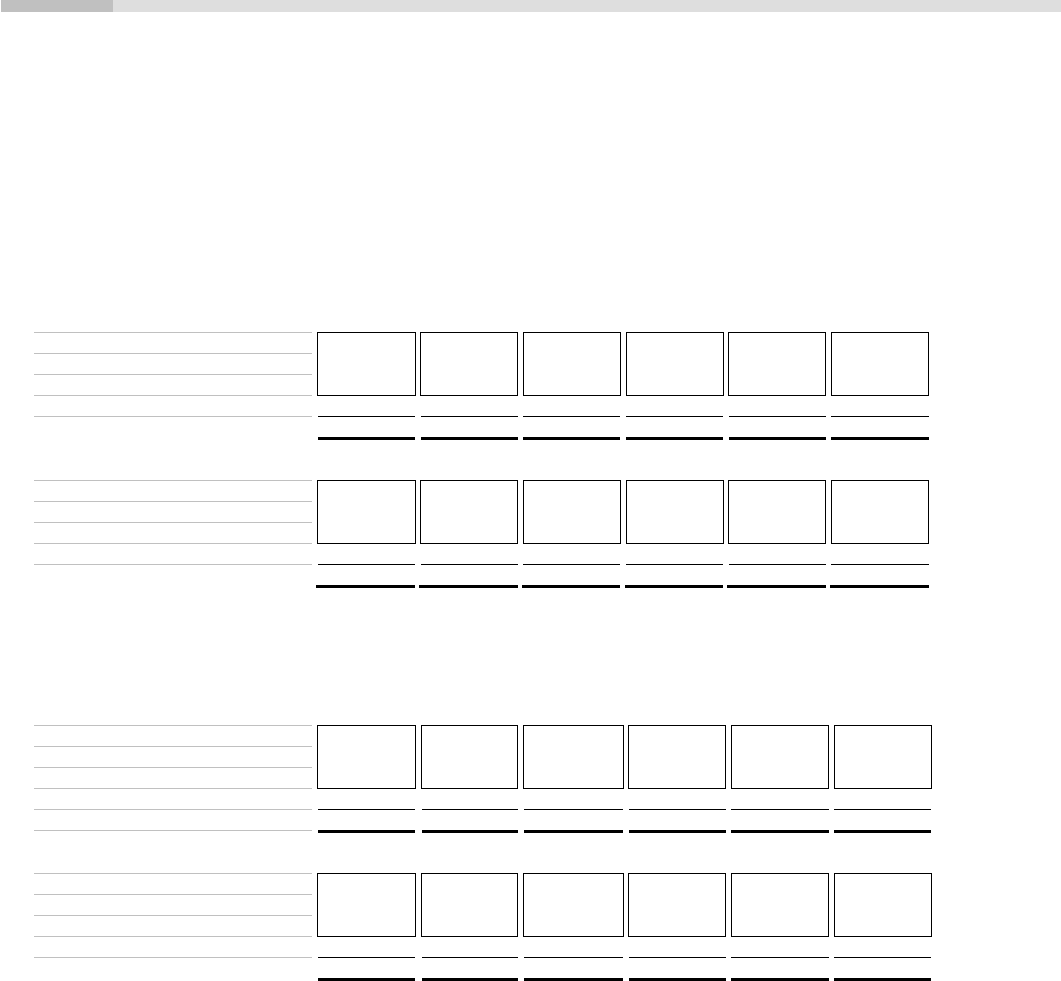

Past due but not impaired gross financial instruments

Past due but not impaired are those loans where

although customers have failed to make payments in

accordance with the contractual terms of their facilities,

they have not met the impaired loan criteria described

below.

Ageing analysis of days past due but not impaired gross financial instruments

(Audited)

The group

Up to

29 days

30-59

days

60-89

days

90-179

days

Over

180 days

Total

£m

£m

£m

£m

£m

£m

At 31 December 2014

Loans and advances held at amortised cost

1,202

230

112

2

1

1,547

Personal

466

183

95

–

–

744

Corporate and commercial

733

46

17

2

1

799

Financial

3

1

–

–

–

4

Other assets

3

1

–

–

2

6

1,205

231

112

2

3

1,553

At 31 December 2013

Loans and advances held at amortised cost

1,044

244

150

9

5

1,452

Personal

470

200

110

–

–

780

Corporate and commercial

567

40

40

9

5

661

Financial

7

4

–

–

–

11

Other assets

3

1

–

–

1

5

1,047

245

150

9

6

1,457

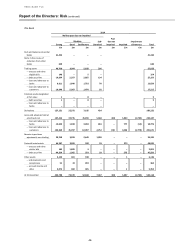

The bank

Up to

29 days

30-59

days

60-89

days

90-179

days

Over

180 days

Total

£m

£m

£m

£m

£m

£m

At 31 December 2014

Loans and advances held at amortised cost

320

109

69

–

–

498

Personal

295

104

66

–

–

465

Corporate and commercial

25

5

3

–

–

33

Financial

–

–

–

–

–

–

Other assets

–

–

–

–

–

320

109

69

–

–

498

At 31 December 2013

Loans and advances held at amortised cost

351

129

82

–

–

562

Personal

347

127

81

–

–

555

Corporate and commercial

4

2

1

–

–

7

Financial

–

–

–

–

–

–

Other assets

–

–

–

–

–

351

129

82

–

–

562

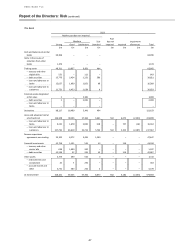

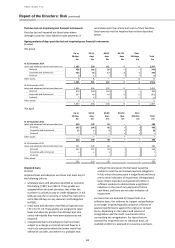

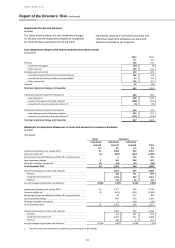

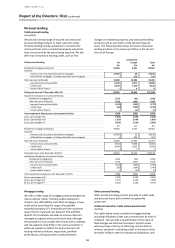

Impaired loans

(Audited)

Impaired loans and advances are those that meet any of

the following criteria:

• wholesale loans and advances classified as Customer

Risk Rating (‘CRR’) 9 or CRR 10. These grades are

assigned when the bank considers that either the

customer is unlikely to pay its credit obligations in full,

without recourse to security, or when the customer is

more than 90 days on any material credit obligation

to HSBC.

• retail loans and advances classified as Expected Loss

(‘EL’) 9 or EL 10. These grades are assigned to retail

loans and advances greater than 90 days past due

unless individually they have been assessed as not

impaired.

• renegotiated loans and advances that have been

subject to a change in contractual cash flows as a

result of a concession which the lender would not

otherwise consider, and where it is probable that

without the concession the borrower would be

unable to meet the contractual payment obligations

in full, unless the concession is insignificant and there

are no other indicators of impairment. Renegotiated

loans remain classified as impaired until there is

sufficient evidence to demonstrate a significant

reduction in the risk of non-payment of future

cash flows, and there are no other indicators of

impairment.

For loans that are assessed for impairment on a

collective basis, the evidence to support reclassification

as no longer impaired typically comprises a history of

payment performance against the original or revised

terms, depending on the nature and volume of

renegotiation and the credit risk characteristics

surrounding the renegotiation. For loans that are

assessed for impairment on an individual basis, all

available evidence is assessed on a case-by-case basis.